How much debt is too much? There may be no hard and fast rules, but the International Monetary Fund says the total global debt load excluding the financial sector — a record-breaking $152 trillion as of 2015 — carries some very real risks.

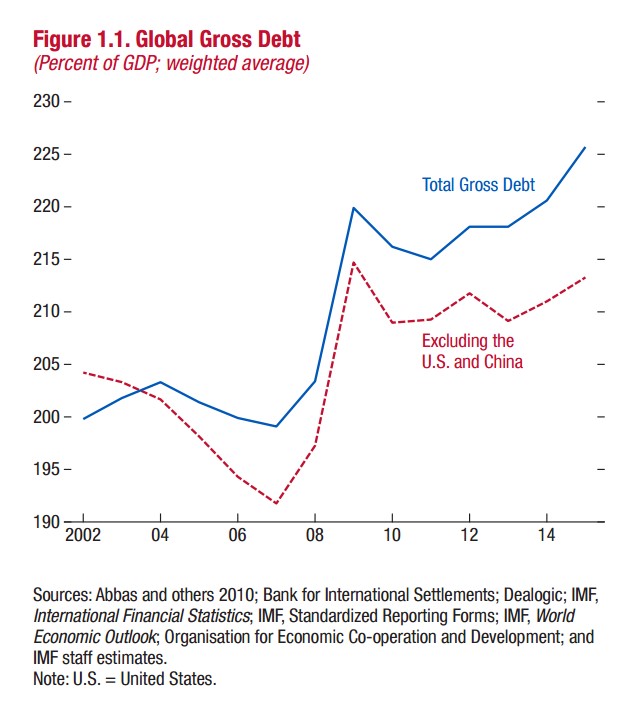

The staggering sum, which equates to 225 percent of global GDP, is the leading number in the IMF's latest installment of its twice-yearly survey of global finances. Going beyond previous data sets, the October 2016 issue looks at data compiled from 113 countries to encompass 94 percent of global GDP.

Related: CBO Says Deficit on the Rise for the First Time Since 2009

The title of the report, “Debt: Use It Wisely,” hints not so subtly at what the IMF thinks of this debt-fueled world economy, one in which economic growth — despite the unprecedented efforts of government and the private sector to spur it via borrowing — remains far weaker than most countries and companies would like it to be.

The Bigger They Are, the Harder They Land

Of that $152 trillion in total global debt, $100 million — or about two thirds — is held by the private sector, and is primarily concentrated in the world's advanced economies, though it also exists in some systemically important emerging economies.

There are two potential hazards to this enormous pile of IOUs, the IMF says. First, the sheer size of the debt is hazardous in and of itself, and has the potential to inhibit economic growth. "It constitutes one of the most important headwinds to growth in the global economy," says Vitor Gaspar, the IMF's director of its Fiscal Affairs Department.

Second, financial and economic stability are at risk. And it's not just the sheer size of the debt, but the type that matters. The private debt, more than the still-significant amount of public debt, that poses the greatest risk to the global economy. As Gaspar explains: "When there's a buildup of private debt, the likelihood of a financial crisis is higher, and financial recessions are more costly and prolonged than normal recessions." That's because rapid, massive deleveraging of the private sector debt is never a pretty process.

Related: A Fed Rate Hike Will Hit 92 Million Americans Right in the Pocketbook

But as Fiscal Monitor states, high public debt is not without its risks either. Public debt has, of course, exploded — it’s grown by 25 percent of GDP from 2008 through 2015, as central banks around the world have pumped money into their economies in the hopes of stimulating laggardly growth. “Only about one-third of advanced economies have made inroads in improving general government net financial worth since 2012 and, on average, these inroads have been small,” the report says. Gaspar gives hope to countries with highly leveraged public sectors by stating it's the strength of a country's fiscal position entering the recession that matters most.

The report calls out China in particular as an emerging economy at risk from too much private debt. "If the corporate debt problem in China is left unaddressed," says Gaspar, "it will have significant consequences for growth in China and increase the risk of a hard landing." And as the world's second largest economy, and America's biggest trading partner, what happens in China won't necessarily stay in China.