Get ready for another Obamacare showdown. Republicans are weighing whether to use the looming debt ceiling fight to revive their war on the president’s health care law.

House Budget Committee Chairman Paul Ryan (R-WI) said Thursday that the GOP wants to repeal what he called Obamacare’s “insurance bailouts” – more formally known as risk adjustment provisions – as part of a larger deal to raise the nation’s borrowing limit, Politico first reported.

Related: Insurers Could Get Multi-Millions in Obamacare ‘Bailout’

“A lot of folks don’t realize there could be some massive insurance company bailouts in the near future with Obamacare,” Ryan said. “That’s one of the issues that’s in the realm of possibility. There are a lot of things…that are being discussed but it’s just not in our interest to negotiate in the media.”

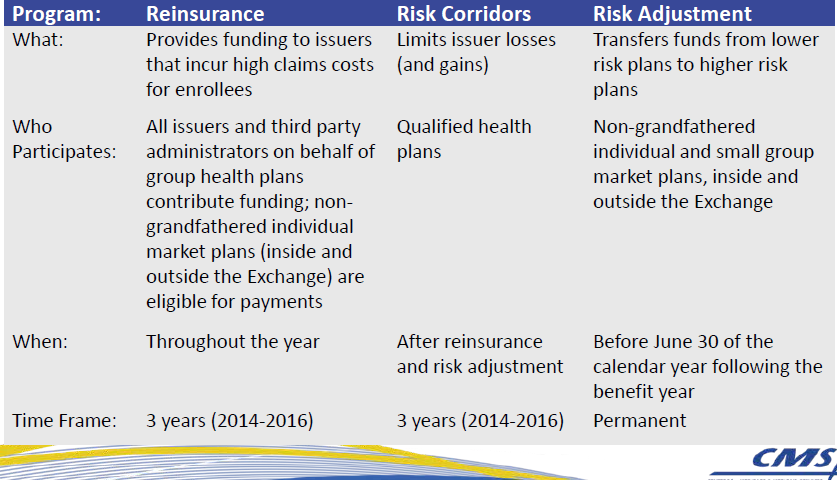

At issue is a provision for so-called “risk corridors” built into the health care law to limit the potential losses insurers could suffer, and the gains they could reap, during the first three years of the transition. Without enrolling the right mix of young, healthy Americans, insurers won’t collect enough in premiums to cover the cost of the claims for older, sicker consumers. A similar risk-sharing provision was implemented when Medicare was expanded to include Part D coverage for prescription drugs.

Under the provision, if an insurance company’s actual claims in 2014 are at least 3 percent greater than the claims projected when it set its rates, the government would be required to reimburse the insurer for half of the excess. If its actual claims increased 8 percent above the projected claims, the government would cover 80 percent of the excess, according to the American Academy of Actuaries.

The Congressional Budget Office estimated last year that the risk corridors would be budget neutral because insurers that enrolled more healthy customers would subsidize those with relatively sick ones. But after a rocky rollout and low enrollment numbers, few insurance companies are expecting to be in surplus.

Republicans have been railing against the risk corridors for months, calling them “bailouts” that they claim could cost taxpayers billions.

"The idea that the federal government should be bailing out insurance companies in order to make Obamacare work, that's not something a lot of people are aware of," Sen. Marco Rubio (R-FL) told Fox News. "I haven't taken a poll on it, but I guarantee you it would be hugely unpopular."

Rubio sponsored legislation that repeals the risk corridors entirely. Similar legislation has been introduced in the House.

Related: More Companies Dump Employee Insurance for Obamacare

The administration and the insurance industry, however, say the provision is not a bailout and is necessary for the law’s success, as well as to maintain market stability and keep premiums from spiking.

The risk corridors came into the spotlight when President Obama announced a rule change in November, allowing people to stay on their policies that would have otherwise been cancelled. Concern begin mounting that the sudden change could make the risk pools worse since healthier people had the option of keeping their old plan instead of signing up for Obamacare. To address this, the administration excluded those plans from the risk adjustment provisions through 2014.

"There's a lot of uncertainty about what the markets are going to look like," said Robert Zirkelbach, spokesman for America's Health Insurance Plans, adding that there are still three months left in the open enrollment period. The risk management provisions written into the law “give the industry some assurance and protect consumers from potentially higher premiums.”

Repealing the risk corridors now would be an additional blow to the insurance industry, which is already experiencing turbulence because of Obamacare’s rocky rollout. On Thursday, Moody’s rating agency changed its outlook on the sector from “stable” to “negative” citing market uncertainty caused by the law.

Top Reads from The Fiscal Times: