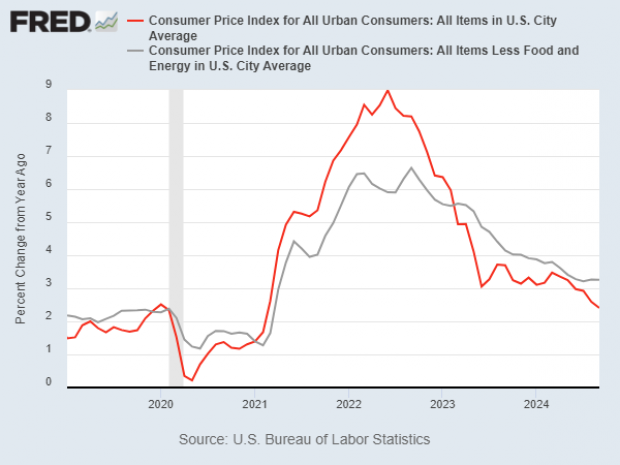

Inflation in September registered its lowest annual reading in more than three years as the Consumer Price Index increased by 2.4% on a 12-month basis, the Labor Department reported Thursday. Although the annual rate was slightly higher than expected, it was below the 2.5% annual rate recorded in August and the smallest increase since February 2021, when the inflation rate began its pandemic-era rise.

On a monthly basis, prices increased 0.2% in September, the same as in August. However, the core price index, which ignores volatile food and fuel prices, rose 0.3% on a monthly basis and 3.3% on an annual basis, slightly higher than the 3.2% annual rate recorded in August and above analyst expectations.

Overall, the latest data shows that inflation continues to cool as it falls back toward the Federal Reserve’s 2% target, but the downward path is bumpy, as many analysts warned it would be. “Things are still gradually coming down, but there is going to be volatility month to month,” Alan Detmeister, a former Federal Reserve economist now with UBS Investment Bank, told the Associated Press.

The report is not expected to change many minds at the Fed as policymakers consider additional interest rate cuts. “Inflation is dying, but not dead,” said Olu Sonola, head of US economic research at Fitch Ratings, per Bloomberg. “Coming on the heels of the surprisingly strong September employment data, this report encourages the Fed to maintain a cautious stance with the pace of the easing cycle. The likely path is still a quarter point rate cut in November, but a December cut should not be taken for granted.”

Good news for Harris, maybe: The inflation numbers are the latest in a string of solid economic reports that should be good news for Vice President Kamala Harris just weeks ahead of the election. But as Politico’s Vitoria Guida writes Thursday, it may be too late for Harris to get credit for the Biden administration’s recent successes in managing the economy.

“The unemployment rate stands at 4.1 percent, the S&P 500 stock index is up more than 20 percent this year, and GDP has been growing at a robust 3 percent pace,” Guida writes. “Middle-class Americans are more optimistic about their financial future than they were a year ago. And with inflation approaching the Federal Reserve’s 2 percent target, Chair Jerome Powell has begun lowering interest rates, providing relief to debt-burdened businesses, credit card holders and potential homebuyers.”

Polls, however, show that voters continue to hold negative views on the economy and trust Republican nominee Donald Trump more on the issue. Although Harris has closed the gap somewhat in recent weeks, a Gallup poll released Wednesday shows that 54% of likely voters think Trump would do a better job on the economy, compared to 45% who picked Harris.

The bottom line: Voters say that inflation and the economy are among their top issues this fall. Although inflation has eased significantly and the economy is showing impressive strength by most measures, voter perceptions are considerably more negative, and this could powerfully influence the vote in November.