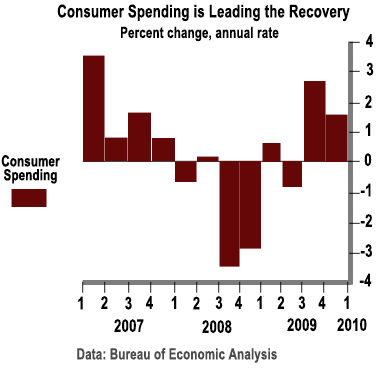

Maybe it’s time to rethink expectations for American consumers. Clearly, they continue to face stiff financial headwinds following the housing collapse and a severe recession, but none of this prevents them from taking their traditional leading role in the economic recovery.

Last year was full of dire predictions that households would be in no shape to lead an economic turnaround, especially amid weak labor markets. But even as Americans cut back on debt, and rebuild their savings, they have started spending again.

Last quarter’s 3.6 percent annual rate of growth—the third consecutive quarterly gain and the strongest in three years—vaulted outlays above the pre-recession peak in the fourth quarter of 2007. No other major sector of the economy, including corporate outlays, homebuilding, or exports has come as close to recouping its losses from the economic downturn as consumer spending.

There are, however, three prevailing conditions that could dampen consumer enthusiasm in the short term: the stock market’s steep drop last week in response to the Greek financial crisis, a high unemployment rate, and falling home values. But what is far more important to the consumer outlook is the surprising strength in the job market. Private-sector employers added 231,000 jobs in April, following a solid 174,000 in March.

That was the strongest two-month advance in three years, and the April gains were the broadest across industries in four years. Continued growth at that clip should be sufficient to bring down the unemployment rate, which stood at 9.9 percent last month. The April jobs report implies that businesses are responding to stronger demand for their products by expanding their payrolls, which is boosting incomes and consumer spending, say economists at Barclays Capital.

In the classic recovery pattern, consumer outlays for big-ticket items, such as cars, furniture, and appliances, are leading the way. The gains have not been as strong as in past recoveries that followed severe recessions, but they are still impressive. In the first four months of 2010, car buying is up 14 percent from the same period last year. Adjusted for inflation, spending on recreational goods and vehicles is growing at a double-digit rate, as are purchases of home furnishings and household equipment. Clothing sales are also accelerating, and spending in the broad services sector, which accounts for two-thirds of all outlays, has grown at a faster rate in each of the past four quarters.

Since the second quarter of last year, consumers have lifted their spending even as they reduced their installment debt by some $50 billion. That suggests households can support the recovery and cut their borrowing at the same time, especially as credit conditions improve. At a banking industry conference on May 6, Federal Reserve Chairman Ben Bernanke said “bank attitudes toward lending may be shifting,” based on the Fed’s latest survey of senior loan officers. Consumer credit through March has risen in two of the last three months, after a steep and steady decline since July 2008.

Still, consumers have a heavy load of debt accumulated over the years and many need to save more. In the first quarter, consumers saved 3.1 percent of their after-tax income. That’s down from 5.1 percent in the second quarter of last year, when tax rebates and other one-time boosts to incomes from the federal stimulus package temporarily lifted savings. But the saving rate is about two percentage points higher than it was two years ago.

One reason for strength in consumer spending is household balance sheets are slowly improving. Even after the nearly 500-point drop in the Dow Jones Industrial Average in two days last week, stock prices are up nearly 60 percent since their March 2009 low. That, plus the stabilization in home prices in recent months, means that consumers have regained about 40 percent of the $17 trillion in net worth they had lost from the second quarter of 2007 to the first quarter of 2009. Historically, as wealth rises, households feel less need to save, so firmer balance sheets will further support consumer spending. Households contributed 80 percent of last quarter’s 3.2 percent growth in real GDP (gross domestic product). Income gains in the April jobs report reflect a growing economy. Basic earnings from wages and salaries grew at a 3.2 percent annual rate in the first quarter, the strongest showing in more than two years, and the April report implies the pace is quickening in the second quarter.

Stronger income growth is also evident in the recent pickup in withholding taxes, which closely mirror labor market trends. In the three months through April, federal withholding was up 12 percent from a year ago, based on the Treasury Dept.’s monthly and daily figures, a sharp turnaround from an 11 percent drop in the three previous months. That’s one reason federal deficit forecasts for fiscal year 2010 are starting to undershoot the White House’s $1.6 trillion projection.

One lesson of every past recession is that consumers are a resilient bunch in the face of adversity. Despite the unique headwinds households face in this recovery, they are proving their mettle once again.