The national debt is now roughly the size of the U.S. economy, crossing a threshold that has long worried deficit hawks and many economists.

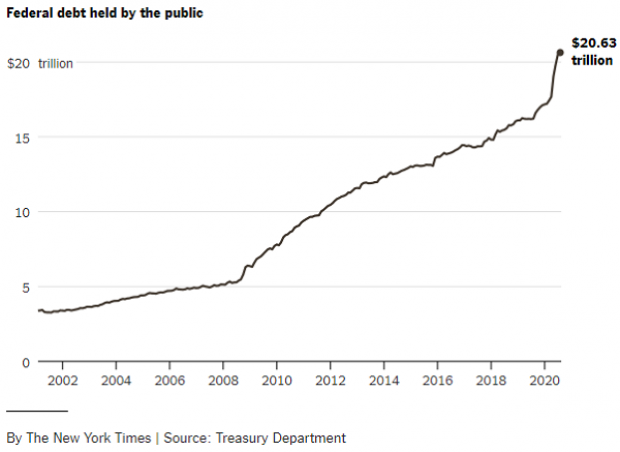

At the end of 2019, the federal debt held by the public stood at $17 trillion, roughly 80% the size of the U.S. economy, and government projections showed it growing to 100% of the economy in about 10 years. But thanks to trillions of dollars of spending in response to the coronavirus recession this year, and the contraction of the economy itself, the debt now stands at 106% of gross domestic product — a 25% increase in a matter of months.

The concern has long been that a debt so large would inevitably ravage the economy by causing inflation to rise and interest rates to spike as investors demand higher returns from an increasingly shaky lender, the U.S. government.

Instead, despite the unprecedented run-up in the debt, interest rates sit near historic lows and inflation is muted in an economy struggling to recover from pandemic-driven losses.

Olivier Blanchard, the former chief economist for the International Monetary Fund and now a senior fellow at the Peterson Institute for International Economics in Washington, told The New York Times that few economists are concerned about crossing the long-feared line.

“At this stage, I think, nobody is very worried about debt,” he said. “It’s clear that we can probably go where we are going, which is debt ratios above 100 percent in many countries. And that’s not the end of the world.”

What changed? Some experts say worries about the debt surpassing the size of the economy were misplaced, in part because of the role played by the Federal Reserve. Since March, the Fed has purchased more than $1.8 trillion worth of Treasury securities, providing the liquidity the Treasury needs to rapidly expand the debt, without any apparent negative consequences. “Fiscal constraints aren’t nearly what economists thought they were,” Daniel Ivascyn, chief investment officer for PIMCO, told the Times. “When you have a central bank essentially funding these deficits, you can take debt levels to higher debt levels than people envisioned.”

Critics in the Modern Monetary Theory school – which holds that inflation is the main constraint on government spending, not the size of the debt – say that the mainstream economic models that link increased government debt with rising interest rates are just plain inaccurate. “The whole premise that deficits drive up interest rates, it’s just wrong,” Stephanie Kelton, a professor of economics at Stony Brook University and a leading MMT supporter, told the Times.

Still, some investors remain concerned about the possibility of a rapid rise in inflation driven by the tidal wave of debt-fueled spending, and that concern is showing up in soaring gold prices, among other things. And some economists warn that the growing debt will have to be addressed through higher taxes or reduced spending at some point in the future, even if the immediate effects seem benign.

The political implications: Although many economists seem to have lost their fear of government debt, Republican efforts to limit the size of the next coronavirus bill are grounded in part in worries about adding another $2 trillion or $3 trillion to the national debt. But GOP lawmakers are finding little support among economists these days, including those on Wall Street. “What’s very clear is that the U.S. economy has some room,” Rick Rieder, chief investment officer of fixed income at BlackRock, told the Times. “I would argue that we still have room now for another fiscal package.”