First, the administration revealed that enrollments for Obamacare next year will barely hit 10 million, far below previous projections.

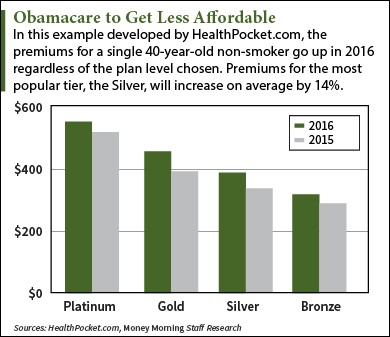

Then last week, the consulting firm of McKinsey & Company estimated that premiums for policies under the Affordable Care Act, also known as Obamacare, were going up substantially in 2016. For instance, the median rate increase for the lowest priced, highly popular “Silver” plan will rise by 11 percent – compared to just a seven percent increase in 2015.

Related: Millions Face Premium and Deductible Sticker Shock under Obamacare

Now there are troubling reports that consumers will be facing soaring out-of-pocket costs for deductibles next year – increases that in many cases will neutralize the benefits of their health care plans or discourage some from purchasing coverage.

“That these deductibles are so high is clearly one of the reasons people aren’t buying a plan—they simply don’t see themselves getting anything for the money,” Robert Laszewski, president of Health Policy & Strategy Associates, a business and policy consultant, said in a newsletter on Monday.

Department of Health and Human Services officials insist that there are still plenty of plans available with low premiums for those willing to aggressively shop on the federal and state operated insurance exchanges. Americans have until the end of the year to enroll for the third season of Obamacare. But even in cases where consumers find good deals on premiums, they are likely to be stung on the back end by requirements to pay sizeable out of pocket costs before their Obamacare coverage actually kicks in.

The average annual out-of-pocket costs per worker increased nearly 230 percent between 2006 and 2015, according to an annual survey of employer health benefits coverage by the Kaiser Family Foundation.

Related: Democrats Begin the Long, Tortuous Retreat from Obamacare

An eye-opening report by The New York Times published over the weekend found that many of the newly insured are “feeling nearly as vulnerable as they were before they had coverage.”

Indeed, in many states more than half the plans being sold on Obamacare insurance exchanges have a deductible of $3,000 or more, according to a survey by the newspaper.

For many, that means they must pick up the cost of many routine doctor visits and treatment, while counting on their insurance primarily for catastrophic or other major medical expenses.

Among the findings of The Times survey:

Related: An Obamacare Change to Medicare Is Backfiring

- In Miami, the median deductible for health insurance is $5,000, with half the plans above the median and half below it.

- In Jackson, Miss., the median deductible is $5,500.

- In Chicago, it is $3,400.

- In Phoenix, $4,000

- And in Des Moines, Iowa, it is $3,000.

According to HealthPocket.com, Bronze plan deductibles are rising on the Obamacare federal exchanges by an average of 11 percent to $5,731 and Silver Plan deductibles are rising by 6 percent to an average of $3,117.

A survey by the Commonwealth Fund published last November found that three in five low-income adults and about 50 percent of adults with moderate incomes believe that deductibles are “difficult or impossible to afford.”

Health care policy experts say insurers designed their plans with substantial rising deductibles and other cost-sharing measures as a way to encourage low and moderate income Americans who qualify for federal subsidies to try to hold down their medical costs. Moreover, advocates of this approach argue that even with the higher deductibles, enrollees nonetheless benefit from preventative services like mammograms and colonoscopies and other visits with doctors that are provided without out-of-pocket payments.

Related: House GOP Scores a Major Win in Obamacare Legal Challenge

But that provides little solace for many consumers who have been stunned by the overall cost of their policies. Many are simply not buying new policies – preferring to pay a penalty of $695 and gambling that they won’t encounter steep medical costs.

“The deductible, $3,000 a year, makes it impossible to actually go to the doctor,” David R. Reines, 60, of Jefferson Township, N.J, who suffers from chronic knee pain, told The Times