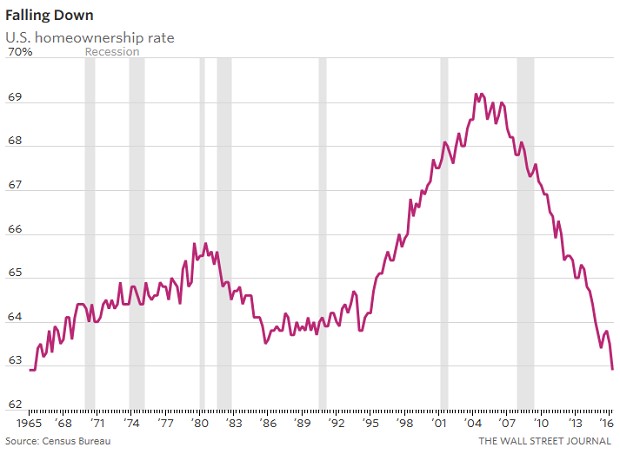

The housing market is still hot in many parts of the country, with national home prices hitting record highs, but the percentage of people buying rather than renting their home continues to fall.

Related: 39 US Cities With Record High Home Prices

The homeownership rate in the second quarter of 2016 fell to 62.9 percent, its lowest level since 1965, according to new data from the U.S. Census Bureau.

Still, the drop from the same period in 2015 was less than 1 percent, which shows that the rate may finally be stabilizing after declining every year since before the housing bubble burst in 2006. The drop reflects a trend among today’s young adults to delay buying a home far longer than previous generations. And there may be a silver lining behind the latest drop.

“While the millennial homeownership rate continues to decline, it’s important to note that the decrease could be just as likely due to the new renter household formation as it is their ability to buy homes,” Trulia chief economist Ralph McLaughlin said in a statement. “Certainly low inventory and affordability aren’t helping their efforts to own, but moving out of their parents’ basement and into a rental unit is also a good sign for the housing market.”

Despite all the barriers to homeownership, Americans still overwhelmingly say they’d like to be homeowners. Nearly nine in 10 of those surveyed earlier this summer by Wells Fargo said that home ownership is a dream come true.

Difficulty savings for a down payment represents the number one reason that those who want to buy a home haven’t.