When It Comes to Fees, These Credit Cards Are the Worst

Two credit cards from First Premier Bank have the most fees of 100 cards researched for a CreditCards.com report released today.

The average number of fees per credit card analyzed was six, but the First Premier Bank Credit Card and the First Premier Bank Secured MasterCard carry 12 potential fees each. The PenFed Promise Visa Card was the only one in the survey that levied no fees at all.

A quarter of the cards surveyed charged an annual fee, although 10 percent waived that fee for a consumers’ first year. All cards except for the PenFed Promise Visa Card charged a late payment fee, which can run up to $25.

Related: What to Know Before Your Teen Gets a Credit Card

Penalty fees tend to be easier for consumers to avoid (don’t make late payments), and it’s worth shopping around for cards that don’t have fees for the transactions you need.

Most cards carry a cash advance fee, typically the greater of either $10 or 5 percent of each cash advance. Among cards that allow balance transfers, 90 percent charge a fee for doing so, typically $5 or 3 percent of the transfer.

Another common fee was the foreign transaction fee, typically about 3 percent per transaction, charged by 77 percent of cards. “If you travel internationally a lot, a credit card that doesn’t charge foreign transaction fees is a great value,” CreditCards.com senior industry analyst Matt Schulz said in a statement.

If you’re hit with an unexpected, one-time fee, try calling your issuer and asking them for a refund. Often customer service reps are authorized to do so on a case-by-case basis.

MOST POTENTIAL FEES

- First Premier Bank Credit Card (12)

- First Premier Bank Secured MasterCard (12)

- Credit One Visa Platinum (9)

- Fifth Third Bank Platinum MasterCard (9)

- Navy Federal Credit Union Platinum (9)

- Navy Federal Credit Union Cash Rewards (9)

- Regions Visa Platinum Rewards (9)

FEWEST POTENTIAL FEES

- PenFed Promise Visa Card (0)

- ExxonMobil SmartCard from Citi (3)

- Spark Classic from Capital One (3)

- Capital One Spark Cash Select for Business (3)

- Spark Miles Select by Capital One (3)

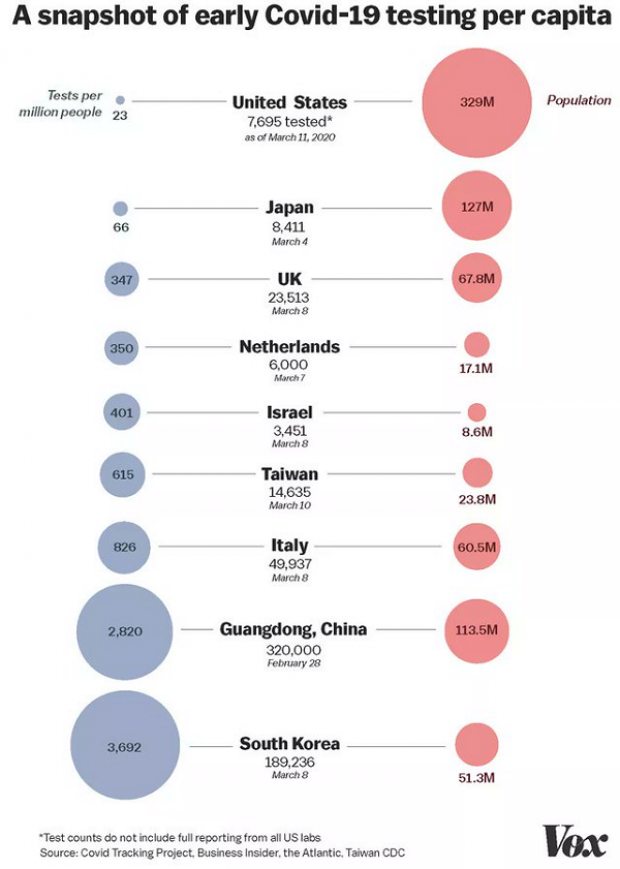

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”