When people talk about money in politics, they invariably focus on elections — on the insidious role played by outside groups to push into office those with hidden political agendas. But for all the money spent on electoral politics, perhaps the bigger threat comes from greater sums spent in the First Amendment-protected exercise of lobbying.

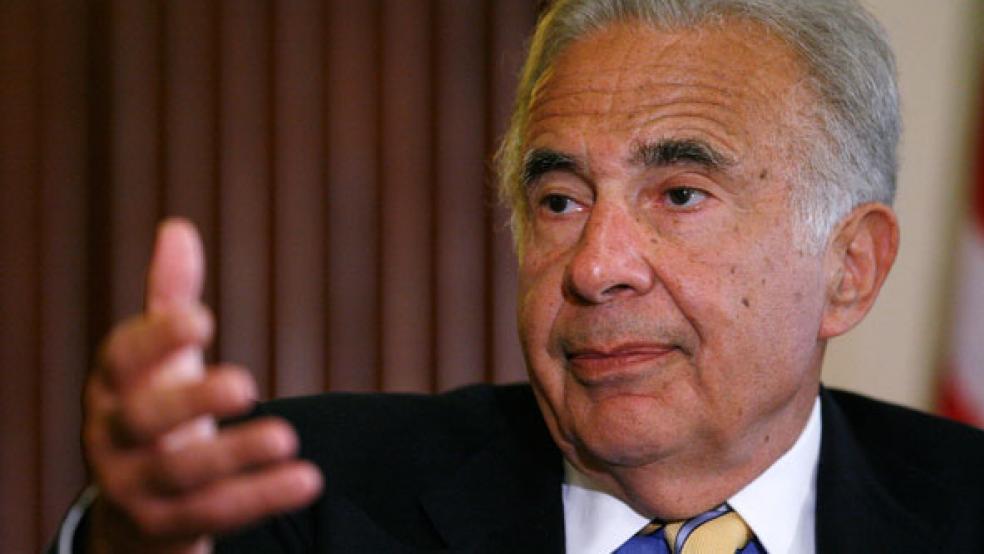

This week, billionaire investor Carl Icahn announced the formation of a $150 million SuperPAC, which he says will be dedicated to ending the spectacle of “so many of our great companies leaving our country.” Icahn is particularly exercised about so-called “inversions,” where domestic corporations merge with a foreign partner and shift their corporate masthead overseas, pretending to be headquartered abroad to take advantage of a lower tax rate.

Related: Are Activist Investors a $100 Billion Drag on the Economy?

We’ll deal with what Icahn is really after in a second. But first let’s marvel at the sheer sum Icahn plans to personally donate to this crusade. As of June 30 of this year, the entire presidential campaign, representing nearly two dozen candidates, has accumulated $211 million in SuperPAC funds, according to the Center for Responsive Politics. Around half of that, $103 million, was raised by the SuperPAC for flailing candidate Jeb Bush, and even that’s dwarfed by Icahn’s individual commitment (which Icahn vows to supplement with third-party funds, making this work-in-progress the biggest SuperPAC operating in America today).

The New York Times lists the largest individual SuperPAC donor this year as Texas hedge fund manager Robert Mercer, with $11.3 million in donations, mostly to Sen. Ted Cruz. Icahn is devoting over 13 times as much, not for a candidate but a legislative priority.

Buying a presidential candidate gets you access and probable support on public policy preferences. Buying legislation gets you the legislation. It’s a far more efficient and less risky allocation of resources.

Related: How the Government Is Rolling Over for Big Banks Again

Icahn has done poorly picking winners with his campaign contributions, so he's now going directly to Capitol Hill to get what he wants. Victory for his SuperPAC would generate windfall profits for his personal investments. In his letter to key members of Congress announcing the SuperPAC, Icahn provides a solution to the mass exodus of U.S. corporations: “international tax reform.” In fact, he gets more specific, endorsing a framework created by Sens. Chuck Schumer (D-NY) and Rob Portman (R-OH), as a way to fund a long-term highway bill.

Schumer-Portman would allow the $2.2 trillion held by corporations overseas to be repatriated into the United States at a rate far below the current 35 percent corporate tax (Icahn puts the number at 5 to 10 percent). This would save corporations between $550 and $660 billion in taxes. The money collected on the initial repatriation would then be used to fill gaps in the Highway Trust Fund for infrastructure projects. Icahn depicts this as a win-win: Infrastructure gets funded, and companies stay in America rather than seeking inversions.

Related: ‘Moderate’ John Kasich Has a Radical Plan for Highway Spending

It’s hardly the case that the only way to stop American corporations from abandoning the country is to give them a giant tax cut. For example, the Treasury Department took relatively modest steps to crack down on inversions last year, and the rules have slowed them down.

Plus, amnesty like this would reduce revenue over time, as the Center on Budget and Policy Priorities points out. Corporations would know that they could simply refuse to repatriate future funds until Congress gives them another deal, providing incentives for them to shield more money abroad. This would not end tax avoidance but exacerbate it.

It’s also untrue that, as Icahn claims, companies who repatriate overseas earnings would use them to “invest in new capital and create new jobs.” In reality, the Senate Permanent Subcommittee on Investigations found in 2011 that, after the last tax amnesty in 2004, the top 15 companies who repatriated funds wound up cutting 21,000 jobs. Even George W. Bush, who signed that amnesty, has lamented that corporations promised to create jobs after repatriation but instead put the money into increasing executive salaries and passing it on to shareholders — in particular people like Carl Icahn.

Related: U.S. Companies Quicker to Give Board Seats to Activists

Icahn owns $900 million in stock in Apple, a company with $180 billion stashed overseas. He has repeatedly counseled Apple to buy back a bunch of shares and hand out higher dividends, essentially leaking out its cash reserves to shareholders. Bringing back overseas funds at a low tax rate enables this.

As Matthew Yglesias pointed out at Vox, the savings on Icahn’s share of Apple’s overseas funds, between the current 35 percent repatriation rate and the 5 to 10 percent rate he favors, amounts to around $250 million. Icahn would already make back his SuperPAC investment and a tidy profit just off of Apple’s response to the repatriation tax amnesty, to say nothing of his other holdings.

So you have a rich institutional investor making a $150 million bet that he can buy legislation that will make him at least $250 million richer. And he wants to do it in the next two months. “After this December, because of elections… it will be almost impossible to pass this legislation until the next administration,” Icahn wrote to Congress. “The inability of Congress to enact desperately needed legislation because of certain members not willing to compromise is reprehensible, and the members responsible must and will be held accountable.”

That threat adds leverage to Icahn’s already prodigious investment: He’s warning Congress that he will work to defeat any member that doesn’t give him his tax windfall.

Related: Wall Street to Congress — Don’t Make Us Pay the Infrastructure Bill

International tax reform as part of the highway bill was actually dead in the water before Icahn announced this. Schumer pronounced himself “not optimistic” that the parties could get it done. But all of a sudden, there’s a $150 million war chest behind the policy, perhaps enough to sway many wayward Congressmembers.

If it succeeds, we will again confirm the power of money in politics, in a manner more pernicious than campaign contributions. This represents a bid to directly purchase Congressional votes. Even if we rolled back Citizens United and moved to publicly financed elections, this brazen yet constitutionally protected activity would remain a feature of our politics.

The proposed tax amnesty-for-infrastructure swap was always cynical, a kind of stick-up by corporate America: “Give us our tax cut so nobody gets hurt and you can repair a few roads.” Icahn audaciously doubles down on this, threatening members of Congress for his own personal enrichment. As long as there are billionaires and greed, their money will flow through our political system, seeking a high return on investment.