Goldman Sees Profit in the Tax Cuts

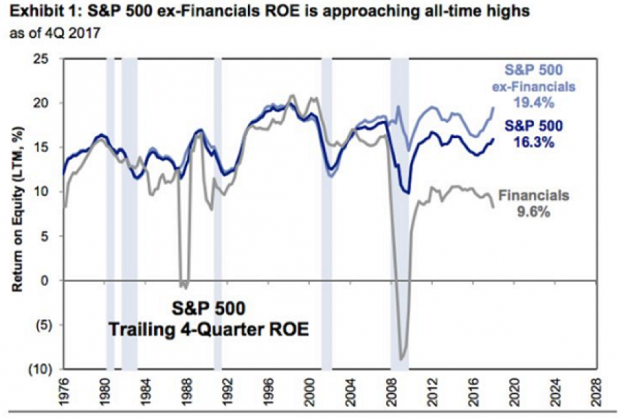

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.