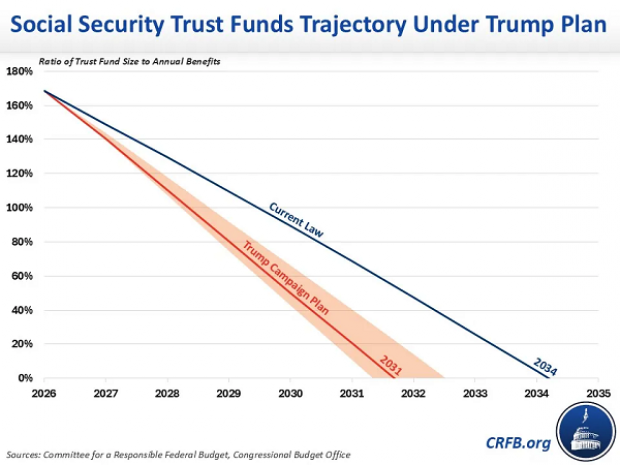

Social Security will be forced to cut benefits by an estimated 23% in 10 years if Congress fails to prop up the program’s trust funds before then, but a new analysis from a budget watchdog group warns that Republican presidential candidate Donald Trump’s proposals would move up the day of reckoning by as much as three years while forcing an even larger benefit reduction.

The report from the nonpartisan Committee for a Responsible Federal Budget, which advocates for debt and deficit reduction, found that several of Trump’s proposals would widen Social Security’s projected financial shortfall. Ending taxes on Social Security benefits would reduce the program’s cash balance by an estimated $950 billion between 2026 and 2035. Eliminating federal income taxes on tips and overtime income would cost about $900 billion over the same time period, while the combination of more restrictive immigration rules, which would reduce the number of migrant workers paying into the system, and higher tariffs, which would increase the cost of many goods and thereby increase annual cost-of-living adjustments, would cost about $400 billion.

Altogether, the proposals would reduce the cash balance in the Social Security system by roughly $2.3 trillion over a decade, according to the group’s “central estimate” of the effects of Trump’s plans. (The “low” estimate for the revenue loss is $1.3 trillion over 10 years, while the “high” estimate is $2.8 trillion.)

As a result, the Social Security system would be forced to cut benefits in fiscal year 2031 rather than in 2034, as currently projected. “In other words,” the group said, “the trust funds would be insolvent only six years after the next President takes office instead of nine – reducing the remaining life of the trust fund by one-third.”

Additionally, the size of the benefit cut would increase under Trump’s proposals. The current projected 23% cut — roughly $16,500 a year for a typical dual-income household — would become a 33% cut by 2035.

No plans to bolster Social Security on the table: Neither presidential candidate has offered a plan to improve Social Security’s long-term financial health and avoid the projected benefit cuts. The CRFB analysts did note, however, that Vice President Kamala Harris’s proposals would not have a significant negative effect on the Social Security trust funds.

Harris campaign spokesperson Joe Costello told CBS News that the analysis shows that Trump is a threat to the Social Security system, while the Democratic candidate seeks to safeguard it. “Vice President Harris is committed to protecting Social Security benefits and is the only candidate who will actually fight for seniors, not just pay them lip service on the campaign trail,” Costello said.

Trump spokeswoman Karoline Leavitt rejected the CRFB analysis altogether while arguing without basis that undocumented immigrants are a serious threat to the Social Security system. “The so-called experts at CRFB have been consistently wrong throughout the years,” Leavitt said in a statement. “By unleashing American energy, slashing job-killing regulations, and adopting pro-growth America First tax and trade policies, President Trump will quickly rebuild the greatest economy in history and put Social Security on a stronger footing for generations to come,” she said.

In its analysis, CRFB addressed Trump’s argument about the curative power of energy production, saying, “increased energy exploration is unlikely to have a meaningful effect on Social Security.” And while faster economic growth could indeed help Social Security’s finances, CRFB was skeptical about the potential for Trump’s plans to do so. “[B]ased on available analyses and understanding the effects of President Trump’s agenda on the national debt, it is unlikely his plans would significantly boost the size of the economy, and many estimates find his plans would reduce long-term output,” CRFB said.

Social Security

Trump Proposals Could Lead to a 33% Cut in Social Security Benefits

Reuters/Carlos Barria