Wall Street has seen this circus before. That’s why, as the clock ticked closer to a partial shutdown of the federal government, investors had been fairly sanguine in the face of the ongoing high-wire act. Even with a shutdown looking increasingly certain, the markets are far from panic mode, though investors are clearly showing signs of worry and a mounting aversion to risk.

It wasn’t all that long ago that the S&P 500 and Dow Jones Industrial Average reached new closing highs on word that the Federal Reserve wouldn’t yet ease up on its monthly asset purchases meant to stimulate the economy. But since Sept. 18, the day of the Fed’s announcement, the S&P has now fallen about 2.5 percent, including a dip of more than 1 percent last week and losses in seven of the last eight trading sessions.

Yields on 10-year Treasuries have slipped from 2.72 percent to 2.64 percent as investors moved into U.S. government bonds – still seen as a safe bet despite the growing chances of a shutdown.

RELATED: THE SHOCKING COST TO TAXPAYERS OF A SHUTDOWN

“Neither financial markets nor consumer confidence gauges have signaled much concern about developments on Capitol Hill,” wrote Jim O’Sullivan, chief economist at High Frequency Economics, in a note to clients Sunday night. “After the debt-limit saga of 2011 and the fiscal-cliff showdown coming into this year, there appears to be a presumption that some kind of last-minute deal will be brokered. Collectively, policymakers are being viewed as the boy who cried ‘wolf.’”

Even if the wolf is real this time, investors still hope that it doesn’t have sharp teeth. A shutdown might cost hundreds of millions or even billions of dollars, depending on how long it lasts. But many analysts still expect any shutdown to be resolved quickly, and not cause massive economic disruption.

“Should we have a shutdown, we would expect it would be relatively short — public uproar and market pressure will hopefully spark an agreement,” Bank of America Merrill Lynch economists Ethan Harris and Michael Hanson wrote to clients Monday. “A shutdown of a few days would likely have no real measurable effect upon the economy and result in only a small sell-off in the markets.”

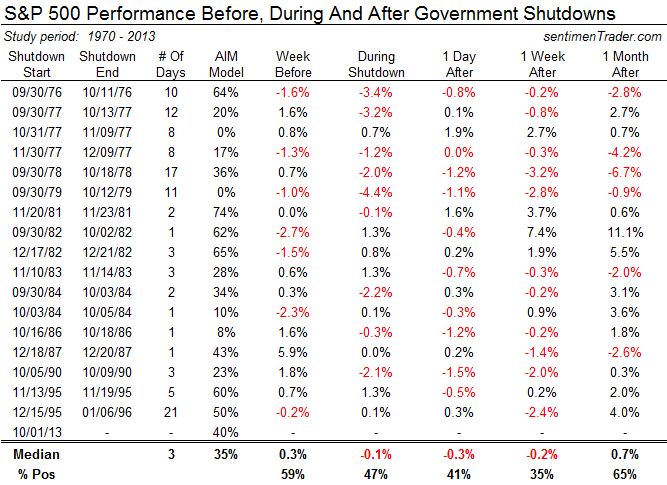

The government last shut down in December 1995 and January 1996, but investors can look back at a number of recent budget battles and a longer history of shutdowns that had little lasting impact, at least on stock prices. “Since 1970 there have been 17 ‘shutdowns,’” Jeffrey Saut, chief investment strategist at Raymond James, said in a Monday commentary, “and guess what, we have survived every single one of them.”

That history may present an opportunity for investors, some analysts say. The S&P 500 fell 3.7 percent from peak to trough during the mid-‘90s shutdown drama and then rebounded 10.5 percent in the subsequent month, according to S&P Capital IQ.

The fiscal fighting could again cause a drop of 5 percent or more, S&P chief equity strategist Sam Stovall noted, but that “may end up as a gift to investors” if stocks then bounce even higher. “While we believe the odds of a government shutdown are increasing, we suspect this may prove to be a great buying opportunity for stocks,” Piper Jaffray Technical Market Strategist Craig Johnson wrote to clients on Monday, adding, “We continue to believe that stocks will continue to climb into year's end as economic conditions continue to improve and uncertainty in Washington subsides.”

By contrast, analysts are much more alarmed by the debt-ceiling deadline looming next month, when the Treasury is set to exhaust the extraordinary measures used to avert a default by no later than Oct. 17.

“A government shutdown would be temporary and probably make only modest dents in fourth-quarter growth, whereas failure to agree on raising the debt ceiling in a few weeks could put the U.S. in technical default and be massively disruptive to the economy and global financial system,” Russ Koesterich, chief investment strategist for BlackRock, wrote in emailed comments.

As we approach that critical date, investors will also still be wondering just when the Federal Reserve will pull back on its bond buying and what quarterly earnings might look like. So for now, investors should expect increased volatility, Koesterich says, and decide how they want to act based on that. “Those investors uncomfortable with volatility should consider getting a bit more defensive, possibly raising cash, while those with longer-time horizons can probably use the market angst around the U.S. budget issues as a buying opportunity.”