A new analysis by The Wall Street Journal finds that the median effective global tax rate for S&P 500 companies dropped by more than five percentage points after the 2017 tax cut package went into effect. Two years ago, the firms paid a 25.5% effective tax rate, but in the first quarter of 2019, that rate fell to just 19.8%.

“Much of the decline is coming because fewer firms are paying rates at the highest end,” say the Journal’s Theo Francis and Richard Rubin.

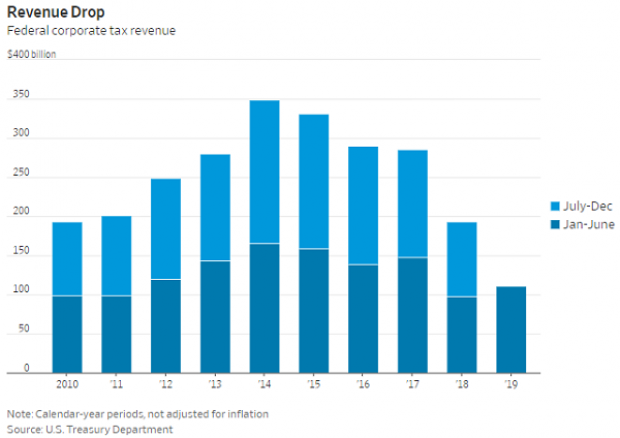

Those lower rates translate into less revenue for the federal government. “So far this fiscal year, the federal government has collected $164 billion in corporate taxes, up 2% from the prior year as the economy continues growing, but 26% below where they were in the comparable period before the tax law took effect,” Francis and Rubin write.