The powerful pharmaceutical industry is doing its best to hold back the tide, but mounting public outrage over excessive pricing of both old and new drugs may prompt government intervention after the 2016 election.

The controversy is already playing out on the presidential campaign trail and on Capitol Hill where House Democrats are demanding Valeant Pharmaceuticals provide documentation to justify the soaring costs of its drugs.

Related: Drug Company Profits Soar as Taxpayers Foot the Bill

Meanwhile, Democrat Hillary Rodham Clinton’s campaign purchased ads in Iowa and New Hampshire this week for Clinton to claim credit for forcing another company, Turing Pharmaceuticals AG, to partially roll back a massive increase in the cost of a long-standing drug used to treat AIDS and cancer patients. Clinton accused the company’s 32-year old CEO, Martin Shkreli, of “price gouging” on Twitter.

Billionaire Donald Trump, the GOP presidential frontrunner, also jumped into the act, calling Shkreli a “spoiled brat” for boosting the cost of the drug, Daraprim, from $13.50 to $750 a pill.

Shkreli, a hedge fund manager, has become the new symbol of industry greed and insensitivity. He recently announced he would cut back the price, without saying by how much.

“There’s no question that the drug industry is going to be scrutinized,” Joseph Antos, a health care expert with the American Enterprise Institute, said on Tuesday. “And obviously, if the next president is a Democrat, there’s an extremely high likelihood that some action that the drug industry would consider adverse to their interests would be taken.”

Related: Wonder Drugs Blow a $1 Billion Hole in VA’s Budget

Antos said in an interview that future legislative action might not rise to the level of government price controls, which many conservatives would strongly oppose. But the industry may be forced to be more transparent in justifying the prices and comparative effectiveness of its drugs.

At one time critics focused much of their wrath on Gilead Sciences Inc., the California based pharmaceutical company that charged as much as $1,000 a pill for the new wonder drug Sovaldi for treating the potentially lethal Hepatitis-C virus. The cost of the drug blew a hole in the budgets of the Department of Veterans Affairs, Medicare and Medicaid and forced federal and state officials to ration the availability of the popular drug.

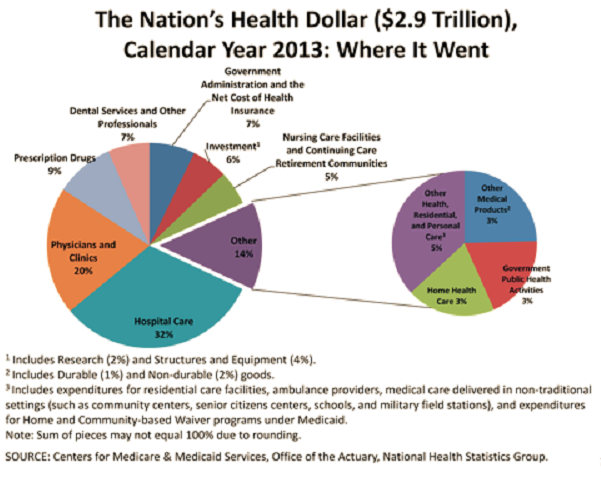

Nevertheless, the drug does save money in the end by avoiding costly liver transplants and associated follow-up treatment. The other newcomers to the pharmaceutical business offer no such deal. They simply have business plans that depend on exploiting existing drugs by raising costs to unsustainable levels for quick returns. If they succeed, the pharma percentage of overall health care costs could make the current 9 percent spent on drugs look like chump change.

Now industry critics have two easy targets to choose from – including Turing and Valeant, a major firm that jacked up the price of two heart medicines three to six fold the same day it acquired the rights.

In both cases, the companies weren’t marketing newly developed drugs, which may have cost tens of millions of dollars to develop but drugs that have been on the market for many decades – making it far more difficult to justify a huge increase in price. Citron Research, an online investment research company, published a damning report on Valeant’s marketing practices this week, describing them essentially as “jack up prices and cut spending.”

While most pharmaceutical companies spend an average of 17 percent of their income on research and development, Valeant spends only 3 percent, according to the report. A chart accompanying the analysis shows how prices charged by the company for roughly 30 older prescription drugs have risen over the past two and a half years, from as little as 90 percent for a nasal spray to 2,288 percent for ear drops.

Related: Cash-Strapped VA May Start Rationing Some Treatments

All 18 Democratic members of the House Committee on Oversight and Government Reform have asked the GOP chairman, Rep. Jason Chaffetz (R-UT), to subpoena Valeant and compel company officials to provide documents justifying its price increases, according to the Washington Post. Democrats want Shkreli and Michael Pearson, the Valeant CEO, to testify before the committee, although Chaffetz may be resisting the call.

The company earlier this month refused to respond to a request from Democratic Rep. Elijah E. Cummings of Maryland and Sen. Bernie Sanders of Vermont to explain the decision to raise the prices of Nitropress, a drug used to treat congestive heart failure, and Isuprel, a drug used to treat irregular heart rhythms.

The Wall Street Journal first reported that on the same day the company acquired the drugs, it tripled the cost of a vial of Nitropress to $805.61 and increased the cost of a vial of Isuprel from $215 to $1,346.

PhRMA, the prescription drug industry’s main lobbying arm, warned recently that proposals like those of Clinton and Sanders to cap skyrocketing drug costs “would restrict patients’ access to medicines, result in fewer new treatments for patients, cost countless jobs across the country and end our nation’s standing as the world leader in biomedical innovation.”

Related: Costly Hepatitis C Drug Makers Face New Fire

Clinton’s plan, among other things, would cap monthly and annual out-of-pocket costs for prescription drugs to save patients with chronic or serious health conditions hundreds of thousands of dollar, and a monthly limit of $250 on out of pocket costs for such patients. She would also deny tax breaks to companies for costly consumer advertising and insist that pharmaceutical companies instead invest in research and development.

“These proposals are driven by the false notion that spending on medicines is fueling overall health care cost growth and ignores how the current marketplace for medicines helps keep spending in check,” John Castellani, PhRMA’s president and CEO, wrote recently. “In reality, the share of health care spending attributable to medicines is projected to continue to grow in line with overall health care cost growth for at least the next decade. This is because competition and negotiation by payers result in steep discounts in medicine prices, and as a result of the current patent system 90 percent of medicines used are low-cost generic copies.”

While drug industry officials contend that the tens of billions of dollars they generate annually are more than justified by the costs of research and promotion of new drugs, Clinton, Sanders, a socialist Democrat also running for president, and even Trump have tapped into mounting public resentment over drug costs that are adding significantly to the cost of health care coverage and out-of-pocket expenses.

“What’s going on is greater and greater interest in this at the grass roots level and in the media, and I believe is going to put pressure all the candidates – in both parties -- to come forward with some response,” said John Rother, President and CEO of the National Coalition on Health Care.

Related: Medicare’s Budget Busting $4.5 Billion for Hep-C Drugs

Rother said that an emerging campaign theme is that the prescription drug market “is broken” and that government intervention is needed to correct the problems. “Price controls aren’t really part of that unless you’re Bernie Sanders,” Rother said in an interview. “I think just about everybody else is going to be using terms like, greater transparency, comparative effectiveness research, paying for value – all in the context that we have to make the market work again.”