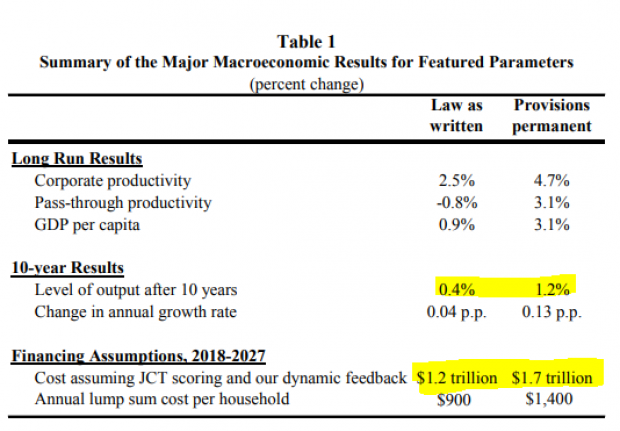

The Republican tax cuts won’t spur enough economic growth to pay for themselves, according to a new study by two Harvard economists on opposite sides of the political divide. The analysis, by conservative Robert J. Barro and former Obama economic adviser Jason Furman, finds that the tax overhaul will cost the U.S. Treasury $1.2 trillion over 10 years, or $1.7 trillion if provisions set to expire are made permanent.

The law’s changes would boost GDP by 0.4 percent over a decade, or about triple that if the expiring provisions are extended — a modest increase well shy of the turbocharged growth many Republican leaders had publicly projected. And if larger federal deficits raise interest rates and crowd out other investment, the boost to GDP would fall to 0.2 percent, or 1 percent with expiring provisions extended.

While the authors agreed on several points, they also interpreted their findings differently and disagreed about the wisdom of the tax law and how tax reform should proceed from here. Each wrote a separate conclusion to the study.

Barro called the 2017 changes “an important step in improving the efficiency of the U.S. tax system” but suggested that “tax reform is best viewed as part of a broad reform package—reminiscent perhaps of the Bowles-Simpson Commission. Such a package would particularly feature entitlement reforms and maybe even a value-added tax.”

Furman warned that he doesn’t expect the tax changes as written to improve the welfare of the median U.S household, and that the higher deficits produced by the tax cuts may well lead to “damaging spending cuts” or other costs. He added that, in his view, “the most important priority is that we need more revenue” and noted that the study “contains an important finding that it is possible to substantially improve on growth while raising revenue through a tax reform that improves the tax base and raises taxes rates.”

The authors will present their paper together at the Brookings Institution on Friday.