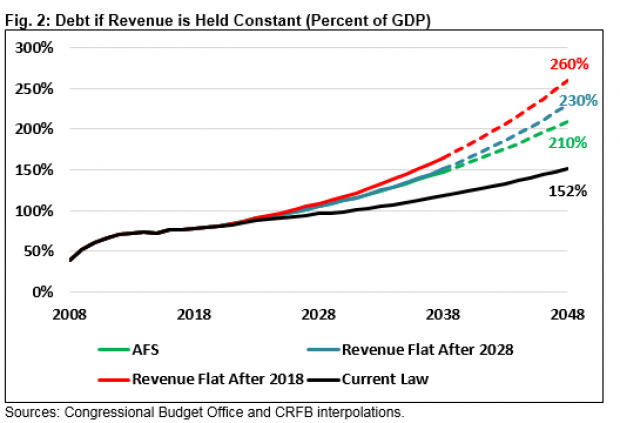

The Congressional Budget Office, in its long-term outlook released in June, projected that federal debt held by the public would increase sharply over the next 30 years, climbing from 78 percent of GDP this year to 118 percent in 2038 and 152 percent by 2048.

But that estimate was required to assume that current law would generally remain unchanged — meaning that, for example, tax cuts currently set to expire after 2025 would in fact end and that spending caps that Congress agreed to lift for 2018 and 2019 would be restored for future years. In other words, it baked in assumptions that might be considered unrealistic given the professed desire of President Trump and Republican lawmakers to extend the expiring tax cuts, and given Congress’ history of battles over spending limits.

Using different and arguably more realistic assumptions, the debt rises even more dramatically. In a follow-up report issued Wednesday, CBO said that if the current tax and spending policies aren’t allowed to expire, debt held by the public would rise to at least 148 percent of GDP by 2038 and 210 percent — more than twice the size of the economy — by 2048. Under this scenario, debt would reach record levels by 2029, five years faster than under the June projection.

The new CBO report also laid out two other scenarios in which lawmakers adjust tax rules to prevent bracket creep and keep revenue levels steady as a share of GDP, either in 2018 or 2028. Under those scenarios, debt would grow even higher, as this chart from the Committee for a Responsible Federal Budget shows.

The CBO report also warns about the economic impact of higher debt levels. If lawmakers extend current policies, real gross national product per person would be about 1.2 percent lower in 2038 than if the tax cuts and spending increases are temporary.

The report notes that the debt projections are uncertain and may be too low, especially for later years, since its current models “are based on the nation’s historical experience with federal borrowing” and may not properly reflect the effects of unprecedented debt levels. “Employing its usual models, CBO projects that in any of the scenarios, debt would equal more than 200 percent of GDP by 2048—but those models probably understate the increase in debt,” the report says.