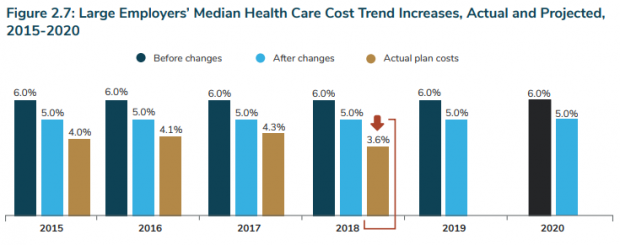

The cost of employee health benefits is projected to rise 5% next year, topping $15,000, according to an annual survey released Tuesday by the National Business Group on Health.

That increase is the same as was projected for 2019, though the actual rise this year has been lower, following the trend of the last several years.

For 2020, the employee share of health care costs is expected to average nearly $4,500.

The survey of nearly 150 large employers — who offer coverage to more than 15 million people — found that fewer plan to offer high-deductible health insurance plans as the only option for workers. Instead, they will look to give employees more choices, such as preferred provider organization (PPO) plans. The share of employers offering high-deductible plans will shrink to 25% in 2020, down from 30% this year and 39% in 2018.

The survey also found that, to deal with rising health care costs, many are considering or implementing new strategies, such as passing drug price discounts directly on to workers or offering new options for primary care. Some are also expressing openness to the idea of expanding access to Medicare, though most have reservations about Medicare for All.

“One of the challenges employers face in managing their health care costs is that health care is delivered locally and change is not scalable. It’s a market-by-market effort,” said Brian Marcotte, President and CEO of the National Business Group on Health. “Employers are turning to market-specific solutions to drive meaningful changes in the health care delivery system.”

Employers’ health care agenda: More than half of employers surveyed said that implementing more virtual health initiatives, such as digital coaching and support for medical decisions, was a top priority for next year. And nearly four in 10 said that taking a more focused approach to high-cost claims was a top initiative.

Embracing new approaches to primary care: About half (49%) of large employers said they plan to pursue at least one so-called “advanced primary care” strategy next year, providing employees with more comprehensive health management options. A third of employers will offer on-site or nearby primary care, while 24% said they are looking to contract directly with care providers and move away from the currently prevalent model of paying for each individual visit or treatment.

“Employers are really looking to do something different at the primary care level and move away from fee-for-service episodic care to a whole-person view of managing health,” NBGH Chief Strategy Officer Ellen Kelsay told reporters, according to Fierce Healthcare.

Dealing with drug costs: Employers remain concerned about the high cost of drugs, including how to finance new treatments with price tags of $1 million or more. “Some of these therapies will cost more than what an employee will earn in a lifetime,” said Marcotte. One in five employers in the survey said they will switch away from traditional pharmacy benefits contracts next year and instead pass along pharmaceutical rebates directly to workers. About 60% of employers plan to make such a switch by 2022. And three out of four employers said they would consider supporting a plan to have the government negotiate prices for all drugs that cost more than $1 million, and about half would consider supporting a national fund to cover part of the costs of such drugs. “That’s not something employers typically say,” Marcotte told CNBC.

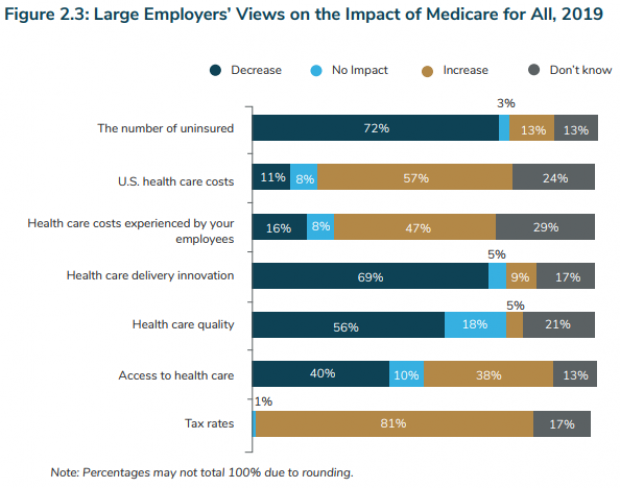

Skepticism about Medicare for All: While 72% of employers believe Medicare for All would reduce the number of uninsured, 81% believe it would increase taxes. More than half (57%) of employers say Medicare for All would result in higher overall health care costs — and worse health care quality. About half also say it will lead to higher costs for workers. Employers are split, though, on the idea of extending Medicare coverage to more people. More than half say that the government health care program should be expanded to cover people under 65, with about one in four in favor of lowering the eligibility age to 60 while a similar percentage say Medicare coverage should kick in at age 50.

The bottom line: “U.S. health care spending is going to become increasingly unsustainable until employers — which cover a plurality of Americans — decide they've had enough,” Axios’s Caitlin Owens says. And this survey “is another sign that they're getting closer to that point.”