How a Smart Home Can Save You Time and Money

More than a quarter of Americans have smart home products and they report that the devices save them an average of 30 minutes a day and more than $1,000 per year, according to a new report by Coldwell Banker and CNET.

Adoption of smart home products is even higher among millennials, with more than half embracing the technology. Additionally, parents of young children are twice as likely to have installed smart home products than non-parents.

“Smart home technology is catching on because it is literally changing the way we live in our homes,” Coldwell Banker Chief Marketing Officer Sean Blankenship said in a statement. “Not only is it shifting the financial perception of the home, but it is also transforming our emotional connection to our homes.”

Related: Want a Smarter Home? You Don’t Have to Wait

More than eight in 10 of those surveyed said they’d be more likely to buy a home if it included smart technology like connected lights, thermostats or security systems. Nearly three-quarters said that smart home products provide peace of mind when it comes to home security.

Those numbers are expected to grow as technology gets better and cheaper, and millennials start purchasing and upgrading homes in larger numbers. A 2013 report by the Organization for Economic Co-Operation and development found that a four-person family had about 10 connected devices, but projected that number to grow to about 25 in five years and as many as 50 in 10 years.

Top Reads from the Fiscal Times:

- Clinton Attempts to Cure the Email Blues. Again.

- Did Kasich Just Do an About-Face on Climate Change?

- While Trump Whirls and Rages, Cruz Stays the Course

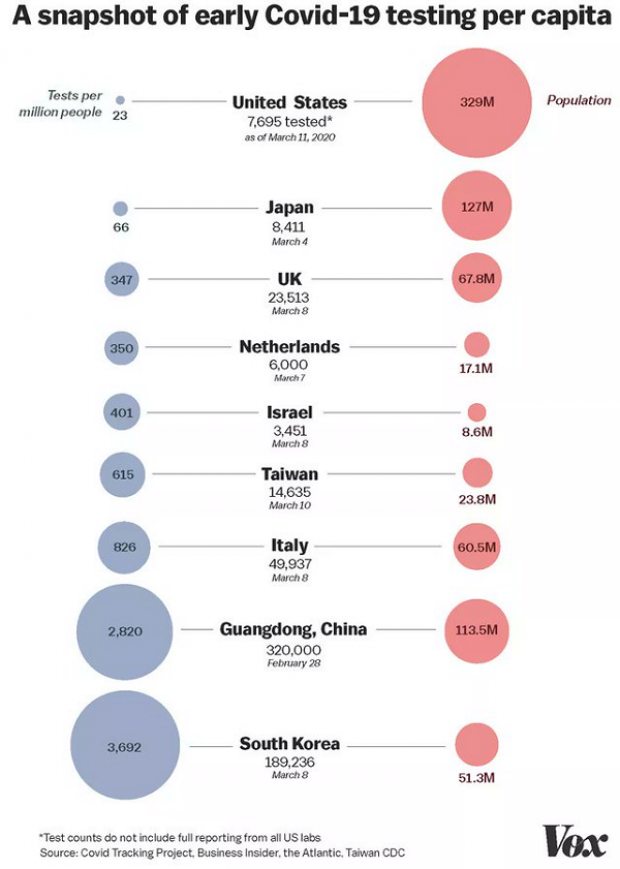

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”