It’s Super Bowl week, but before we get to the big game on Sunday, we’ll see the Super Bowl of political set pieces Tuesday when President Trump delivers his first State of the Union address.

Trump is expected to strike a more bipartisan tone in setting an agenda for his second year in office, including a push for infrastructure investment and immigration legislation.

He’ll likely also tout the economy, which grew 2.5 percent in 2017, up from 1.9 percent the year before — and spike the football on the tax bill he signed into law last month, calling it the “biggest tax cut and reform in American history.” (Just for the record, again: It is not the largest tax cut ever passed in the U.S.)

Trump’s speech, including his claims about the economy, will inevitably provide plenty of fodder for fact-checkers.

Here’s an overview of the U.S. economy and America's fiscal outlook:

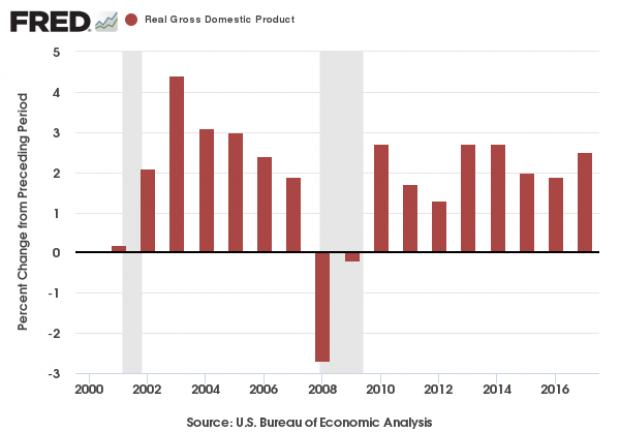

The Economy Is Humming Along

U.S. GDP grew 2.5 percent last year (or 2.3 percent, depending on how the figure is calculated). Either way, the economy is posting solid growth, though it is not expanding at the 3 percent or 4 percent annual rate Trump has promised. Still, the consensus outlook for 2018 projects solid growth to continue.

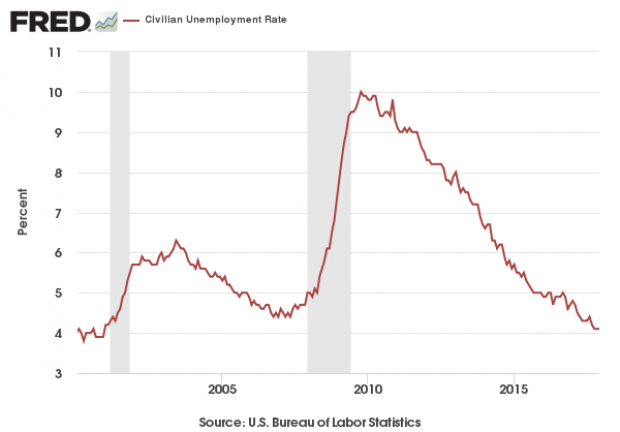

Unemployment Is at Its Lowest Level Since 2000

The unemployment rate is at 4.1 percent. Employers added 2.1 million jobs in 2017, which was the lowest annual total in seven years — though it’s no surprise that job growth has slowed at this stage of the economic recovery.

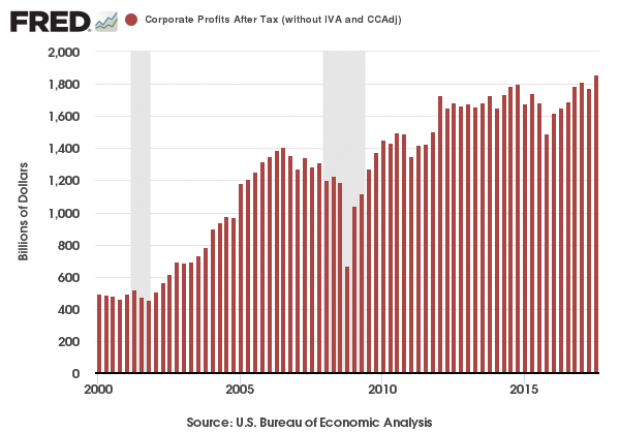

Corporate Profits Are High …

Corporate profits have been rising for years, and by some measures now sit at record highs. Many analysts think they have likely peaked, with wage pressure finally building to claim a larger share of earnings. However, profits could remain at their current lofty levels or even climb further once the GOP tax cuts take effect.

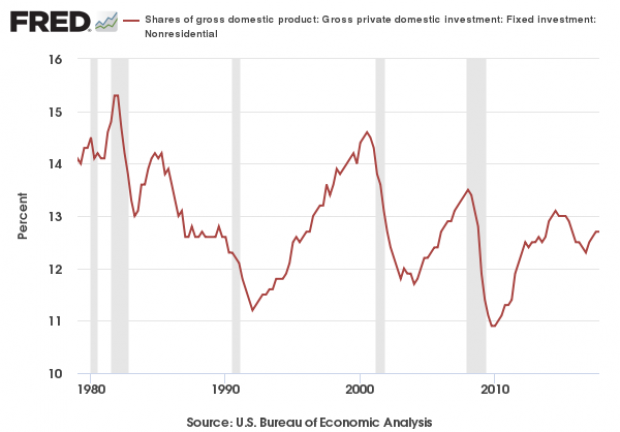

… but Business Investment Is Not

Republicans say their overhaul of the tax code will boost domestic investment in the U.S., raising GDP growth while producing higher wages for workers. It’s too soon to tell just how much impact the new tax rules will have on private investment, but it’s clear that there’s plenty of room for improvement. While nonresidential private investment as a percentage of GDP has risen off its 2010 low, it’s still below previous peaks, and the long-term trend is getting weaker.

Wages Are Rising, Slowly

Average hourly earnings grew 2.5 percent last year, slightly faster than inflation, which rose 2.1 percent in the 12 months through December. "We need to see wage growth in this country, something we haven't seen in almost a decade," Gary Cohn, the director of the National Economic Council, said recently. The big question now: Will companies actually pass some of their tax cuts on to employees in the form of raises?

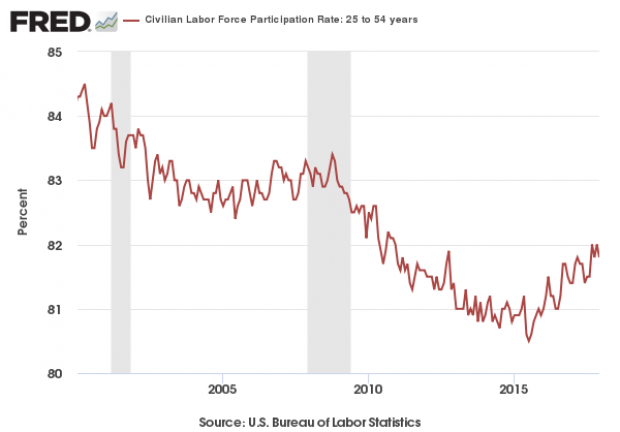

And Some Workers Are Coming Off the Sidelines

While the overall labor force participation rate has bounced around at or under 63 percent for many months, more “prime-aged workers” — those between 25 and 54 years old — appear to be reentering the working world over the last couple of years.

“Higher wage growth should induce some of these additional labor force non-participants to enter the labor market,” the White House Council of Economic Advisers said earlier this month. “If so, a return to the pre-Recession participation rate for prime-age workers would result in an additional 1.7 million Americans back at work. There is some evidence of this positive trend already: A greater share of prime-aged men were employed or looking for work in December 2017 than at any other point since May 2011.”

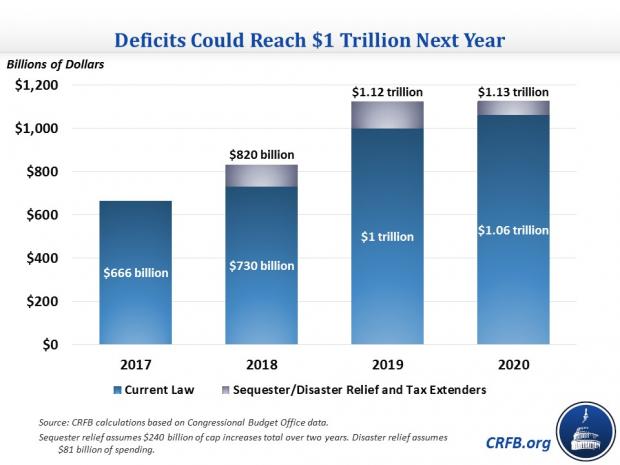

The Federal Deficit Is Headed Toward $1 Trillion

Trump wants to increase funding for the military, and Congress is looking to increase overall spending by about $250 billion over two years. Then there’s the potential cost of a much-needed infrastructure plan. Will any of the increased federal spending be paid for? Will fiscal fights derail an infrastructure plan? As it is, the federal deficit is projected to reach $1 trillion a year by 2019.

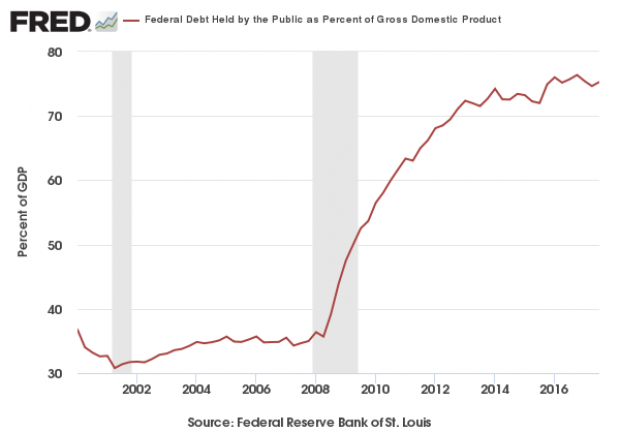

And the National Debt Keeps Climbing

If the economy is chugging along, was this the right time to pass tax cuts (largely benefiting companies and the wealthy) that will add about $1.5 trillion to the national debt over the coming decade? Or should we be positioning ourselves to better weather the next recession? Higher debt levels may make it harder to deal with the next inevitable downturn.