Budget Deal Moving Ahead, Despite Outrage on the Right

The bipartisan deal to suspend the debt ceiling and increase federal spending over the next two years will get a vote in the House on Thursday, House Majority Leader Steny Hoyer (D-MD) said late Tuesday. Leaders in both parties have expressed confidence that the bill will pass before lawmakers leave town for their August recess.

"We're gonna pass it," Hoyer told reporters. "I think we'll get a good number [of votes]. I don't know if it's gonna be huge, but we're gonna pass it."

President Trump announced that he backs the deal, removing one possible hurdle for the bill. “Budget Deal gives great victories to our Military and Vets, keeps out Democrat poison pill riders. Republicans and Democrats in Congress need to act ASAP and support this deal,” he tweeted Tuesday evening.

Despite widespread agreement that the bill will pass, however, not everyone is on board.

Grumbles from the left: Some progressive Democrats have been critical of the deal, portraying it as too easy on Republicans. Worried that the agreement could set up a budget crisis in 2021, Rep. Ro Khanna (D-CA) said he was “concerned that it was a two-year deal. Why not a one year deal?... It seems like it’s basically handcuffing the next president.” Other liberals, noting that Democratic leaders have agreed to avoid “poison pill” riders on controversial issues such as abortion and funding for the border wall in the funding bills that must pass this fall, lamented their loss of leverage in those negotiations.

Outrage on the right: Resistance to the deal was more pronounced on the right, with the hardline House Freedom Caucus announcing Tuesday that it would not support the bill due to concerns about the growing national debt. “Our country is undeniably headed down a path of fiscal insolvency and rapidly approaching $23 trillion in debt. … All sides should go back to the drawing board and work around the clock, canceling recess if necessary, on a responsible budget agreement that serves American taxpayers better—not a $323 billion spending frenzy with no serious offsets,” the 31-member group said in a statement.

The deficit hawks at the Committee for Responsible Federal published “Five Reasons to Oppose the Budget Deal,” which include its purported $1.7 trillion cost over 10 years. CRFB noted that the agreement would increase discretionary spending by 21 percent during President Trump’s first term, pushing such spending to near-record levels.

Sen. John Kennedy (R-LA) was more colorful in his criticism, saying, “You don’t have to be Euclid to understand the math here. We’re like Thelma and Louise in that car headed toward the cliff.” Nevertheless, Kennedy said he would consider supporting the deal.

Is the deficit hawk dead? The budget deal represents “the culmination of years of slipping fiscal discipline in Washington,” said Robert Costa and Mike DeBonis of The Washington Post, and it highlights the declining influence of fiscal conservatives in the capital, at least as far as policy is concerned. Sen. James Lankford (R-OK) said the Republican Party’s credibility on fiscal restraint is “long gone.”

Although it may be too early to declare the fiscal hawk extinct – plenty of critics say the bird will return as soon as there’s a Democratic president – it certainly seems to be in ill health. As the University of Virginia's Larry Sabato said Wednesday: “A battered bird has been named to the list of endangered species. The ‘deficit hawk’ is on the road to extinction. Rarely spotted around Washington, D.C., the deficit hawk’s last remaining habitat is found in some state capitals.”

Some Republicans said that fiscal conservatism was never really a core Republican value, dating back to President Reagan’s tax-cut-and-spend policies, and that Paul Ryan’s emphasis on fiscal issues was an aberration. “It was never the party of Paul Ryan,” former House Speaker Newt Gingrich told the Post. “He’s a brilliant guy, but he filled a policy gap. The reality here is that Republicans were never going to get spending cuts with Speaker Pelosi running the House, and they didn’t want an economic meltdown or shutdown this summer.”

Is the whole debate missing the point? William Gale of the Brookings Institution, who served on President George H.W. Bush’s Council of Economic Advisers, said he wasn’t sure why the budget deal was producing so much hostility, since it basically maintains the status quo and – more importantly – is focused solely on discretionary spending. “There *is* a long-term budget issue,” Gale tweeted Tuesday, “but cutting [discretionary spending] is not the way to go.”

Instead, Gale says that any serious fiscal plan must focus on the mandatory side of the ledger, where the rapidly increasing costs of health care and retirement are straining against revenues reduced by repeated rounds of tax cuts. Gale recommends a combination of entitlement reductions and revenue increases – a standard mix of policy options that faces an uncertain future, with well-entrenched interest groups standing opposed to movement in either direction.

Greenspan Has a Warning About the GOP Tax Plan

The Republican tax cuts won’t do much for economic growth, former Federal Reserve Chair Alan Greenspan told CNBC Wednesday, but they will damage the country’s fiscal situation while creating the threat of stagflation. "This is a terrible fiscal situation we've got ourselves into," Greenspan said. "The administration is doing tax cuts and a spending decrease, but he's doing them in the wrong order. What we need right now is to focus totally on reducing the debt."

The US Economy Hits a Sweet Spot

“The U.S. economy is running at its full potential for the first time in a decade, a new milestone for an expansion now in its ninth year,” The Wall Street Journal reports. But the milestone was reached, in part, because the Congressional Budget Office has, over the last 10 years, downgraded its estimate of the economy’s potential output. “Some economists think more slack remains in the job market than October’s 4.1% unemployment rate would suggest. Also, economic output is still well below its potential level based on estimates produced a decade ago by the CBO.”

The New York Times Drums Up Opposition to the Tax Bill

The New York Times editorial board took to Twitter Wednesday “to urge the Senate to reject a tax bill that hurts the middle class & the nation's fiscal health.”

Using the hashtag #thetaxbillshurts, the NYT Opinion account posted phone numbers for Sens. Susan Collins, Bob Corker, Jeff Flake, James Lankford, John McCain, Lisa Murkowski and Jerry Moran. It urged readers to call the senators and encourage them to oppose the bill.

In an editorial published Tuesday night, the Times wrote that “Republican senators have a choice. They can follow the will of their donors and vote to take money from the middle class and give it to the wealthiest people in the world. Or they can vote no, to protect the public and the financial health of the government.”

Like what you're reading? Sign up for our free newsletter.

Can Trump Succeed Where Mnuchin and Cohn Have Flopped?

President Trump met with members of the Senate Finance Committee Monday and is scheduled to attend Senate Republicans’ weekly policy lunch and make a personal push for the tax plan on Tuesday. Will he be a more effective salesman than surrogates in his administration?

Politico’s Annie Karni and Eliana Johnson report that both Democrats and Republicans say Mnuchin and chief economic adviser Gary Cohn have repeatedly botched their tax pitches, “in part due to their own backgrounds” as wealthy Goldman Sachs alums. “House Speaker Paul Ryan earlier this month asked the White House not to send Mnuchin to the Hill to talk with Republican lawmakers about the bill, according to two people familiar with the discussions — though Ryan has praised the Treasury secretary’s ability to improve the legislation itself,” Karni and Johnson write.

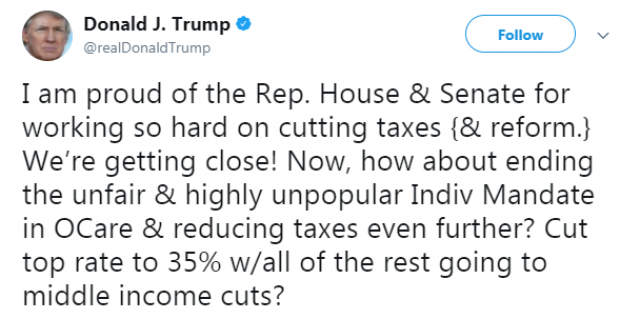

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”