With Americans planning to spend an average of more than $1,000 each this holiday season (10 percent more than last year), there’s going to be a lot of money changing hands over the next few months.

Just over a fifth of that money will go to small businesses, according to the National Retail Federation. While that’s a sizeable share of the pie, it also means that there’s plenty of room for Americans to spend more with their community merchants. There are plenty of reasons to do so, including smaller crowds in the shops, more personal customer service and the economic benefit it brings the local community.

For shoppers used to taking care of their entire holiday list via Amazon and a mall filled with chain stores, however, it requires a bit more planning. Read on for some great tips on spending locally this holiday season.

Related: Here's How to Find the Best Black Friday Deals

1. Sign up for alerts from your favorite small businesses. While they may not have the same rich rewards packages as their chain competitors, many small businesses do have loyalty programs for customers. Sign up for their emails or follow them on Facebook or Twitter to get exclusive coupons or notifications about new merchandise or sales. Many local retailers also host holiday parties, trunk shows or other special events for customers on their mailing list.

Daily deal sites like Groupon and Living Social also often offer great promotions in partnerships with neighborhood businesses. If you can’t stand the inbox clutter, or don’t want to give out your personal email address, consider setting up a separate account just for retailers and other “junk mail.” If you use gmail, such correspondence often goes directly into your “promotions” tab.

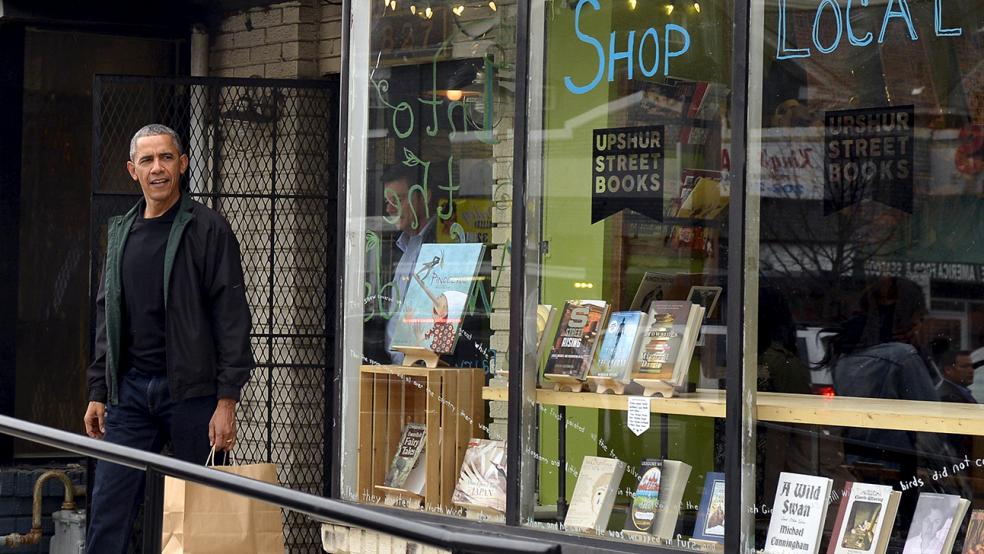

2. Get out on Small Business Saturday. Black Friday and Cyber Monday get a lot of media attention, but sandwiched between the two is Small Business Saturday, a day dedicated to supporting local businesses. Originally created in 2010 as a promotion by American Express to help small businesses compete during the holiday shopping rush, the day has grown into a national movement that drew 95 million shoppers last year. “It’s about more than just shopping,” says Small Business Saturday spokesperson Nicole Leinbach Reyhle. “It’s about celebrating, supporting and saying ‘thank you’ to the small businesses for everything that they do for our communities year-round.”

Related: The Early Bird’s Guide to Holiday Shopping — 7 Stress-Reducing Tips

American Express provides even more incentive for cardholders, offering double rewards for those who activate their card for the program and shop with eligible retailers anytime between now and the end of the year.

3. Try a new store…. Make a point of going into a local small business that you haven’t previously visited. If you’re new to the area or aren’t sure how to find small businesses, check out your local Chamber of Commerce website or see who’s advertising on local news sites. Etsy also allows users to search for local stores that sell items made by its artists.

4. …Or try a new town. Many small businesses are located in downtown or Main Street areas that make for a pleasant day trip. Grab a friend and take a road trip for a day of shopping and dining in a nearby community.

5. Go for gift cards. Gift cards are among the most popular gifts (more than 60 percent of consumers surveyed by the NRF this year said that they had gift cards on their lists), partly because they’re so convenient and make for practical presents for people you may not know particularly well. This year, instead of stocking up on cards for Starbucks or Amazon, choose ones for your local coffee shop or a retail store. That way you’re not only giving money to the business, but you’re also incentivizing someone else to spend some time with that merchant as well and potentially even spend additional money.

Related: The 5 Best Store Credit Cards for Holiday Shopping This Year

6. Strike up a conversation. Given their investment in the business, shop owners have an expertise that store managers at larger chains may not. Often, they’re personally responsible for selecting the merchandise and can offer you insight into the manufacturer or tips on how to care for a product. Their knowledge of the store also makes them excellent sources of advice on gifts for hard-to-please recipients. “The most important thing when you’re shopping small is to build relationships with the people who run the store,” says Mihaela Akers, a business coach and marketing strategist who works with small businesses. “If you initiate a conversation with them, you’ll find that they really want to help you.”

7. Ask about the return policy. The return policy at some small businesses is stricter than what you’ll find at a big-box store. Pay attention to the fine print, especially if you’re shopping for a gift that you’re not going to give for weeks or months.

8. Think outside the shop. It’s easy to just think about stores when you’re trying to shop locally, but there are plenty of other ways to spend your money at community businesses. Go to local restaurants instead of chains, check out a local bank (which may even offer better rates than your big bank) or hit up the farmers’ market instead of the supermarket.

Related: The 20 Most Expensive Shopping Streets in the US

Also keep an eye out this time of year for holiday markets, festivals and fairs, which often invite local businesses to set up booths to sell items. If you see a company that you don’t know, take some time to ask about their business. “That’s a new way to get to know businesses, since so many of the vendors are local,” says Megan Wilson, who runs shopping and dining tours in Richmond, Virginia. “A lot of time they’ll be handing out coupons and announcements as well as selling merchandise. It’s a really neat way to build relationships locally and to take care of your gift life while you’re at it.”