Congress and the President have two months to hammer out a budget before the country teeters on another fiscal cliff. One big issue is the $85 billion in spending cuts on defense and domestic programs imposed by the sequester. Some Republicans want roughly half of that restored for defense while Obama wants a similar amount reinstated for domestic programs.

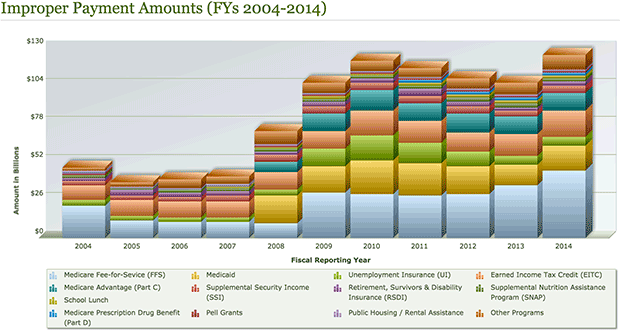

Imagine how easy that would be if the government could reclaim the more than $100 billion wasted annually on overpayments and fraud.

The Government Accountability Office has confirmed the Obama administration’s worst fears that Medicare and Medicaid fraud and overpayments are spinning out of control and posing a serious long-term budget challenge to Congress and the White House.

In fiscal 2014 alone, 22 agencies approved improper Medicare, Medicaid and Earned Income Tax Credit payments totaling an astounding $124.7 billion—an increase of $18.9 billion or 15 percent from the previous year, according to a new report. Those overpayments accounted for over 75 percent of the estimated government-wide overpayments or improper payments.

Related: White House Takes Aim at Billions in Medicare and Medicaid Fraud

Federal spending on Medicare and Medicaid, the two major federal programs to provide health care to seniors and the poor, is projected to rise in the coming years, making it essential for the Obama administration and Congress to find ways to ferret out unintentional mistakes and blatant corruption and theft from the entitlement programs.

The Congressional Budget Office has repeatedly warned that – in the coming decade – the debt will grow at an “unsustainable” rate unless Congress and the White House intervene. Lawmakers and the administration are also concerned about trying to reduce the “tax gap” – the difference between taxes owed the federal government and those actually collected, estimated at another $385 billion.

“The federal government continues to face an unsustainable long-term fiscal path,” the GAO report stated. “Changing this path will require difficult fiscal policy decisions to alter both long-term federal spending and revenue. In the near term, executive branch agencies and Congress can take action to improve the government's fiscal position by addressing two long-standing issues—improper payments and the tax gap. Over time, these issues involve amounts near or exceeding $1 trillion.”

Related: Medicare Drug Program Still Plagued by Fraud

For last year alone, government auditors estimate an error rate in the billings and payments of ten targeted entitlement programs that exceeded 10 percent. Improper payments and fraudulent billings have captured the attention of administration officials, lawmakers and government watchdogs in recent years, yet only now is the full magnitude of the problem coming into focus.

The findings were revealed late last week during testimony by Comptroller General Gene L. Dodaro before the Senate Finance Committee -- providing an update on improper payments and their fiscal implications. The Obama administration in early September quietly stepped up its auditing and enforcement operations to crack down on cheating by Medicare and Medicaid doctors, hospitals and other medical facilities, as The Fiscal Times reported. The administrative initiative was prompted by a Feb. 26 letter from Office of Management and Budget Director Shaun Donovan declaring the crackdown a “key priority” of Obama’s final two years in office.

Overpayments by the Medicare and Medicare Advantage programs for seniors, and Medicaid for low-income Americans have reached near crisis level and have prompted cries of outrage from the public and government leaders.

Last June, for example, it was revealed that the federal government had handed out hundreds of millions of dollars’ worth of erroneous benefits. About 200 people had received $10 million worth of Medicaid benefits although they had been dead for years. A previous GAO report found that in 2011, four states reported that at least 8,600 people received double benefits from different states – in effect cheating the government of about $18.3 million.

Related: The Government’s $125 Billion Slap in the Face to Taxpayers

“The GAO’s dogged documentation of $124.7 billion in improper payments is a great service to the country, but measuring wasteful spending is only useful if Congress has the political will to force executive branch agencies to change their culture and recoup overpayments,” Leslie Paige, vice president for policy and communications at Citizens Against Government Waste, said in a statement.

Paige noted that while lawmakers have fumed about excessive payments and fraud, Congress since October 13 has suspended the Recovery Audit Contractor (RAC) program of the Centers for Medicare and Medicaid Services. That program had recovered more than $9.7 billion for the Medicare Trust Fund before being placed on hold.

“It is unconscionable that members of Congress continually complain about waste, fraud, and abuse, while they quietly sanction the destruction of the RAC program,” Paige said.