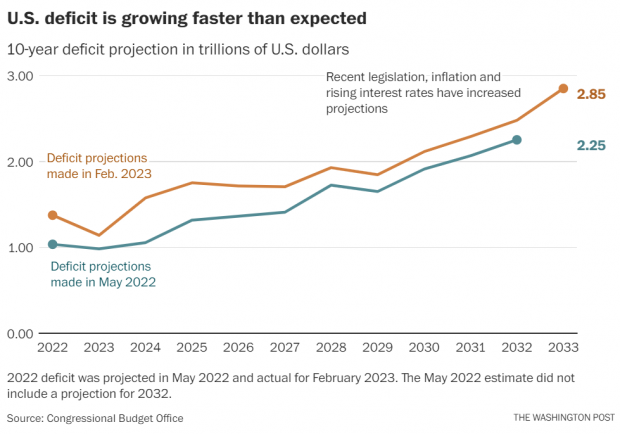

Federal finances are deteriorating more rapidly than expected, the Congressional Budget Office said Wednesday as it released its 10-year outlook for the federal budget and the U.S. economy.

The 101-page report finds that the gap between spending and revenues is growing faster than previously estimated, thanks in part to new legislation, with the current fiscal year deficit projected to come in at $1.4 trillion, rising to $2.7 trillion in 2033. The cumulative deficit is now projected to total $18.8 trillion over the next 10 years, which is $3 trillion more than the CBO projected just last spring.

Measured as a percentage of the economy, the deficit will equal 5.3% of gross domestic product in 2023, a number that will bounce higher over the next decade, reaching 6.9% in 2033 — a level of deficit spending that has been seen only five times since the end of World War II, CBO said.

Debt held by the public will rise, as well, up from the current 98% of GDP to 118% of GDP by 2033 — an increase of roughly two percentage points a year, and reaching the highest level ever recorded. Assuming no changes are made to the current trajectory, that number will keep rising, hitting 195% of GDP in 2053.

CBO warns of a sharp rise in entitlement spending: The leading drivers of deficit growth are on the mandatory spending side of the budget, including Social Security and Medicare, as well as growing interest payments on the national debt. Outlays for Social Security will roughly double, rising from $1.2 trillion in fiscal 2022 to almost $2.4 trillion in 2033. Medicare spending will more than double, rising from $710 billion in 2022, to more than $1.6 trillion in 2033 — at which point it will account for 4.1% of all spending in the economy, CBO said.

Altogether, the rising deficits will help push the national debt to roughly $50 trillion by 2033.

Firing up the debate: The report will provide plenty of fuel and perhaps some urgency to the burgeoning battle over spending levels in next year’s budget and beyond. Although CBO does not provide advice on how best to alter the current fiscal trajectory, CBO Director Phillip Swagel said Wednesday it’s clear that something must change.

“Over the long term, our projections suggest changes in fiscal policy must be made,” Swagel told reporters. “The fiscal trajectory is unsustainable. Our spending is outpacing our revenue. At some point, something has to give.”

Lawmakers sparred over the implications of the report, with Republicans focusing on spending. “Today’s report from the non-partisan CBO shows the damage of Democrat spending on the national debt is worse than we thought,” said House Budget Chairman Jodey Arrington (R-TX). “House Republicans must rein in the unbridled spending and restore fiscal sanity in Washington before it’s too late.”

Democrats, on the other hand, focused on revenues. “Decades of Republicans’ unpaid-for tax cuts for the mega-rich and well-connected have added trillions to the debt, deprived the economy of needed revenue, and failed to deliver their promised benefits for the economy or American workers,” Rep. Brendan Boyle (PA), the top Democrat on the House Budget Committee, said in a statement. “Democrats will not be lectured about fiscal responsibility by the same Republicans who drove up the deficit and are now holding our entire economy hostage by refusing to pay the bill.”

In a statement, Maya MacGuineas of the nonpartisan Committee for a Responsible Federal Budget, which advocates for reducing deficits and debt, said the report should inject a “dose of reality” into the debate in Washington.

“It’s time for policymakers to stop grandstanding and demagoguing these important issues and wake up to the reality: we will need to make changes to spending on Social Security, Medicare, and other programs, and we need to raise the necessary revenue to fund them,” she said. “Everything should be on the table to get our unsustainable fiscal problems under control.”