Of course, you want to help your kid out. But skip co-signing that car loan unless you’re willing and able to foot the entire bill, because there’s a good chance you’ll have to.

Almost two in five co-signors ended up paying some or all of the outstanding balance because the primary borrower reneged, according to a new survey from CreditCards.com. More than a quarter said their credit score dropped because the other person on the loan either paid late or not at all.

“If you had to rank the worst possible things you can do credit wise, co-signing is probably no. 1,” says credit expert John Ulzheimer, who previously worked at FICO and the credit bureau Equifax. “Think about it: If a bank isn’t willing to do business with that person on their own, why should you?”

Related: Parents: Read This Before Co-Signing Your Kids’ Student Loans

Besides the risk of default by the primary borrower — which often goes unnoticed by the co-signor until debt collectors start calling — carrying extra debt has its own drawbacks, says Ulzheimer. If the co-signor applies for a mortgage or car loan, the lender will factor in that co-signed debt when approving a new loan.

“If you really want to co-sign, you should be just as willing to give them the money with no strings attached because you will have to do that anyway,” he says, noting that a larger down payment on a house or car may be enough for the person to qualify for the loan by themselves. “If you want, you can come to some informal arrangement where they pay you off over time.”

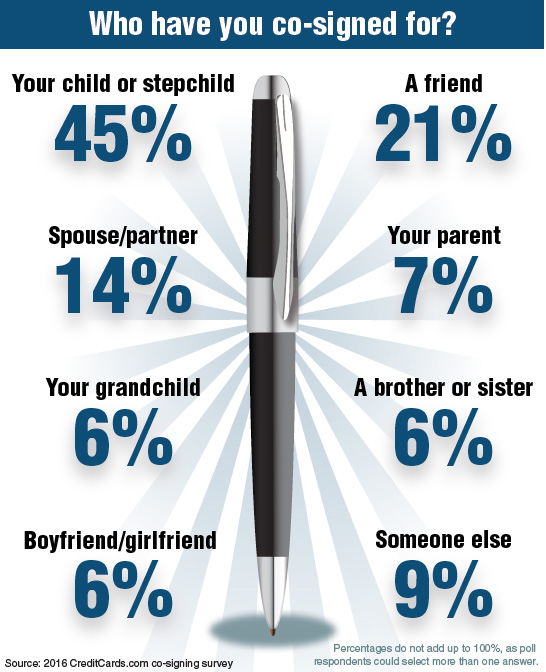

About one in six adults have co-signed a loan or credit card for someone else. About half did so for their child or stepchild. The most common type of co-signed loan was an auto loan, accounting for half of all co-signings. That was followed by personal loans (24 percent), student loans (18 percent) and credit cards (16 percent).

Older and more affluent Americans were more likely to co-sign for a loan. About a quarter of 50 to 64-year-olds and a fifth of those older than 65 co-signed a loan, while only 14 percent of 30 to 49-year-olds did. A quarter of those who earned more than $75,000 a year helped someone on a loan, compared with only 11 percent earning less than $30,000 a year.

If the financial consequences aren’t enough to dissuade you from signing that loan for your child, consider this: More than a quarter of co-signers said the experience damaged their relationship with the primary borrower.

“It makes for a really uncomfortable Thanksgiving dinner when you have one relative who defaulted on a loan on one side of the table and another who is paying it off on the other side,” says Ulzheimer.