The Senate version of the $1.9 trillion American Rescue Plan will cut taxes by about $3,000 on average this year, according to a new analysis by the Tax Policy Center. Families with children will see an even larger tax cut of more than $6,000, TPC’s Howard Gleckman wrote Monday.

The tax provisions modeled by the TPC include the economic impact payments (EIPs) of up to $1,400 per person and the expansion of child tax credits. “By far the single biggest tax cut in the Senate bill is the next installment of the direct EIPs,” Gleckman said. “They cut household taxes by an average of about $2,300, representing more than two-thirds of the overall tax cut.”

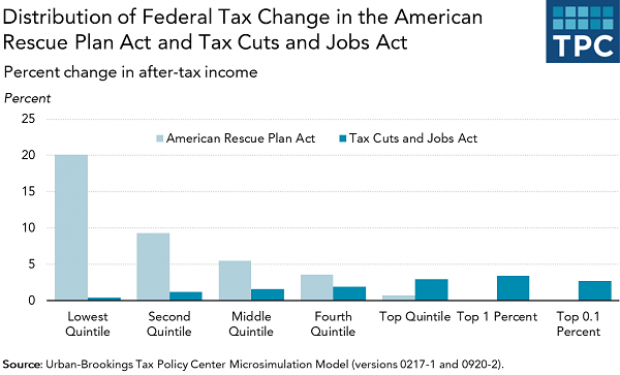

Low and moderate-income households would receive nearly 70% of the benefits – a marked contrast with the 2017 Tax Cuts and Jobs Act, which delivered nearly half of its benefits to the wealthiest 5%. “As they say, elections have consequences,” Gleckman said. “And few bills show that contrast as much as the Republican’s TCJA and the Democrats’ ARP.”