Non-farm employment grew by 199,000 in December, the U.S. Labor Department announced Friday, a disappointing result that fell well short of expectations for the month.

At the same time, the unemployment rate dropped three-tenths to 3.9%, wage growth accelerated and the previous month’s hiring numbers were revised upward by 141,000 — all positive signs for the economic recovery despite the surge of the omicron Covid-19 variant.

“Both sides of today’s report agree the labor market is recovering,” economist Nick Bunker of Indeed said in a research note, referring to the separate surveys of employers and households that contribute to the monthly report. “The disagreement is just over how fast it is happening.”

Biden talks jobs: Speaking at the White House, President Biden talked up his administration’s performance on job creation. “I would argue the Biden economic plan is working and it’s getting America back to work, back on its feet,” he said. “This is the economy I promised and hoped for.”

Biden noted that the drop in the unemployment rate in 2021 was the sharpest reduction in U.S. history, and that the 6.4 million jobs added during the year set a new record.

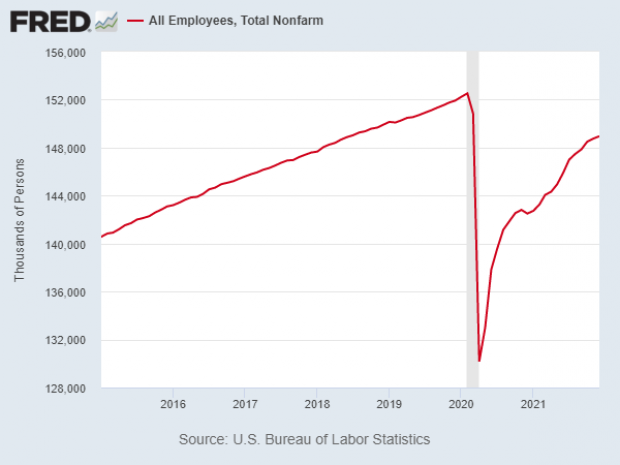

The numbers are indeed impressive, but analysts highlighted some needed context. While about the same number of jobs were added in 2021 as in the first three years of the Trump administration combined — 6.5 million total jobs were added in 2017, 2018 and 2019 — Biden was starting off in a very different place, in the middle of a pandemic that pummeled the labor market and produced a historically low base on which to build. (See Philip Bump of The Washington Post for more on the politics of jobs numbers.)

And it’s important to note that even though 84% of the jobs lost during the pandemic have now been recovered, the labor market is still 3.6 million jobs short of where it stood before the pandemic began in early 2020, when the unemployment rate stood at a 50-year low of 3.5% — and even further behind where it would be had there been no Covid-19 crisis at all.

Pressure on the Fed: The combination of lower unemployment and rising wages will only increase pressure on the Federal Reserve to reduce its support for the economy and raise interest rates repeatedly this year. The dollar declined and Treasury yields rose Friday as investors doubled down on bets that the Fed will hike its benchmark rate as soon as March.

“The disappointing monthly change in headline nonfarm payrolls masks what is actually a very strong jobs report ... this jobs report likely will alleviate any lingering doubts on the part of more-dovish [Fed Open Market Committee] members that the final hurdle for liftoff has been met,” economists Anna Wong and Andrew Husby told Bloomberg News, referring to the Fed’s threshold for raising rates once the economy is strong enough.

Diane Swonk, chief economist at Grant Thornton, said that even though the economy is still millions of jobs short relative to early 2020, “the labor market is behaving as if we’re beyond full employment,” giving the Fed further incentive to start raising rates sooner rather than later.

Is Manchin listening? Roll Call’s Peter Cohn notes that the Fed’s plan to accelerate its withdrawal of monetary support and raise rates faster could have important implications for fiscal policy in the coming months. On the one hand, higher rates mean higher interest costs on the national debt, which could amplify Sen. Joe Manchin’s (D-WV) concerns about any new spending programs that contribute to the debt.

On the other hand, one of Manchin’s main concerns is inflation, and the Fed’s assertive effort to get inflation under control could ease the West Virginian’s worries about the potential for Biden’s Build Back Better plan to spark further price increases throughout the economy.

“With the Fed winding down its unconventional monetary policy on a faster timetable than anyone thought, Manchin is seemingly getting his wish,” Cohn says. “Now it's up to Biden and Democratic leaders to work with Manchin on a fiscal package that meets his demands, or risk seeing several signature campaign promises go up in flames ahead of crucial midterm elections.”