Martin Feldstein Is Optimistic About Tax Cuts, and Long-Term Deficits

In a new piece published at Project Syndicate, the conservative economist, who led President Reagan’s Council of Economic Advisers from 1982 to 1984, writes that pro-growth tax individual and corporate reform will get done — and that any resulting spike in the budget deficit will be temporary:

“Although the net tax changes may widen the budget deficit in the short term, the incentive effects of lower tax rates and the increased accumulation of capital will mean faster economic growth and higher real incomes, both of which will cause rising taxable incomes and lower long-term deficits.”

Doing tax reform through reconciliation — allowing it to be passed by a simple majority in the Senate, as long as it doesn’t add to the deficit after 10 years — is another key. “By designing the tax and spending rules accordingly and phasing in future revenue increases, the Republicans can achieve the needed long-term surpluses,” Feldstein argues.

Of course, the big questions remain whether tax and spending changes are really designed as Feldstein describes — and whether “future revenue increases” ever come to fruition. Otherwise, those “long-term surpluses” Feldstein says we need won’t ever materialize.

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

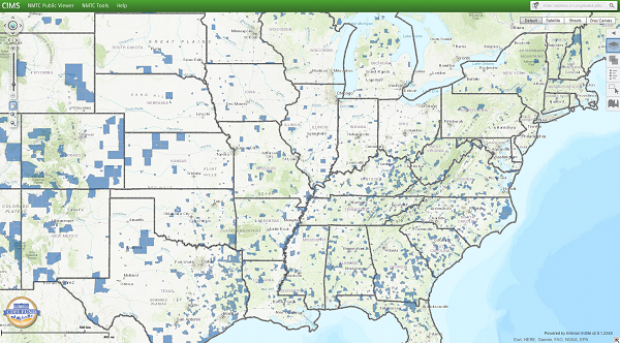

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

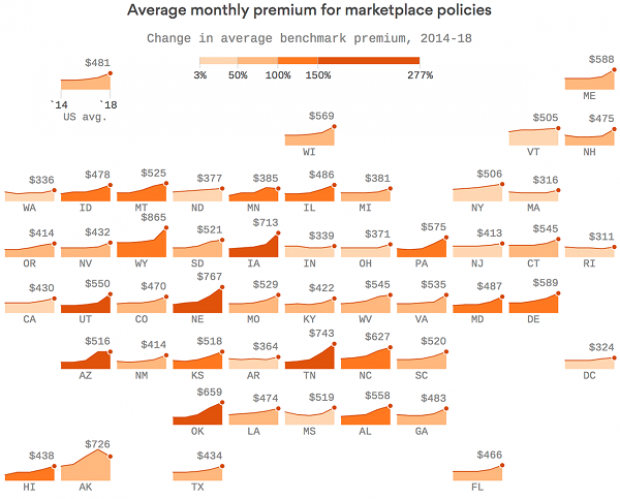

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).