The bulls have reached a critical threshold. The Dow Jones Industrial Average ended last week above the 17,000 level and its 200-day moving average. This is a big deal, capping an impressive 11 percent rally that started exactly one month ago.

A similar advance back in October and November took the Dow up to the 18,000 level, also crossing its 200-day moving average in the process, before the buying stalled. Stocks spent the next four months dribbling lower.

Unless stocks can break confidently higher from here, questions will continue to linger about the health and vitality of this seven-year-old bull market. And for stocks to keep surging, much depends on the success of the European Central Bank's aggressive new stimulus push as well as the pace of any further interest rate hikes from the Federal Reserve this year.

Related: Here’s Why China’s Not the Global Economy’s Problem

Last Thursday, ECB chief Mario Draghi once again seemed to deliver: The ECB cut all three of its key interest rates, expanded its bond-buying program by $22 billion to $88 billion per month and delivered a surprise by broadening its purchases to include non-bank investment-grade corporate bonds and unveiling a new four-year bank loan program (at rates as low as -0.4 percent).

Investors initially responded positively, but then doubts crept in. After all, both the ECB and the Bank of Japan have been throwing as much stimulus at their moribund economies as they can, and it just doesn't seem to be working anymore. Moreover, in his press conference, Draghi said rates were unlikely to fall deeper into negative territory due to potential complexities. All of this cast a pall on the efficacy of extreme monetary policy stimulus and highlighted the limitations of further measures.

Jonathan Loynes, chief European economist at Capital Economics, says his team has long warned that cheap money stimulus "cannot address all of the deep-seated problems facing the currency union, including the fundamental lack of competitiveness in the peripheral countries and structurally weak growth in the core."

The Federal Reserve’s policy announcement this Wednesday, and its update to the Summary of Economic Projections or "dot plot," will be critical in determining where stocks go from here. Two massive factors weighing on corporate earnings growth — which have fallen three quarters in a row for the first time since the recession ended — are directly related to the Fed's policy stance: The price of commodities including crude oil and the strength of the U.S. dollar.

In December, the Fed revealed an expectation for four quarter-point hikes in 2016. The futures market expects only a single rate hike. If Fed officials move their forecast nearer to where the market is, they would do much to boost stock prices on expectations of an earnings rebound. A more dovish Fed is bearish for the dollar (which is good for foreign earnings) and bullish for commodities (because of economic growth expectations, inflation expectations and currency effects from a weaker dollar).

Related: How US Oil Producers Are Finally Turning Off the Tap

This kind of shift from the Fed is far from a slam dunk, however, as Fed policy hawks eyeing a 2 percent inflation target can point to ongoing labor-market tightening and evidence of rebounding core inflation. Indeed, Bank of America Merrill Lynch economists see the core Consumer Price Index inflation rate (excluding food and fuel) reaching 2.2 percent at the end of the year while the Fed's preferred core Personal Consumption Expenditures Deflator rate hits 1.7 percent.

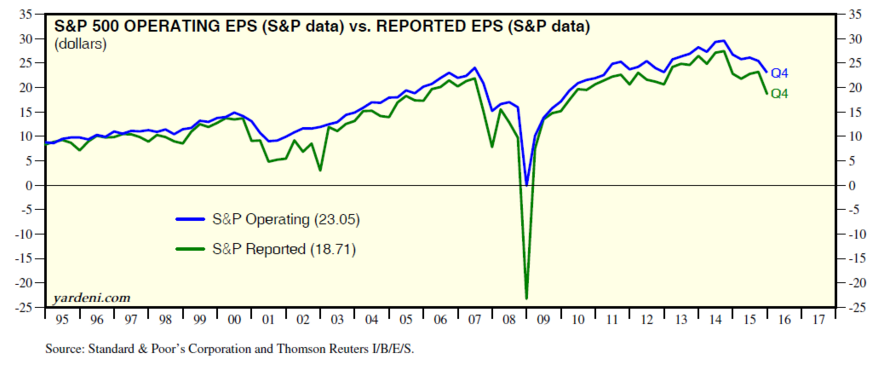

Whatever trajectory the Fed lays out, investors still have to contend with the ongoing drop in corporate earnings. The Q1 reporting season starts on April 11 when Alcoa (AA) reports after the bell. Ed Yardeni of Yardeni Research notes that S&P 500 reported earnings have fallen 18.1 percent year-over-year through the end of 2015. Analysts tracked by FactSet currently expect S&P 500 earnings to decline 8.3 percent in the first quarter, while corporate managers are aggressively lowering expectations with a bevy of negative preannouncements.

Will a temporary pause in the Fed's policy tightening campaign be enough to overcome all of this? We're about to find out. But mark me down as skeptical.