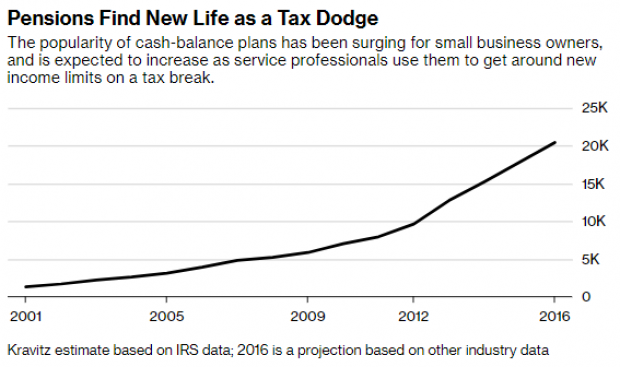

Traditional pension plans are being used by some doctors, lawyers and other wealthy small business owners to shield hundreds of thousands of dollars in income from taxes, Bloomberg’s Ben Steverman reports, and new tax rules related to pass-through businesses are expected to make the plans even more popular.

Guidelines released by the Treasury Department last week limit the use of the 20 percent pass-through tax deduction for some high-earning professionals, who will have to keep their incomes under $315,000 per married couple in order to claim the full benefit of the tax break. Defined-benefit pension plans provide a way to reduce income and, in the wake of the new tax rules, are especially attractive to older, high-income service providers who operate their own businesses.

Here’s an example of how a pension plan could be used, provided to Bloomberg by Daniel Kravitz, who markets pension plans:

“A 61-year-old married doctor with a practice earning $650,000 a year could set up a defined-benefit pension to get his taxable income under $315,000. He could put $268,000 in a cash balance pension, in addition to putting money in his 401(k) and contributing to employee retirement accounts, and get down to an effective tax rate of 20 percent ...”

The cash in the pension plan is eventually rolled over into an IRA and dispersed after retirement, with taxes paid at a lower rate. “Doctors and lawyers got really annoyed when they were excluded from the pass-through deduction,” Kravitz said. “After tax reform, these plans become even more beneficial.”