Here’s Why Whole Foods Is Apologizing to Customers

Stocking up at Whole Foods for a Fourth of July Bar-B-Q this weekend? Better double check the prices you’re paying.

Most customers expect to pay high prices at Whole Foods. The gourmet supermarket is often jokingly referred to as “Whole Paycheck.” But in its New York stores, the grocer may have gone too far.

The company’s co-CEOs admitted in a video shared online yesterday that workers in the stores had been mislabeling the weights of its prepared foods. “Straight up, we made some mistakes,” co-CEO Walter Robb said in the video.

Related: Born in the USA—24 Iconic American Foods

The executives never said the word “sorry,” but said that they would retrain their workers, implement a third-party auditing system, and give items for free to customers who found a mistake not in their favor.

The New York City Department of Consumer Affairs announced last week that an investigation had tested 80 types of prepackaged foods and found that all of them had mislabeled weights.

“It is unacceptable that New Yorkers shopping for a summer BBQ or who grab something to eat from the self-service aisles at New York City’s Whole Foods stores have a good chance of being overcharged,” DCA Commissioner Julie Menin said in a statement announcing the investigation last week. “Our inspectors tell me this is the worst case of mislabeling they have seen in their careers.”

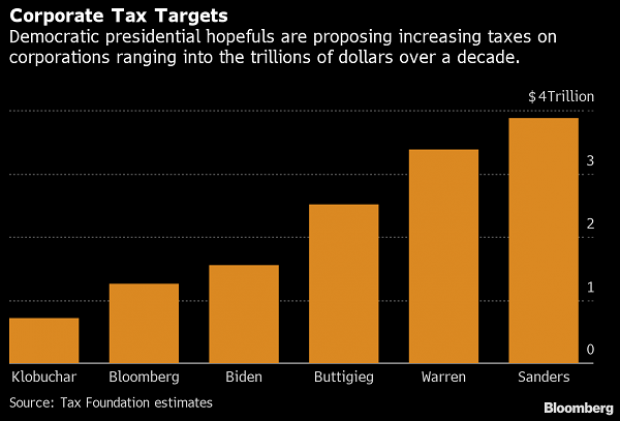

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

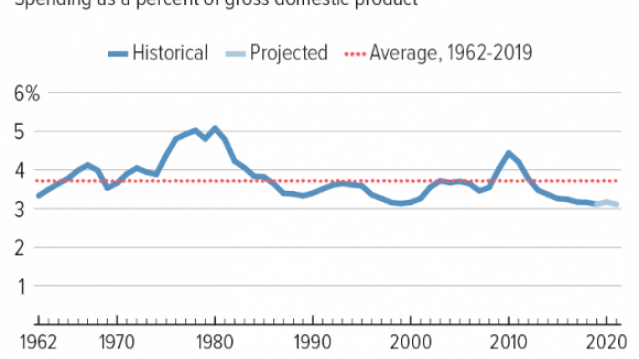

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

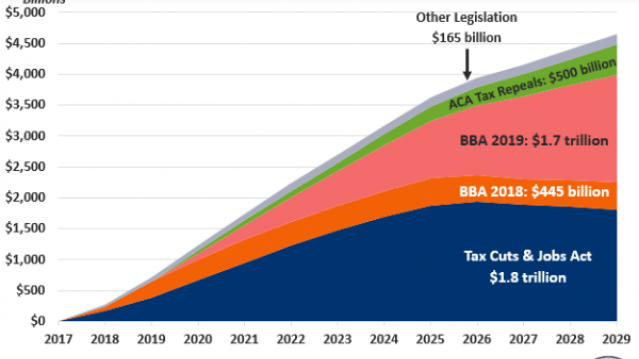

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

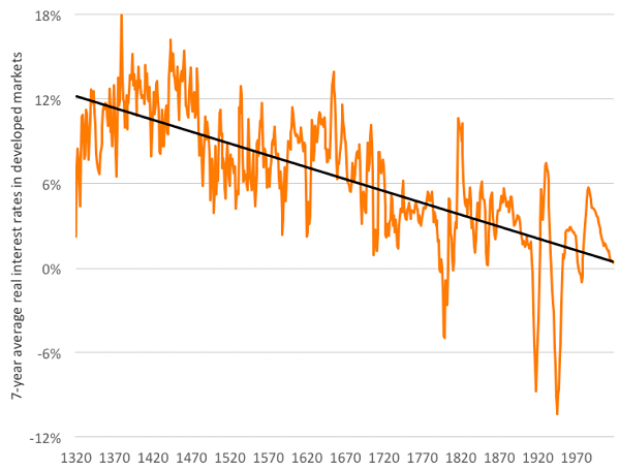

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

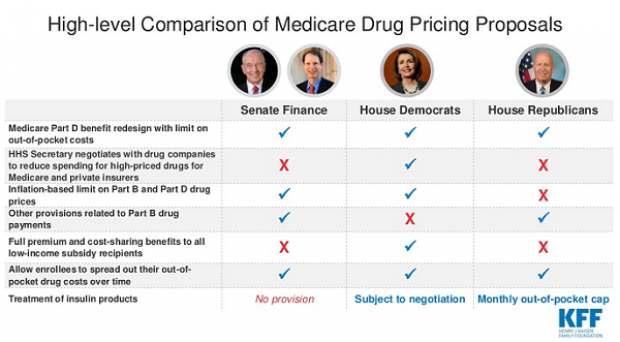

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.