How much will the growing pile of national debt cost the federal government in the years ahead? According to a new analysis released by the Congressional Budget Office, the answer depends in large part on what happens to interest rates.

In its latest report, the CBO projects rising interest rates by the end of the decade: “Over the long term, CBO projects a substantial increase in interest costs, in part from a projected rise in interest rates. Because debt is already high, even moderate increases in interest rates would lead to significantly higher interest costs. Moreover, federal borrowing is projected to rise significantly, further driving up interest costs.”

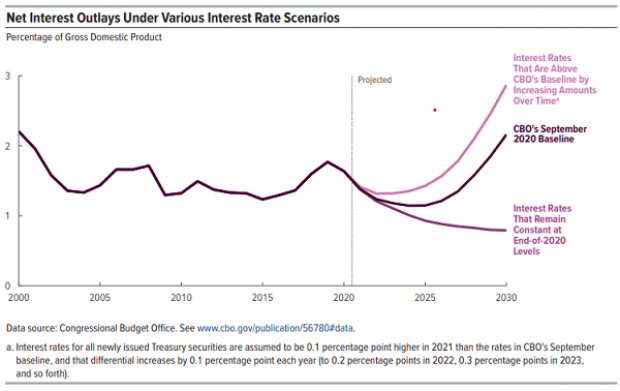

Relative to the size of the economy, interest costs are projected to rise from the current 1.4% of GDP to 2.2% of GDP by 2030 – a level that is “generally in line with the 50-year average of 2.0 percent.”

Deficit hawks warn that it’s extremely risky to bet that interest rates won’t rise, and that if rates rise even slightly more than projected, the long-term costs would be tremendous.

However, as critics have long pointed out, CBO’s track record on interest rate projections is pretty bad, and the new report admits as much: “CBO’s forecasts of interest rates have exhibited larger mean errors than its forecasts of other economic indicators. In particular, CBO has overestimated interest rates during their persistent downward trend that began in the early 1980s.”

CBO could be wrong in the same way again, as some economists argue, and interest rates could remain stuck at historically low levels for years to come. If so, interest costs for the federal government could continue to fall (see the bottom line in the chart below).