It's pretty clear by now just how dependent the global financial system is on the largesse of the world's central banks. The Federal Reserve, in particular, has taken on immense importance in the post-crisis world of ultra-low interest rates, aggressive stimulus measures and constant stock market activism.

So it's not surprising that markets — especially bonds and currencies — reacted negatively to Wednesday's upbeat and hawkish Federal Reserve policy statement, which opened the door to a new interest rate hike as soon as September. And while it's tempting to dismiss this as merely a pity party by liquidity junkies worried that Fed Chair Janet Yellen is going to prick their bubble, these folks could be justified in their concern.

After all, fundamentals seem to matter less and less (witness the five-quarter long U.S. corporate earnings recession and stretched stock valuations) while stimulus matters more and more. Remember Brexit? All the fear of a possible breakup of the European Union got washed away by non-specific hints, since walked back, of a "helicopter money" drop of coordinated fiscal/monetary spending out of Japan.

Related: The Federal Reserve Bank, Explained

The post-2009 bull market is fragile and very sensitive to any dramatic shift in policy. I'm not even talking about an aggressive rate hike campaign; merely a halt to asset purchase programs underway in Japan and Europe. Globally, the monthly pace of financial asset monetization has never been higher.

The high from the monetary morphine is easy to see. About a quarter of the global bond market is trading at negative interest rates (around $13 trillion worth). Stocks have been boosted by corporate share repurchases funded by cheap debt issuances. Recent strength in consumer spending, especially in autos and housing, depends on debt-servicing costs being so low.

Yet for reasons beyond the scope of this article — including everything from mal-investment in Chinese fixed assets to aging demographics in the West and a slowdown in investments needed to boost U.S. labor productivity — the medicine hasn't fixed the deep scars left from the housing crash.

Related: Home Prices Hit an All-Time High: Is This Another Bubble?

More debt was simply piled on. Systemic hurdles to healthy growth, everything from a lack of fiscal transfers and a banking union in Europe to needed reform of America's health care, educational, regulatory and tax systems, were kicked further down the road. Monetary policy normalization was also repeatedly delayed, creating moral hazard problems.

Policymakers slavishly served the whims of the stock market, the one easily controlled metric of economic resurgence, justified by a mutated version of supply-side, trickle-down economics known as "wealth effect" dynamics.

Sure, corporate profits surged to record highs. And stock prices, too.

Related: Throwing Shade on the Dow's Record High

But the middle-class remains under pressure by many metrics. The U.S. electorate is nervous and angry: The right is clamoring for protectionism and nationalism, while the left attacks free trade deals and wealth/income inequality.

10 Year Treasury Rate data by YCharts

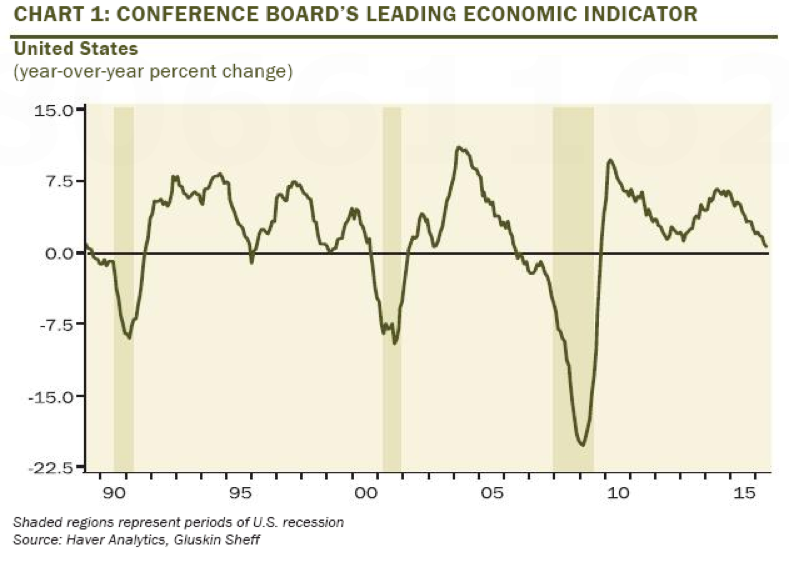

Within this dour structural context, the chart above of leading indicators suggests the economy is increasingly vulnerable and demonstrating classic late-business-cycle behavior. Higher short-term interest rates in this environment will invert the yield curve — the difference between long-term and short-term interest rates — which is the holy grail of recession indicators.

The market reaction to the Fed’s release backs this up. Treasury bonds rallied (pushing long-term yields lower). Precious metals surged. Stocks fell from their highs. And the U.S. dollar slumped.

Why is the Fed turning hawkish? Well, stocks are just below record highs, the unemployment rate is below 5 percent and inflation is becoming a problem. The monetary morphine has done what it can as a powerful palliative. And now side effects are manifesting. It's a stagflationary policy trap of its own creation.

Related: Why Clinton or Trump Could Face a Stock Market Nightmare

The chart above tells the story. Core inflation is above the Fed's 2 percent target and is rising, pulled higher by rapidly increasing housing costs. Ongoing tightening in the labor market is also driving a steady, if choppy, rise in wage growth.

Goldman Sachs analysts believe that, while there is only a 30 percent chance of a September hike, there is a 70 percent chance the Fed will hike before the end of the year. The futures market has assigned better-than-even odds of a December rate hike. And it's notable that the lone dissenter in the July policy decision, Kansas City Fed President Esther George, voted for an immediate rate hike.

We'll know more when Yellen speaks at the central bank symposium in Jackson Hole, Wyoming in August. Also watch for the July jobs report in early August.

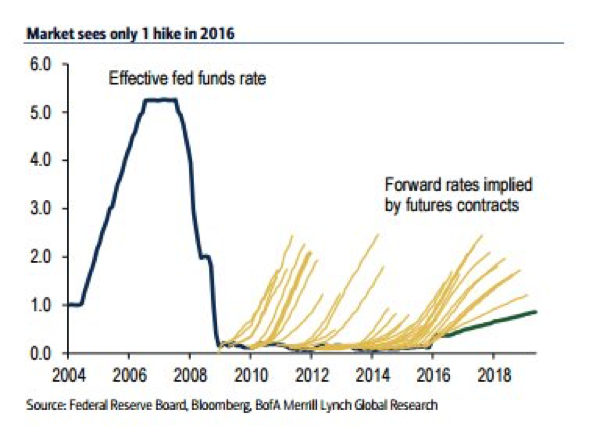

If the market disruption continues, the Fed will surely backtrack as it has so often during this bull market. The chart below reveals just how many times the futures market has expected the Fed to act only to be surprised by its willingness to prolong its experiment with ultra-low rates and avoid any significant selloff in stocks.

For now, with inflation rising but arguably still low, the Fed has the luxury of being able to justify further delays to policy normalization via new rate hikes. But the party won't last forever.