Competition in the health insurance market isn’t as healthy as it could be, a new study by the American Medical Association finds.

The key details:

- 73 percent of metropolitan areas in the U.S. have highly concentrated insurance markets

- In 91 percent of metropolitan areas, at least one insurer had an overall market share of 30 percent or more

- In 46 percent of metropolitan areas, one insurer has a market share of 50 percent or more

- Half of all states had commercial health insurance markets that were less competitive in 2017 than during the previous year

- Anthem dominated 75 metropolitan markets, more than any other insurer, according to a tally by Becker’s Hospital Review. Health Care Service Corp. followed with leading market share in 40 metro areas, and UnitedHealth Group led in 27 metro areas.

“High concentration levels in health insurance markets are largely the result of consolidation (i.e., mergers and acquisitions), which can lead to the exercise of market power and, in turn, harm to consumers and providers of care,” the report says. “It appears that consolidation has resulted in the possession and exercise of health insurer monopoly power—the ability to raise and maintain premiums above competitive levels—instead of the passing of any benefits obtained through to consumers.”

One takeaway, the authors say, is that antitrust regulators should vigorously scrutinize proposed mergers between insurers. “The AMA continues to urge that competition, not consolidation, is the right prescription for health insurance markets,” Dr. Barbara L. McAneny, the AMA’s president, said in a statement. “The slide toward insurance monopolies has created a market imbalance that disadvantages patients and favors powerful health insurers.”

Axios’ Caitlin Owens notes that one study published last year found that insurers with more market power can bargain for lower prices in markets where providers are highly concentrated. Whether those lower prices get passed onto consumers is another matter. “The policy dilemma that arises from our findings,” the 2017 study said, “is that there are no insurer market mechanisms that will pass a portion of these price reductions on to consumers in the form of lower premiums.”

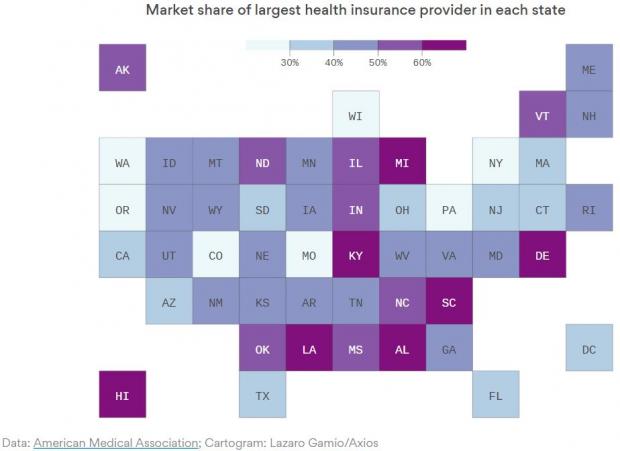

The Axios chart below breaks down the market share of the largest insurance provider in each state — and you can see the tables at the back of the AMA study to find more details about your state or city.