Republicans Push Ahead on Medicaid Restrictions

The Trump administration on Friday approved Ohio’s request to impose work requirements on Medicaid recipients. Starting in 2021, the state will require most able-bodied adults aged 19 to 49 to either work, go to school, be in job training or volunteer for 80 hours a month in order to receive Medicaid benefits. Those who fail to meet the requirements over 60 days will be removed from the system, although they can reapply immediately.

The new work requirements include exemptions for pregnant women, caretakers and those living in counties with high unemployment rates and will apply only to those covered through the expansion of Medicaid under the Affordable Care Act. There are currently about 540,000 people on Medicaid in Ohio who receive coverage through the expansion, according to Kaitlin Schroeder of The Dayton Daily News, compared to roughly 2.6 million Medicaid recipients in the state overall.

Once implemented, the work requirements are expected to result in 36,000 people losing their Medicaid eligibility, according to state officials, though critics say the reductions could be significantly larger. Similar work requirements in Arkansas pushed 18,000 people off the Medicaid rolls in six months.

A larger GOP project: The creation of new work requirements is part of a larger effort by Republicans to limit the expansion of Medicaid, says The Wall Street Journal’s Stephanie Armour. Since the Affordable Care Act passed in 2010, 36 states have expanded their Medicaid programs under the ACA and the number of people in the program has grown by 50 percent, from roughly 50 million to about 75 million. But many red-state governors have expressed concerns about the cost of Medicaid expansion and worries about a lack of self-sufficiency among the able-bodied poor, and are embracing new limitations on the program for both fiscal and political reasons.

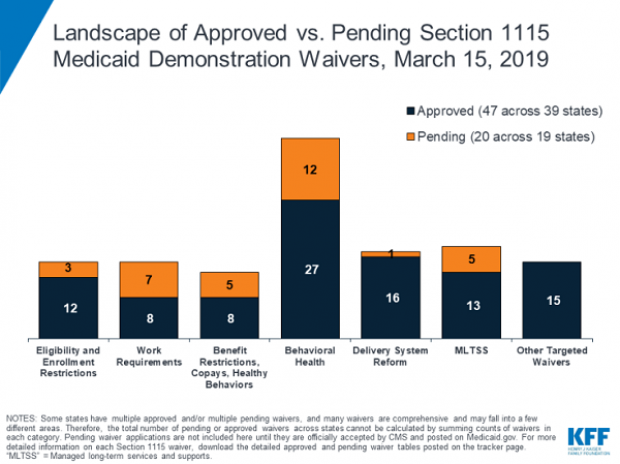

In 2017, the White House in 2017 gave states the green light to explore ways to limit the reach and expense of their Medicaid programs. Governors have proposed a variety of new rules, which require waivers from the federal government to enact. Kentucky, for example, wants to drug-test Medicaid recipients, and Utah wants a partial expansion and a cap on payments. Kaiser Health News summarizes the variety of waivers states have requested, which are governed by Section 1115 of the Social Security Act, in the chart below.

Legal challenges: Efforts to restrict Medicaid have received legal challenges, and U.S. District Judge James Boasberg blocked work requirements in Kentucky last year. The same judge, who has expressed doubts about the administration’s approach to Medicaid, will rule on the legality of work requirements in both Kentucky and Arkansas by April 1.

The bottom line: The Trump administration is seeking fundamental changes in how Medicaid works. Even if Boasberg rules against work requirements, expect the White House and Republican governors to continue to push for new limitations on the program.

Where Trump Will Compromise on Tax Reform

White House officials tell USA Today’s Heidi Przybyla that President Trump will include a number of compromises to limit his tax plan’s benefits for the wealthy when he promotes the blueprint next month:

“The compromises will include ending a 23.8% preferential tax rate for hedge-fund managers, or the so-called carried interest rate, White House legislative affairs director Marc Short told USA TODAY. … Retaining parts of a state and local tax deduction that benefits many middle-class families in blue states is also an area where Trump is expecting compromise.”

Trump campaigned on raising the carried interest rate, saying its beneficiaries are “getting away with murder.” But changes to the carried interest rate may run into opposition from House Republicans, and the tweaks appear unlikely to win any Democratic support.

Larry Summers Savages Trump Tax Plan Analysis

Former Treasury Secretary Larry Summers made his distaste for the Trump administration’s tax framework clear last week when he said Republicans were using “made-up” claims about the plan and its effects. Summers expanded his criticism on Tuesday in a blog post that took aim at the report released Monday by the Council of Economic Advisers and chair Kevin Hassett, which seeks to justify the administration’s claim that its tax plan will result in a $4,000 pay raise for the average American family.

Never one to mince words, Summers says the CEA analysis is “some combination of dishonest, incompetent and absurd.” The pay raise figure is indefensible, since “there is no peer-reviewed support for his central claim that cutting the corporate tax rate from 35 to 20 percent would raise wages by $4000 per worker.” In the end, Summers says that “if a Ph.D student submitted the CEA analysis as a term paper in public finance, I would be hard pressed to give it a passing grade.”

One of the authors cited in the CEA paper also has some concerns. Harvard Business School professor Mihir Desai tweeted Tuesday that the CEA analysis “misinterprets” a 2007 paper he co-wrote on the dynamics of the corporate tax burden. Desai’s research has found a connection between business tax cuts and wage growth, but not as large as the CEA paper claims. “Cutting corporate taxes will help wages but exaggeration only serves to undercut the reasonableness of the core argument,” Desai wrote.

For Tax Reform, It May Be 2017 or Bust

National Economic Council Director Gary Cohn said Monday that tax reform has to happen this year, even if it means Congress has to stay in session longer. "I think we have a unique window in time right now, but unfortunately we keep losing days to this window,” he said. “The opportunity is now." House Speaker Paul Ryan said last week he’d keep members over Christmas if that’s what it takes. And Ryan predicted Monday that tax reform would pass the House by early next month and then get through the Senate to reach the president’s desk by the end of the year. But there are plenty of skeptics out there, given the hurdles. Issac Boltansky, an analyst at the investment bank Compass Point, told Business Insider, "The idea of getting tax reform done this year is a farcical fantasy. Lawmakers have neither the time nor the capacity to formulate and clear a tax reform package in 2017."

Do Republicans Have the Votes for the Next Step Toward Tax Reform?

Passing a budget resolution for 2018 through the Senate will open a procedural door to a $1.5 trillion tax cut over 10 years. The resolution is expected to reach the Senate floor this week, although there are questions about whether Republicans have the 50 votes they need to pass it. Sens. Susan Collins (R-ME) said this weekend that she would vote for it and Lisa Murkowski (R-AK) is likely a “yes” as well, but Sen. Rand Paul (R-TN) is reportedly a likely “no” and John McCain (R-AZ) appears questionable. Now it looks like Sen. Thad Cochran (R-MI) won't be back in Washington this week to vote on the resolution due to health problems. The Hill says Cochran’s absence puts tax reform “on knife’s edge.”

Quote of the Day - October 16, 2017

Speaking at a cabinet meeting on Monday, President Trump said:

"Obamacare is finished, it's dead, it's gone ... There is no such thing as Obamacare anymore."

Click here for the video.