Lawmakers in Washington will need to address some serious fiscal questions next year, not least of which is what to do about Trump-era tax cuts set to expire at the end of 2025.

Some in Congress want to extend the expiring provisions of the 2017 tax cuts, which were signed into law by then-President Donald Trump after passing through Congress with overwhelming Republican support, but according to a new analysis published by the Congressional Budget Office, doing so would come at a substantial price: $4.6 trillion over 10 years.

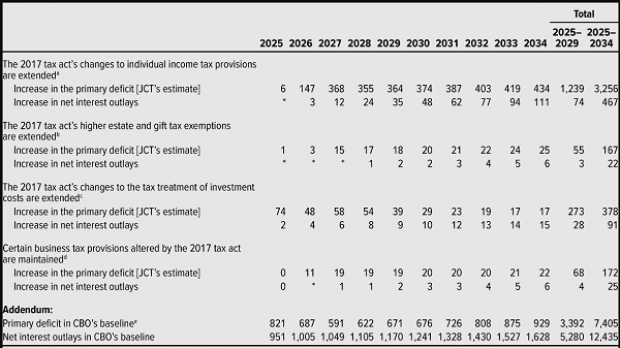

Analysts from CBO and the Joint Committee on Taxation found that extending the tax cuts for individuals would reduce federal revenues by roughly $3.3 trillion over a 10-year period ending in 2034. Interest costs would also rise, with net interest outlays rising by $467 billion over a decade.

The 2017 tax law also included provisions cutting taxes on estates, gifts, investments and some types of small business income; extending those cuts would cost $717 billion, plus another $138 billion for interest.

Tallying it up (the table from the CBO report showing the breakdown of the costs is below) and the total cost comes to roughly $4.6 trillion.

Framing the debate: Democrats have long complained that the Trump tax cuts were fiscally irresponsible and tilted toward the wealthy, and President Biden has vowed to let them expire. “By the way, that tax credit of his expires next year,” he said in April, referring to Trump. “Well, let me tell you something: It’s going to stay expired and dead forever if I’m reelected.”

However, Biden has also vowed not to raise taxes on anyone making less than $400,000 a year, and it’s not clear how he will square that pledge with his stated goal of letting the individual tax cuts expire. Treasury Secretary Janet Yellen recently told lawmakers that the president intends to allow the 2017 tax cuts to continue for families earning less than $400,000, with the revenue losses to be made up by as yet unspecified tax increases in other areas.

Senate Budget Committee Chair Sheldon Whitehouse echoed Biden’s call for letting the tax cuts expire. “Remember the Trump tax scam cutting taxes for billionaires and big corporations. Now they’re set on extending those tax cuts, even though it would blow up the deficit,” he said in a statement Wednesday. “The Trump tax cuts were a gift to the ultrarich and a rotten deal for American families and small businesses. With their impending expiration, we have a chance to undo the damage, fix our corrupted tax code, and have big corporations and the ultra-wealthy begin to pay their fair share.”

Republicans continue to defend the tax cuts while promising to extend them. In a statement, Ways and Means Committee Chairman Jason Smith and House Budget Committee Chairman Jodey Arrington pushed back against the CBO report, claiming the agency’s “track record in predicting the economic and fiscal outcome of the 2017 Trump tax cuts is poor to say the least.”

“The truth is, the Trump tax cuts resulted in economic growth that was a full percentage point above CBO’s forecast, and federal revenues far outpaced the agency’s predictions,” they said. “Republicans believe working families do not need the IRS taking any more out of their pockets ...”

The bottom line: Extending the Trump tax cuts would be enormously costly in budgetary terms, but you can expect to see a serious effort to do so next year, if not sooner.