Retirement plans often involve traveling, socializing and feeling financially secure, but they don’t usually include paying off debt. However, the reality is that many Americans close to retirement will carry debt into their golden years and must plan accordingly.

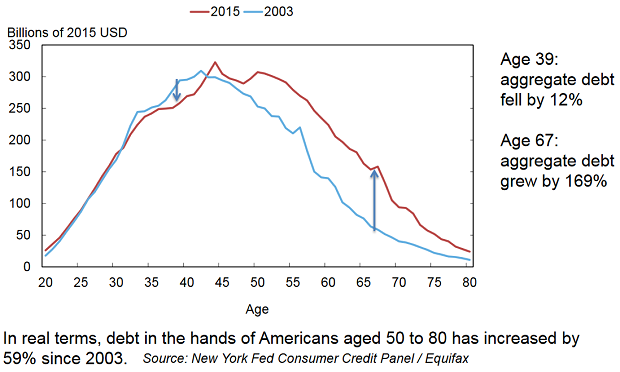

While younger people generally carry more debt, older Americans owe more than they used to. The amount of debt held by Americans aged 65 grew by 48 percent on a per capita basis from 2003 to 2015. By contrast, the per capita debt at age 30 fell by 12 percent during the same period. In 2015, Americans at age 65 have 29 percent more in auto loan debt, 47 percent more in home-secured debt and 886 percent more in student loan debt when compared to 2003.

Debt won’t necessarily derail retirement plans, but it will require careful preparation. “Yes, it is possible, but not ideal,” says Wade Chessman, president of Chessman Wealth Strategies in Dallas. “It just becomes another expense that needs to be managed.”

Depends on the debt

All debts are not created equal. The type of debt is important, says Matthew Boersen, a certified financial planner at Straight Path Wealth Management in Jenison, Minnesota. “A reasonable mortgage or small car loan is not worrisome,” he says, “but credit card debt is, even if it appears retirement cash flow may be able to offset the payments.”

Related: Why Carrying a Mortgage in Retirement Can Really Pay Off

He says to consider the interest rate. If it’s low — and tax-deductible, like mortgage-related interest — then it may be worth paying each month in retirement and simply increasing IRA withdrawals to accommodate the payments. But if the interest rate is high, the loans should be paid off as quickly as possible.

Don’t forget 401(k) or 403(b) loans. “You have to pay them in retirement, or pay taxes as if they were distributed,” says Leon LaBrecque, managing partner of LJPR Financial Advisors in Troy, Michigan. “Before you retire, figure out your strategy to get rid of your 401(k) loan, whether before or after retirement.”

Employ a budget

Those who have debt in retirement should keep a careful, written budget with a full payoff schedule, says Glenn Downing, an investment adviser at Cameron Downing in Coral Gables, Florida. If you keep to the schedule and cash flow in retirement stays positive, then debt is manageable, he says.

“Once a particular debt is paid off,” he says, “the monthly amount allocated for that debt can be rolled over to the next debt, or retained, as sort of a ‘raise.’”

It’s important that retirees don’t increase their spending while paying off the debt. It helps to monitor expenses using a program like Mint.com and change spending behavior based on that data, says Chessman.

Related: What Your Retirement Savings Should Look Like at Age 50

Restructure debt

Soon-to-be retirees should consider restructuring debt either by consolidating or refinancing before entering their golden years. “Be sure you do it prior to your last paycheck,” says Kevin Reardon, president of Shakespeare Wealth Management in Pewaukee, Wisconsin. “Banks have tougher standards once your paycheck goes away.”

Find extra cash

To make the debt payments, retirees should look everywhere to find cash. LaBrecque recommends using buyouts or payouts of funds for overtime and unused vacation to knock out loans. Consider working a part-time job in retirement or work a few extra months before retirement to reduce or eliminate debt. Be wary of big withdrawals from retirement plans, though, warns Boersen.

“Retirees always need to be careful with large lump-sum withdrawals,” he says, “as tax rates and the taxable portion of Social Security can increase in a hurry.”

Still, use your all of your investments wisely. “If you can make a higher rate of return by leaving your assets invested versus paying off the debt, you are better off having debt,” says Reardon. “You will pay off the debt with your invested assets, using interest, dividends and appreciation to make your monthly payments.”

Related: Don’t Let a Late-Life Divorce Ruin Your Retirement Plans

Getting debt-free

To make headway on eliminating your debt while in retirement, it sometimes makes sense to focus on one while making smaller payments on the others. “Kill one at a time and wound several,” says LaBrecque. You don’t have to pick the one with the highest interest rate — the common rule of thumb. Instead, go for the easiest one to pay off, employing the “debt snowball” effect.

After paying off a smaller loan, roll the money used for those payments to the next biggest. This creates a sense of success and will motivate you to continue to pay down debt.

“Of course it's possible to retire with debt,” LaBrecque says, “Otherwise, most Americans could never retire.”