It was inevitable, I guess.

Despite the fact that the U.S. economy has never been larger and is growing fairly steadily, or that net household wealth has soared, or that the job market is rapidly tightening, the Federal Reserve has kept interest rates pegged at close to 0 percent since 2008. Time and time again, expectations of rate “liftoff” have been pushed back as some new worry — fiscal standoffs in Washington, the Greek debt drama, severe winter weather or the Ebola scare — delayed the day of reckoning. No wonder then that the S&P 500 hasn't suffered a correction of 10 percent or more since 2012. Markets have been hypnotized by seemingly never-ending promise of cheap money.

A day after the Dow Jones Industrial Average entered its first "Death Cross" since 2011, and as evidence builds stocks are poised for deeper losses, New York Fed President William Dudley on Wednesday reassured investors in a big way, not unlike the way St. Louis Fed President James Bullard saved the market last October with talk of more stimulus.

Dudley said the Fed can "hopefully" raise rates in the near future, a big walk back from his comments earlier in the week that "liftoff is close" and that he was "very disposed" to vote in favor of a September rate hike. On Wednesday, Dudley added that the drop in the Chinese currency — down 3.8 percent against the dollar over the last two days — will have “huge implications” for global demand and for commodity prices.

Related: Oil Sector Insiders Signal It’s Time to Buy

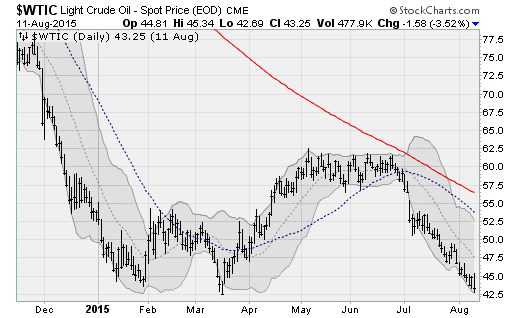

Put plainly: Dudley, an influential member of the Fed's Open Market Committee, is seemingly worried about the impact lower commodity prices will have on inflation already running persistently below the central bank's target.

To my ears, that sounds like a budding excuse to prolong the reign of the Fed's 0 percent interest rate policy through the end of 2015 and into early 2016. If so, stocks could very well turn tail from here and continue their multi-year meltup. While Fed credibility would in my opinion be further damaged, policymakers could spin this as merely a response to developments, a form of the data dependency they have stressed for months.

In its July policy statement, the Fed stressed the need to be "reasonably confident" that inflation is moving back toward its 2 percent target in the medium-term. Such an assessment, in their words, would factor in "a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments."

Further volatility in the valuation of the Chinese yuan, with resulting turbulence in commodity markets weighing on material and energy prices, would seem to suggest caution based on these criteria. The Fed will also be mindful of the negative impact any further strengthening of the U.S. dollar will have on corporate profitability.

Related: What the U.S. Must Do to Avoid Another Financial Crisis

Economist Michael Hanson at Bank of America Merrill Lynch told clients on Monday that developments in China made a September Fed liftoff call "just a little closer" by increasing the uncertainty around upcoming policy meetings. He recommended "paying close attention to upcoming speakers to see how they assess the risks to the Fed's objectives and expected policy path" from the actions in China.

Aneta Markowska, chief U.S. economist at Societe Generale, echoed these sentiments, noting the Fed "wants to engineer a smooth liftoff and will be very sensitive to financial conditions at the time of the September meeting." In her mind, if there is any doubt at all about the market's ability to tolerate higher rates, the Fed will delay.

The risk, of course, is that the longer the Fed waits the more complacent everyone gets; the addiction to monetary morphine only grows more severe. Eventually, as it must, the medicine will be withdrawn. Prolonging the inevitable just makes the hangover more painful.