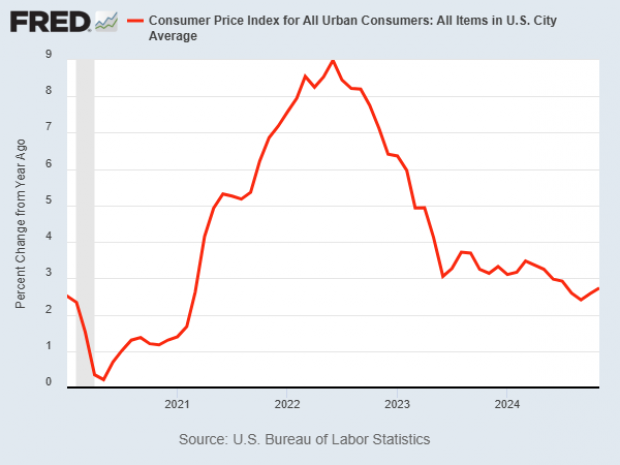

The rate of inflation edged higher in November as consumer prices rose 2.7% relative to a year ago and 0.3% relative to the month before, the Labor Department announced Wednesday. Both readings were a tenth of a percentage point higher than in October, raising concerns that progress in the battle against inflation has stalled above the Federal Reserve’s 2% target rate.

Major drivers behind the inflationary wave include car insurance, which saw a 12.7% increase in prices year over year, housing and airfares, both up 4.7%, and restaurants, up 3.6%. Prices for appliances fell modestly, down 0.2% annually, and gasoline prices were 8.1% lower than a year ago.

The core measure of inflation, which excludes volatile food and fuel prices, rose 0.3% on a monthly basis for the fourth month in a row. Core prices were up 3.3% on an annual basis.

What the experts are saying: The latest data provide more evidence that the downward path for inflation continues to be bumpy, as most economists predicted, but the November report also suggests that inflation may remain above the Fed’s target rate for longer than many experts had hoped. Economist Tuan Nguyen of RSM said that while some of the latest numbers were likely the result of seasonal factors, there is “no denying the signs of a reversal in the disinflation trend, driven largely by strong underlying growth, robust consumer spending and wage gains.”

Still, investors are betting that Fed officials will go ahead with another rate cut next week at their final meeting of the year, even as the outlook for 2025 becomes a bit hazier. “I think they can safely go ahead and do a 25-basis-point cut in December. The markets are prepared for that,” said Loretta Mester, a former president of the Cleveland Fed, per Bloomberg. “However, they’ve got to be rethinking about next year, because it does look now that the inflation progress has stalled out a bit.”

The threat of inflation remaining above the Fed target rate comes as President-elect Donald Trump prepares to take office, with plans that could complicate the Fed’s effort to cut interest rates amid disinflation. Many economists are concerned that Trump’s plan to raise tariffs, deport millions of undocumented migrants and slash taxes will put upward pressure on prices, risking a reignition of significant inflation in the U.S. economy.

Sarah House, senior economist for Wells Fargo, said it may be difficult to bring inflation all the way back to the target if demand remains strong. “Overall, we’re looking at an environment where the low-hanging fruit has been picked and it’s getting harder and harder to make further inroads into reining in inflation,” she said, per The Wall Street Journal. “Now we’re getting to a point where you really need the demand side of the economy to weaken. That’s what makes the last mile so hard.”

Economy

Progress on Inflation Stalls as Prices Tick Higher in November

REUTERS/Mario Anzuoni