Could we solve poverty and income inequality by just doling out money to everyone, no questions asked?

The idea of a universal basic income has stimulated a lively debate among public policy wonks, economists and businesspeople. It even made Goldman Sach’s list of trendy buzzwords this year.

Under such a system, every person would automatically receive a salary “without means test or work requirement,” say campaigners who support the idea. The idea has gained traction in recent months, particularly among Silicon Valley tech executives who see it as a way of solving the problem of job losses resulting from automation. According to some estimates, 47 percent of America’s jobs could be at risk due to automation. In addition, a guaranteed income is seen as a solution to alleviate poverty in an America where the top 1 percent on average make 25 times more than the average salary of the bottom 99 percent.

Related: Trump’s Anti-Trade Populism Is the Opposite of What Made America Great

The concept has attracted an unlikely coalition of supporters on the right and the left. Some conservatives like it because it could replace the existing “welfare state” and the immense cost of running several complementary and overlapping government assistance programs. Liberals see it as a way of narrowing the gap between the rich and poor, uplifting the country’s poorest citizens through a guaranteed social safety net.

Other countries are considering the idea. The Swiss rejected it in a popular vote last month, but the Canadian province of Ontario is launching a basic income pilot program this fall and Finland is considering it.

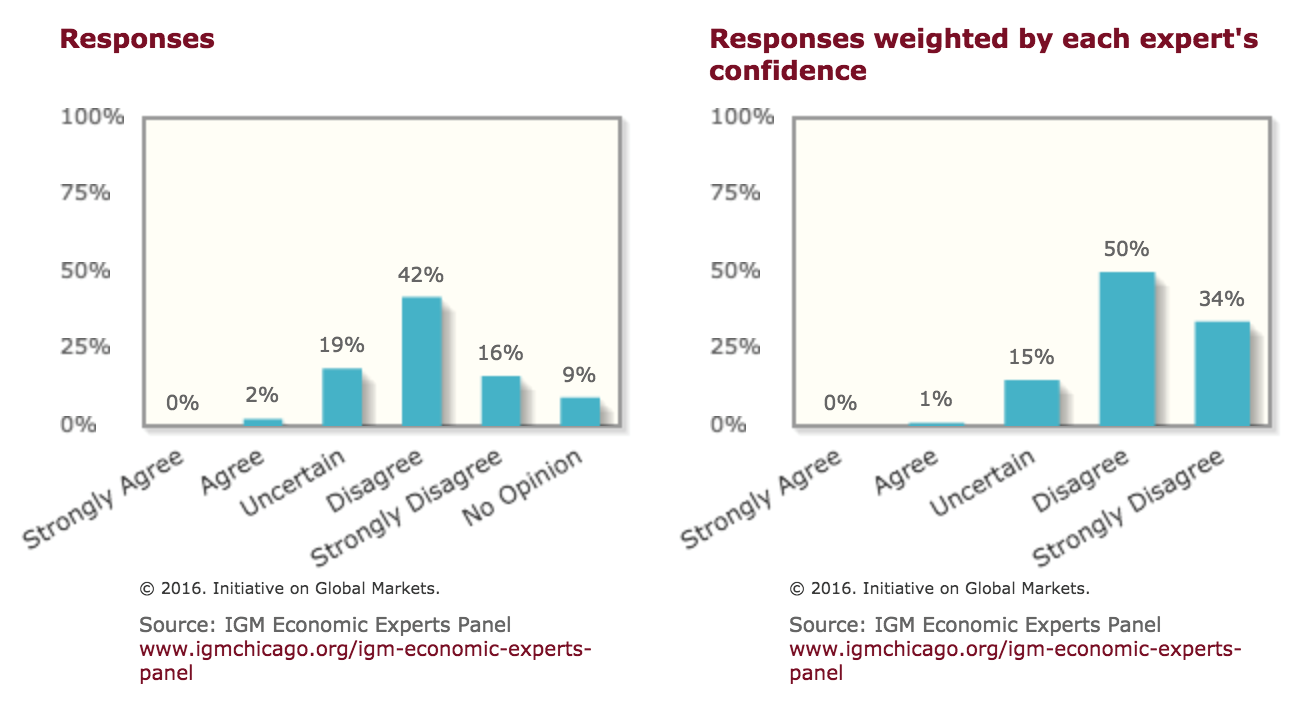

Here in America, a group of 43 influential economists were polled recently by the University of Chicago on a basic income scenario inspired by a Wall Street Journal opinion piece that argued for a basic income of $13,000 for every American. The article’s author, American Enterprise Institute author and political scientist Charles Murray, says under his plan, “the entire bureaucratic apparatus of government social workers would disappear, but Americans would still possess their historic sympathy and social concern.”

Related: 25 US Cities With the Worst Income Inequality

The poll asked whether “granting every American citizen over 21-years old a universal basic income of $13,000 a year — financed by eliminating all transfer programs (including Social Security, Medicare, Medicaid, housing subsidies, household welfare payments, and farm and corporate subsidies) — would be a better policy than the status quo.”

While most of the economists polled opposed the idea, the comments some provided with their responses indicate that they were, at least in some cases, rejecting Murray’s framework more than the underlying concept. Still, there’s no consensus on how a basic income would or should work, with disagreements about how much would be doled out, how such a program would be funded and whether it should exist alone or alongside other social support programs.

Below are some of the comments from the economists:

“Universal basic income is a step in the right direction, but very complicated. Devil would be in details. So, lots of uncertainty.”

- Steven Caplan (University of Chicago), Vote: Agree

“Bill Gates would get 13K, which is crazy. Raising taxes is costly and so redistribution should be targeted to those who need help most.”

- Oliver Hart (Harvard University), Vote: Strongly Disagree

“Current US status quo is horrible. A more efficient and generous social safety net is needed. But UBI is expensive and not generous enough.”

- Daron Acemoglu (MIT), Vote: Uncertain

“This is a dumb question. We are not going to eliminate Social Security and Medicare etc.”

- Richard Thaler (University of Chicago), Vote: No Opinion

“Provocative idea but as stated would cost ~$3 trillion, equal to all federal tax revenue. What about e.g. national defense?”

- Jonathan Levin (Stanford), Vote: Disagree