Someone in the White House thinks marriage is a bad idea.

Earlier this year, TFT showed that a high-earning couple, each with incomes of $400,000, would save about $27,000 annually if they divorced and filed their taxes separately. Now we learn that the Affordable Care Act, a.k.a. Obamacare, is dangling a similar fate in front of middle income earners.

A typical 40-year old couple with two kids could save $7,230 a year by divorcing if one partner earns, say, $70,000 and the other $23,000. Sixty year-olds earning $62,041 each a year would save $11,028 annually if they broke up.

RELATED: DIVORCE 101 DIVDING THE HOUSE

This analysis below, written by Tom Blumer, a blogger at PJ Media, points out the unintended consequence of what Obamacare will do to marriages and families. He used this calculator from the Kaiser Family Foundation to run the numbers.

THE BABY BOOMERS

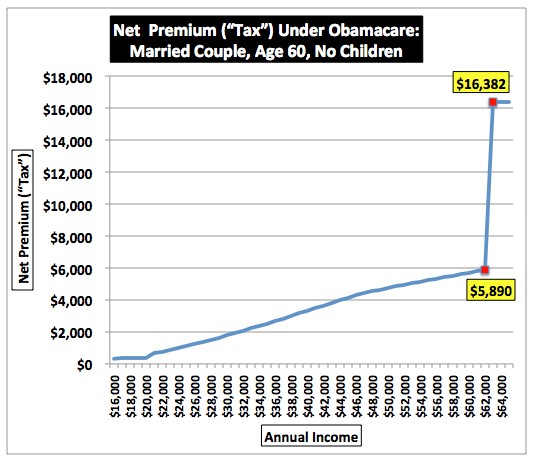

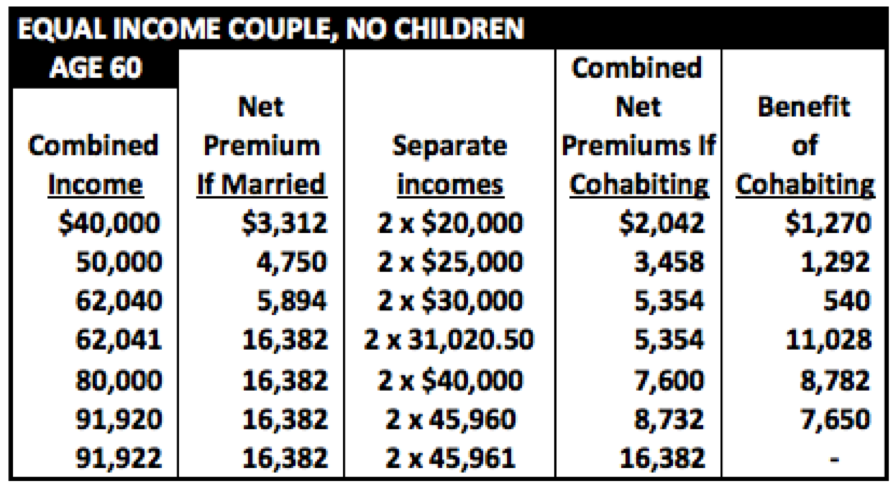

In January 2010, two months before Obamacare’s passage, Robert Rector at the Heritage Foundation gave the impact a name: the “wedding tax.” To illustrate, let’s start with the 60-year-old married couple with no children.

If they have identical earnings totaling $65,000, which will usually net down to $50,000 or less in adjusted gross income after all income and payroll taxes, their Obamacare exchange Silver Plan premium next year with the same earnings will be $16,382, or about one-third of what used to be their take-home pay.

What can this couple do? Well, they could decide to earn a few thousand dollars less, which will negate the five-figure premium hit. Encouraging ordinarily willing workers to put in less effort isn’t good in any economy, but especially not this one. But if either spouse’s earnings are unpredictable or hard to precisely track, they could still “mess up” and get socked with a premium they can’t afford.

The “easiest” solution would be to avoid the “wedding tax” entirely by getting divorced while still living together. Here’s what would happen if they make that choice:

Instead of facing an exorbitant premium increase once their combined earnings hits $62,041 if they were to stay married, each cohabiting adult can earn up to $45,960 before Obamacare’s “tax credit”-free premiums kick in. Their annual after-tax savings at age 60 if they shack up and keep their individual earnings between $31,021 and $45,960 will range from $7,650 to over $11,000. The annual savings will slightly increase every year until Medicare kicks in at age 65. That kind of money can buy a lot of gifts for the grandkids.

But the grandkids will also face the prospect of seeing their moms and dads divorce because of Obamacare.

THE GEN X’ers

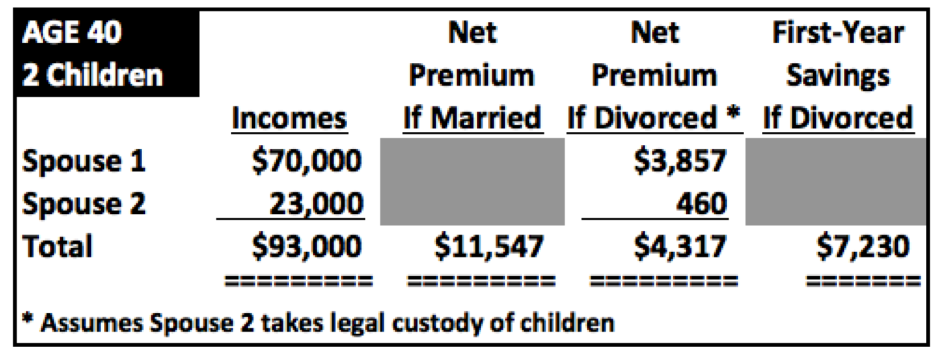

Let’s look at the situation of a 40-year-old couple with two children. The spouses’ annual earnings are $70,000 and $23,000, respectively:

The couple’s annual unsubsidized premium while married is $11,547 (“tax credits” disappear at $92,401 for married couples with two children). But if they divorce and shack up while giving custody of both children to the lower-earning spouse, their combined annual premiums, at $4,317, will be more than $7,200 lower. That’s over $600 a month. As was the case in the previous example, the savings from divorce will gradually increase every year. Those parents will be torn between doing what Western civilization has considered morally right for millennia and their children’s financial well-being.

(There may be contrary examples, but Blumer was unable to find a single instance where staying married led to a lower net health care premium compared to divorcing and living together.) Clearly, many couples who are considering marriage, especially after several years of seeing formerly married couples regress to cohabiting, will look at Obamacare’s “wedding tax” and say, “Never mind.” The effect on society will be incalculable, and certainly not for the good.

Tom Blumer is a frequent contributor to Instapundit and runs BizzyBlog: The Business End of the Blogosphere