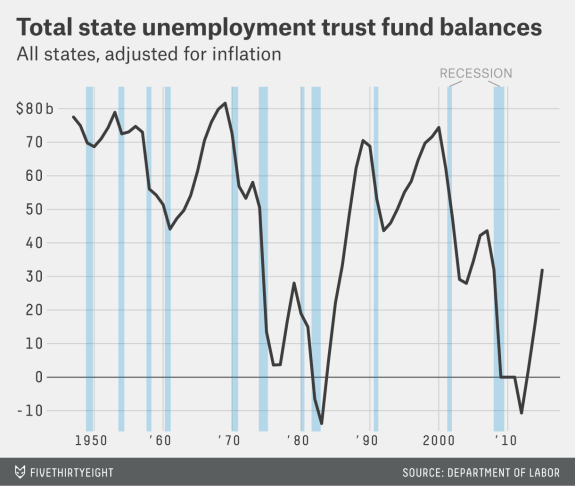

Amid rising anxiety that the U.S. economy could be headed for another recession, most states are woefully unprepared to cope with a fresh round of widespread job losses.

More than six years after the Great Recession officially ended, a mere 18 states have enough money in their unemployment insurance trust funds to get through a 12-month recession, according to Department of Labor data and guidelines reported by FiveThirtyEight.

Related: How Plunging Oil Prices Threaten the U.S. Economy

Most states – including California, Georgia, Illinois, Michigan, Missouri, Ohio and Texas -- have glaring holes in their trust funds, which are designed to provide up to 26 weeks of unemployment payments to state residents. Strikingly, many of those state funds are actually in worse financial shape now than they were before the 2008 financial crisis.

California’s massive unemployment system, for example, is more than $6 billion in debt to the federal government, which provides states with emergency loans in the depths of a recession. At least nine other states that were unwilling to raise more taxes for unemployment insurance owe money either to the federal government or to private bondholders.

At one time or another, 36 states had to borrow from the federal government to pay their unemployment benefits during the last recession.

For decades, states prudently followed a policy of raising taxes in good times to finance unemployment payments in bad times, to counteract the effects of widespread joblessness. But now, many states are pursuing a “pay-as-you-go” approach that could leave many unemployed Americans in the lurch.

If the roiling stock markets and troubled international economy eventually result in another major recession – as some economists now fear -- most states will either have to borrow more from the federal government or private investors or severely reduce the duration and size of the benefits.

Related: How a Government Data Blunder Made the Economy Look Worse

Michael Leachman, director of state fiscal research at the Center on Budget and Policy Priorities, said on Thursday that underfunded unemployment systems could have dire consequences for workers and their families. Some states in the past few years have reduced the maximum number of weeks of insurance from 26 to 20, while also reducing the total benefit and toughening eligibility rules.

“Now you have a system where in a number of states the program is much weaker than before, and their ability to weather the next recession is weaker because they have made significant cuts,” Leachman said in an interview.

“That’s bad not only for the workers who are laid off through no fault of their own, which is how you get unemployment insurance, but it also means that the recession will be deeper and longer because we don’t have this stimulus working its way through the economy,” he added.

President Obama has proposed shifting authority over the unemployment insurance system from the states to the federal government and altering the minimum required wage base and minimum tax rate on employers. He also favors requiring states to offer at least 26 weeks of unemployment benefits.

Related: The Grandparent Economy: How Boomers Are Boosting the Next Generations

However, it’s far from clear that any of Obama’s proposals will get through the Republican-controlled Congress before he leaves office.