Despite stepped up efforts to crack down on Medicare fraud and wasteful spending, the federal government lost at least $43 billion in fiscal 2015 to health care providers who filed improper or bogus claims to the program, according to a new study.

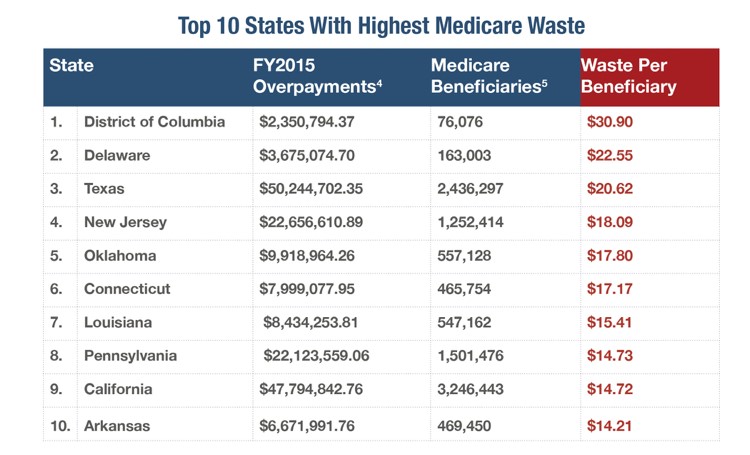

Nine states and the District of Columbia were responsible for the lion’s share of the total improper payments, according to a new study by the Council for Medicare Integrity, a non-profit government watchdog. The states include Texas with $50.2 million in improper payments, California with $47.8 million, New Jersey with $22.6 million and Pennsylvania $22.1 with million.

Related: The Best and Worst States for Taxes in 2017

While the nation’s capital incurred the smallest Medicare losses – some $2.4 million -- it nonetheless topped the list of states in terms of “waste per Medicare beneficiary,” according to the analysis. That means that the District lost $30.90 for every one of its 76,076 residents enrolled in the federal health program for the elderly.

This is the second consecutive year that the District of Columbia has topped all states in Medicare waste per beneficiary. In reviewing federal data, the Council for Medicare Integrity concluded that D.C. wasted more than double the amount per beneficiary than the lowest-ranked state of Arkansas.

Other states topping the list of Medicare waste per capita include Delaware ($22.55 per beneficiary), Texas ($20.62), New Jersey ($18.09), Oklahoma ($17.80) and Connecticut ($17.17). The amount of Medicare overpayments per state was gleaned from the recently released Centers for Medicare and Medicaid Services (CMS) report, Recovery Auditing in Medicare for Fiscal Year 2015. CMS has also provided data regarding the number of Medicare beneficiaries in each state.

Source: Council for Medicare Integrity, Centers for Medicare and Medicaid Services

Medicare overpayments are generally made when a doctor or other health care provider submits an inaccurate bill to Medicare for services provided to a patient, according to the Centers for Medicare and Medicaid Services, which oversees the Medicare program. Typically the providers bill to a code that pays out at a higher rate than what is permissible.

Related: Doctors and Nurses Charged in Massive $900 Million Medicare Fraud

“Medicare loses more money to improper payments than any other program government wide,” Kristin Walter, a spokesperson for the Council for Medicare Integrity, said in a statement Wednesday. “These improper payments are causing Medicare to hemorrhage billions of dollars desperately needed to help sustain the program.”

The Medicare Trustees have projected that funding for Medicare hospital care will begin to run out by 2028, absent government intervention and curtailment of wasteful or fraudulent payments. “It’s more important than ever that everyone become aware of this problem and that work is done to drastically reduce improper payments in Medicare to sustain the program for those who will need it in the future,” Walter said.

While the $43 billion in Medicare overpayments in 2015 is substantial, it is probably just the tip of the iceberg. The Council for Medicare Integrity study was limited to overpayments identified by the federal Recovery Audit Contractor Program (RAC), which reviews just a fraction of the claims of Medicare Part A and B providers.

During his second term, President Obama made cracking down on Medicare and Medicaid fraud a high priority, as federal and state law enforcement agencies launched a series of high-profile arrests and prosecutions.

Related: Audit Uncovers $124.7 B of Overpayments and Fraud in Medicare and Medicaid

Last summer the administration touted a breakthrough in combating rampant fraud in the two health care program. The administration informed Congress that it had prevented $42 billion of improper payments to medical providers in fiscal 2013 and 2014 by using “big data” predictive analytics and other sophisticated detection methods.