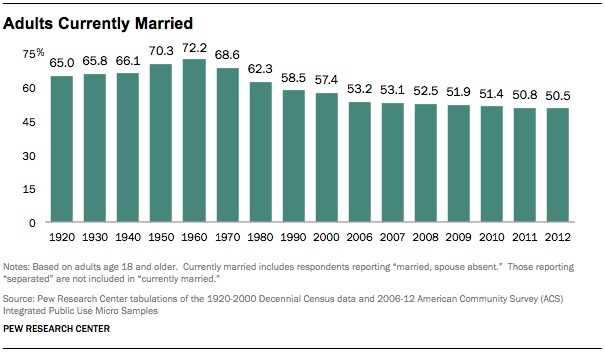

While the number of new marriages has finally started to increase since the recession ended, the total percentage of married adults fell to 50.5 percent, its lowest level ever, according to a report released by the Pew Research Center in February 2014. Twenty percent of adults age 25 or older has never been married, up from just 10 percent in 1960.

There are a number of reasons for the decline in the marriage rate, including dramatic changes to social and cultural norms. When you look at the chart below, you see that baby boomers drove up the numbers and some have divorced or their partners have died, which could affect the numbers. But there are also a number of economic factors, some short- and some long-term that have combined to make it increasingly likely that Americans might just say “I don’t.”

1. Growing income inequality means fewer marriages.

The uneven economic recovery and disappearing American middle class mean that fewer Americans are tying the knot. Historically, marriage rates have fallen during periods of income inequality, as poorer workers tend to get married less often and divorce more frequently.

The trend actually contributes to inequality, since married couples tend to be better off financially. Singles need to spend a greater share of their budget on things like food, housing, taxes, child care, and health insurance

2. Women don’t need a husband for financial security anymore.

There is still a clear wage gap between men and women, but it’s smaller for younger women and single women. For unmarried, career-focused women, that can create a compelling case to push back the wedding, or to spend less time focused on finding a mate. Waiting until after 30 to get married can net women more than $18,000.

Related: The Economics of Marriage: For Love and Money

A 2013 paper from MIT argues that “rising educational attainment, a falling gender gap, and greater female control over fertility choices—have reduced the economic value of marriage for women.”

3. More people are getting divorced.

The percentage of people filing for divorce has increased every year since the recession. That may be bad news for marriage, but it’s a positive sign for the economy. Divorces tend to slow down during recessions, and pick up as an economy recovery, according to a recent paper by a University of Maryland professor.

Even those who aren’t married yet are already thinking about splitting up and what it will do to their finances: Nearly two-thirds of divorce attorneys say they have seen an increase in prenuptial agreements.

4. Student loans are getting in the way.

In addition to putting off buying a home or car, some Americans saddled with student loans are also delaying marriage. A recent study by the American Institute of Public Accountants found that 15 percent of those with debt had decided to wait to get married.

Couples want to shore up their finances and enter into marriage on sound financial footing. They also may not be able to afford a wedding. The average celebration in 2014 rang up more than $31,000 in costs, according to wedding planning site The Knot.

Related: For Richer, For Poorer: The Growing Marriage Gap

5. It’s hard to find “the one” when you’re living with your parents.

Thanks to those debt payments, soaring rent, and a job market that’s just now starting to really pick up steam after several sluggish years, it’s become common for young adults to repopulate the parental nest after college.

Living at home may save millennials money, but it’s not doing them any favors on the dating circuit. A Trulia study found that just 5 percent of unmarried adults would date someone that lived with his or her parents.

This article was updated on March 30, 2015.

Top Reads from The Fiscal Times: