A new study suggests that major health insurers are faring far better than previously assumed in providing coverage under the Affordable Care Act. One reason for this stability is the hefty price increases implemented this year, which have doubled gross margins in the first quarter, but hurt consumers who don't qualify for taxpayer subsidies.

Republicans say Congress has no alternative but to repeal and replace Obamacare in the coming weeks to rescue American consumers from a failed system that has sent premiums and copayments skyrocketing, dramatically reduce the availability of coverage in many counties and forced major insurers like Anthem, Humana, and United Healthcare out of the government-subsidized individual insurance market because of huge losses.

Related: Here’s What a Bipartisan Health Care Deal Might Look Like

President Trump insists that Obamacare is “dead,” even as Senate Republicans struggle to agree on a replacement plan that can attract at least 50 votes before the August recess. However, a new analysis of early 2017 results by the Kaiser Family Foundation indicates that the individual market is stabilizing and that insurers in the Obamacare market are regaining profitability.

The latest findings released on Monday contrast sharply with an earlier analysis of premium and claims data from 2011 to 2016 that showed a worsening situation with the opening of the exchange markets in 2014 and 2015. But things began to pick up in 2016, and the new report, based on first quarter financial data from 2017, shows that recent premium increases on average of 20 percent or more were sufficient to bring insurer performance back to pre-ACA levels.

A study by eHealth of Obamacare premiums and deductibles showed “a 22 percent increase since last year’s open enrollment; the average [monthly] family premium was $1,021, an increase of 23 percent since last year.

Healthpocket said the popular Silver plan premiums jumped an average 17 percent in 2017 for individuals and 15 percent for deductibles.

| Individual Age Profile | 2017 Average Premium | 2016 Average Premium | Increase |

| 30 year-old | $364.91 | $312.00 | 17% |

| 40 year-old | $410.73 | $351.02 | 17% |

| 50 year-old | $574.10 | $490.75 | 17% |

| 60 year-old | $872.01 | $744.99 | 17% |

Family deductibles averaged $12, 952 in 2017.

| Cost-Sharing Category | 2017 Avg. for Individuals | 2017 Avg. for Families |

| Deductible (Medical) | $3,572 | $7,474 |

| Max Out-of-Pocket Costs | $6,449 | $12,952 |

Related: How Republicans Can Save Their Health Care Plan – and the Nation’s Health

This more positive trend is based on a number of factors, including a decline in the share of health premiums that insurance companies paid out as claims and the average monthly hospital patient days per 1,000 enrollees. The latest findings were based on insurer-reported financial data from Health Coverage Portal TM, a market database maintained by Mark Farrah Associates. The database also includes information from the National Association of Insurance Commissioners.

Among the key findings:

Improved medical loss ratios

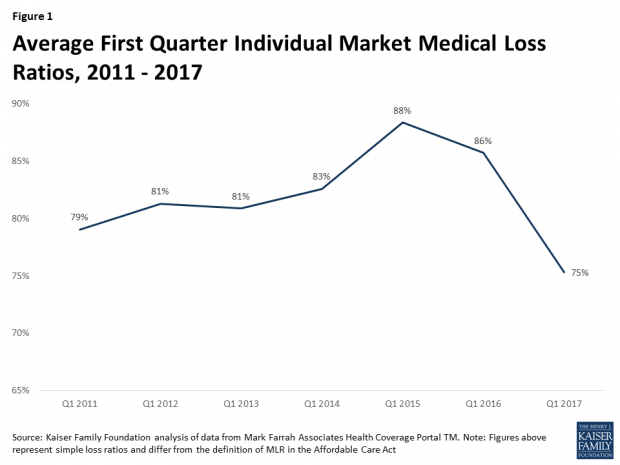

Medical loss ratios are the share or percentage of health premiums paid out as claims. The ratio was bad for insurers in the early years of Obamacare, when insurance companies and state regulators had little information to work from in setting premiums and made frequent mistakes. But beginning in 2016, loss ratios began to decline, indicating improved financial performance.

During the first quarter of 2017, following relatively large premium increases, individual market insurers saw “significant improvement in loss ratios,” averaging 75 percent – down from as high as 85 percent. Although the 2017 annual loss ratios are likely to end up higher than 75 percent, “this is nevertheless a sign that individual market insurers on average are on a path toward regaining profitability in 2017,” the report states.

Better Profit Margins

Another yardstick of improvement is monthly average gross margins per member or the average by which insurers’ income from premiums exceeds cost per enrollee in a given month. Gross margins are a good indicator of performance, but not necessarily of profitability, because they don’t include administrative expenses.

Gross margins improved “dramatically” in the first quarter of 2017, according to the report, increasing from $36 in 2015 to $99 per enrollee in 2017. While annual 2017 margins aren’t likely to finish at this high level, “these data suggest that insurers in this market are on track to reach pre-ACA individual market performance levels,” the report projects.

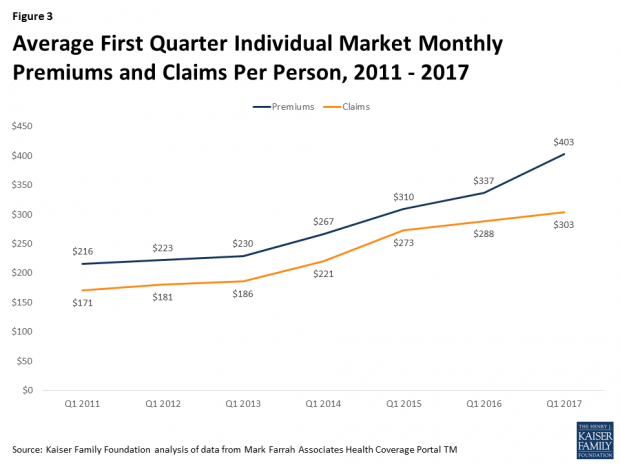

Higher premiums and reduced claims

The combination of a premium increase in 2017 and a simultaneous slowdown in the growth of claims for medical expenses has contributed to the recent improvement in the individual market insurers’ financial picture. “On average, premiums per enrollee grew 20% from first quarter 2016 to first quarter 2017, while per person claims grew only 5%,” the report states.

Related: How the Opioid Crisis is Damaging the US Economy

“These new data offer more evidence that the individual market has been stabilizing and insurers are regaining profitability,” wrote senior vice president Larry Levitt and associate director Cynthia Cox of the Kaiser Family Foundation.

The report highlights several caveats. While the market on average is stabilizing, “there remain some areas of the country that are more fragile,” according to Levitt and Cox. Moreover, uncertainty over Trump administration and Republican congressional policy – such as whether to continue cost-sharing subsidy payments to insurers and whether to continue to enforce Obamacare mandates – will further destabilize the market and drive more insurers away.