Republican tax cut enthusiasts are generally unwilling to link the 2017 Tax Cuts and Jobs Act to the rapidly growing federal deficit, preferring instead to point the finger at spending increases that have been signed into law on a bipartisan basis over the last two years.

“D.C. does not have a revenue problem, which is why revenues hit an all-time high this year. It has a spending problem,” the Republican minority on the House Ways and Means Committee said a recent blog post.

However, the budget hawks at the Committee for a Responsible Federal Budget recently examined the claim that spending alone is driving the deficit higher and concluded that it is “false.”

Fundamentally, a deficit is produced by a mismatch between revenues and spending, CRFB pointed out in a “fiscal fact check” Wednesday, so it’s not possible to assign blame to just one factor. Both revenues and spending have been diverging from their normal historical levels recently, with spending rising and revenues falling when measured as a share of the economy. And the tax cuts have clearly played an important role: “Revenue is unambiguously lower than it otherwise would have been absent the TCJA, and as a result, deficits are higher,” CRFB said.

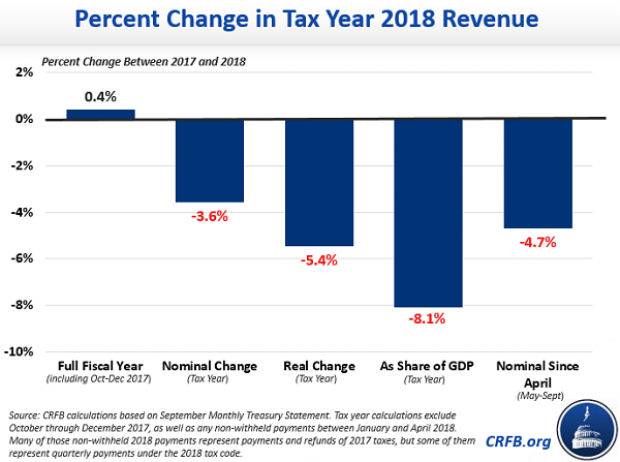

CRFB says that revenue fell by between 3.6% and 8.1%, depending on how you measure it, in 2018, the first year in which the new tax law was in effect (see the chart below for various measures of the revenue shortfall). “The 2017 tax cuts will add roughly $1.9 trillion to the debt through 2028 and have already reduced revenue to 16.3 percent of Gross Domestic Product (GDP) in FY 2019, its lowest level since 2012 when the economy was still recovering from the Great Recession,” CRFB says.

Increased spending has played a role as well, of course, with recent budgets adding billions more in deficit spending. Even so, CRFB concludes that “arguing that tax cuts have not contributed to high and rising deficits is incorrect.”