Surprise medical bills have gotten considerable attention in recent months — like this story, in which a high school teacher was charged nearly $109,000 by the hospital where he was treated for a heart attack, after his insurance paid about $56,000. Those charges were eventually reduced to $332. A recent analysis by the Kaiser Family Foundation found that more than 15 percent of in-patient hospital admissions include bills from out-of-network providers.

A bipartisan group of senators last month unveiled draft legislation to crack down on such unwelcome surprises, but that proposal is still being refined and reportedly won’t be formally introduced until next year.

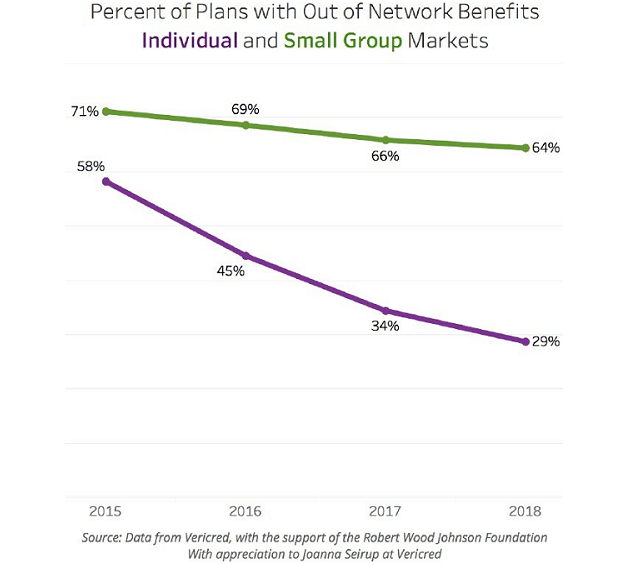

In the meantime, a new report by the Robert Wood Johnson Foundation illustrates one big reason unexpected medical bills have become such a pressing concern for patients: Coverage for out-of-network treatment, especially in the individual market, has fallen pretty sharply in recent years. “Consumers with plans in the individual and small group markets have a high level of exposure to these charges,” the report warns.