The federal government estimates that it has paid billions of dollars less in interest on the national debt in the 2020 fiscal year, despite an increase in the size of the national debt on an annual basis.

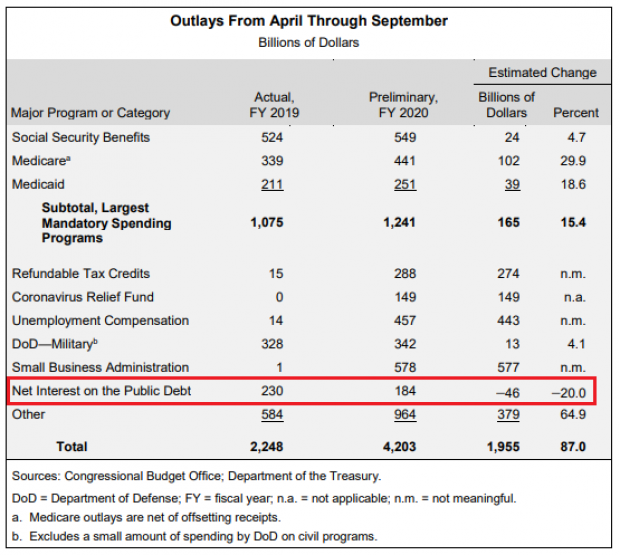

“Net outlays for interest on the public debt decreased by $46 billion compared with the same period in 2019,” the Congressional Budget Office said in its latest monthly budget review, released Thursday. The reason for the decrease? “[L]ower interest rates and lower inflation more than offset the effects of a larger federal debt.” (H/t to former Council of Economic Advisers head Jason Furman for noticing this detail; we’ve replicated his marked-up chart from the CBO report below.)

The Wall Street Journal’s Kate Davidson also noted the reduction in outlays on interest: “Lower interest rates reduced the cost of servicing the debt in fiscal 2020, giving policy makers more capacity to finance the recovery effort. The yield on the 10-year Treasury note was 0.779% late Thursday, down from 1.732% a year ago.”

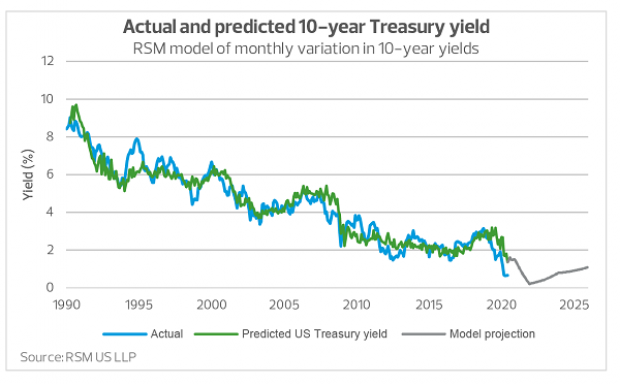

A long-term trend. Joseph Brusuelas, chief economist at the consulting firm RSM, said Friday that “long-term interest rates have undergone a profound structural shift that is likely to keep yields at extremely low levels in the near to medium term.” According to his firm’s model, the long-term downward pressure on interest rates will continue, keeping the 10-year Treasury below 1% through at least 2025 (see the chart below).

“Most important,” Brusuelas said, “our interest rate models imply that under current economic conditions, debt accumulation does not provide the outsized risk to the economic outlook through an interest rate shock, inflation and lower growth than previously thought.”

As a result, the U.S. likely has more room to spend as necessary to boost an economy still struggling amid the coronavirus pandemic. Or, as Brusuelas puts it: “the United States has the fiscal space to adopt the required policy changes to increase productivity and long-term growth.”

A new report from the Brookings Institution also makes the point:

"[T]he fact that rates are so low despite the recent increase in debt does mean that the amount of debt that the U.S. can easily sustain is a lot larger than people used to think. That means there should be much less fearmongering about the debt, and more focus on other national priorities. Furthermore, with interest rates this low, now is a great time to increase public investment, because there are likely many investments the government can make that will yield returns greater than the interest rate that will have to be paid on the debt. Such investments make future generations better off, not worse."