It's a good time to be an optimist. Stocks rallied hard to new record highs last week, jumping strongly off of the late January lows and potentially ending the funk the market's been in since November.

This comes in the face of ongoing tensions over the potential "Grexit," fighting in Ukraine, a slowdown in U.S. economic data and a downturn in forward earnings expectations. Breadth has been narrowing. In fact, as I discussed in a recent post, by some measures stocks are looking vulnerable in a way that they haven’t since the last bull market peaked in 2007.

Related: Gold on a Roll and It Could Go Higher

The catalyst for the move higher despite all this? Excitement over the rumored Apple (NASDAQ:AAPL) car.

No really, I'm serious. The stock is up nearly 23 percent over the past month on reports that its "Project Titan" could be the next big thing — and Apple is dragging the rest of the market higher by the scruff of the neck. Call me a cynic, but maybe they should have called it "Icarus" for all the hubris the guys down at One Infinite Loop are displaying.

The rebound in energy prices have played a role in the market’s surge as well, as crude oil has bounced on the thinking that the recent drop in drilling rig counts (down 34 percent from the October high) will bolster prices. That ignores the fact that production and inventories have soared to record highs and floating storage is filling up fast.

All of this seems pretty flinty in light of the growing list of real-world problems. To be sure, this isn't a new phenomenon; it just seems like the ability of investors to disconnect from the world’s troubles has reached a new level lately.

Related: Why Oil Prices Will Rebound Before We Know It

It started when the Federal Reserve unleashed a torrent of cheap money stimulus, but with the futures market pricing in at least one rate hike this year, monetary policy is poised to tighten. As a result, the ability of stocks to remain disconnected from Yardeni Research's measure of stock market fundamentals — a measure based on the Consumer Comfort Index, commodity prices and initial jobless claims — could soon come under threat.

That's because if stocks are going to keep pushing higher, investors are going to have to continue to ignore some troubling signals from the economic data. Just look at the way new factory shipments are rolling over, suggesting top-line sales are going to contract on a year-over-year basis in a way that accompanied the last two recessions.

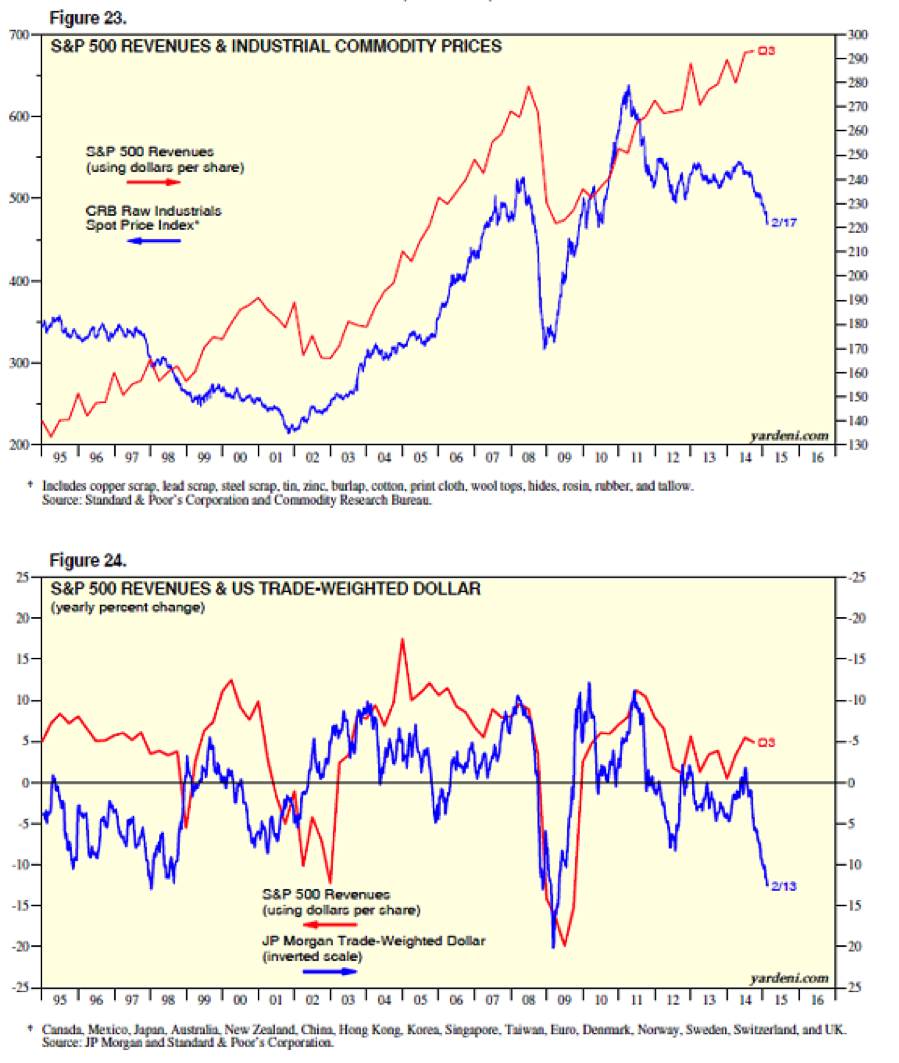

We could also see a repeat of the 1998 profits recession, which resulted in a 20 percent pullback for the S&P 500 (a pullback that was accompanied by currency market volatility similar to what we've been seeing over the last few months). The recent drop in commodity prices and the strengthening of the U.S. dollar have both, as the charts below show, been associated with pressure on S&P 500 revenues.

The top chart shows how the stock market, overall, is more exposed to commodities as a product rather than an expense because of the heavy weighting of energy and materials stocks relative to consumer-oriented issues. With commodity prices down and economic slowdowns across the developed and emerging world — with the United States suffering the longest run of disappointing economic data since 2012, based on the Citigroup Economic Surprise Index — this dynamic will only strengthen as the year rolls on.

Related: The Stock Market Is Weaker Than It Looks

The bottom chart shows that a stronger dollar (the blue line is on an inverted scale) tends to result in weaker revenues for the S&P 500. This is because of the growing importance of foreign sales to U.S.-based companies as a share of overall revenue. When the dollar strengthens, foreign sales are worth less when repatriated.

The dollar's rise has been fueled in part by the relative strength of the U.S. economy compared to slowdowns in Europe and Asia as well as the expectation that the Federal Reserve will raise interest rates this year. Fed policymakers, in their latest projections, are looking for short-term interest rates to rise from near 0 percent to more than 1 percent by the end of the year. The futures market is less aggressive, pricing in a 0.25 percent rate hike. But still, the path is higher.

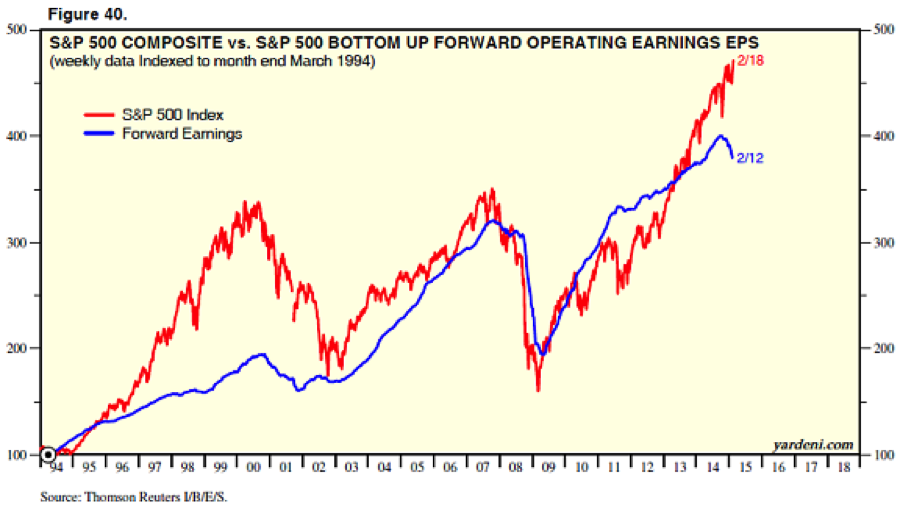

All of this translates into a situation where S&P 500 earnings are set to move lower as top-line growth is hit by the factors discussed above.

Of course, stocks could continue to climb anyway, despite the drop in earnings, thanks to the magic of multiple expansion. If so, people should know that such a rise is based on emotion and speculation, or maybe desperation. While an Apple car might be cool, and could succeed in a big way, I just don't see this as justification for ignoring big downward turn in the hard data.

To join the optimists, I would need to see S&P 500 forward earnings estimates turn higher, a sustained rebound in energy prices and a reacceleration in factory activity. I’ll be watching the data.

Top Reads from The Fiscal Times: