Insurance companies that sat on the sidelines of Obamacare last year are looking to get in the game in 2015. This could mean more options and lower premiums for Obamacare enrollees next year.

A new analysis from The Advisory Board says that in every state where data is available so far, more providers are asking to participate in Obamacare next year.

Related: 4 Reasons Obamacare Premiums Will Rise Next Year

This is good news for consumers, as more competition means more options.

“If new insurers have lower premiums, that may drive down the price for the 2nd lowest cost plan, the benchmark for subsidies,” Kaiser Family Foundation’s Vice President Larry Levitt said on Twitter. He added, “New insurers will provide choice where it didn’t exist before.”

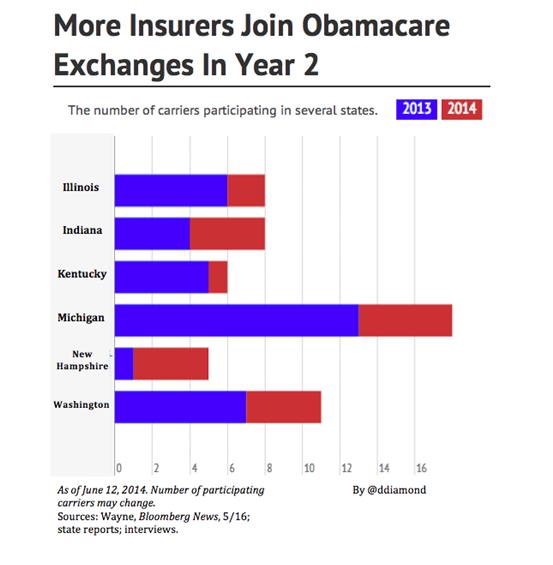

In Michigan, for instance the number of insurers offering plans on the exchanges in 2015 jumped from 13 to 18. Over in New Hampshire, five providers will sell plans on the exchange compared to only one. Meanwhile 10 providers will participate in Illinois’ exchange, compared to six this year.

“The significant increase in the number of carriers and the number of plans they are offering represents good news for Illinois health care consumers. It means consumers will have even more good options to choose from next year,” said Jennifer Koehler, executive director of Get Covered Illinois, in a statement.

It’s not surprising that some insurers opted to wait out the first year of Obamacare. There was so much uncertainty surrounding the law and what the risk pools would look like, so many were hesitant to jump into the marketplace right away.

Last October before the exchanges went live, Aetna pulled out of seven exchanges—saying it wanted to be cautious amid the uncertainty.

"Our first-year approach is to be cautious and focus on those markets where we can be successful," an Aetna spokesperson told The Wall Street Journal.

Related: High Deductibles Keep Obamacare Premiums in Check

Overall, an average of eight insurers participated in 36 states with exchanges run or supported by the federal government, the Department of Health and Human Services said. Some states with their own exchanges had far fewer. Kentucky, for example, had just three.

Now that industry experts have a better idea of the demand, more are expressing interest in entering the exchanges. United Healthcare Illinois, for example, is joining the state’s marketplace after sitting out the first year.

If United and other large insurers join the marketplaces, that could mean big savings for consumers. A study by the National Bureau of Economic Research found that the addition of United Healthcare alone would increase competition in the market that will drive down premiums. The study said that premiums for silver plans in 34 states including Illinois would have been 5.4 percent lower if the giant insurer would have participated in the marketplaces, the Chicago Tribune noted.

Top Reads from the Fiscal Times: