In response to repeated prodding by the General Accounting Office and other government watchdogs, the House Budget Committee is calling for creation of a special commission to crack down on improper payments by government agencies.

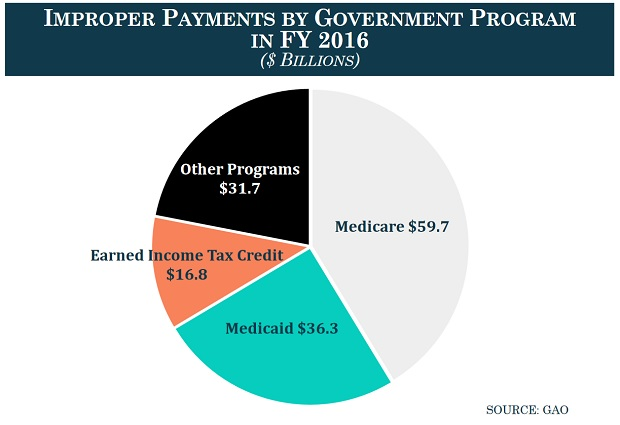

The problem has been well documented: Federal low-income assistance and health care programs including Medicaid, Medicare and the Earned Income Tax Credit (EITC) for working-poor families made improper payments totaling $1.2 trillion between fiscal 2003 and 2016, according to the GAO. (An improper payment is “any government payment made in an incorrect amount (mostly overpayments), to the wrong individual or entity, or for the wrong reason.”)

Related: The 10 States With the Worst Medicare Waste

Among dozens of programs that are part of the federal social safety net, the EITC, Medicare for seniors and Medicaid for the poor and disabled accounted for 78 percent of total improper payments, according to the latest figures from GAO, with error rates of 24 percent, 11 percent and 10 percent respectively.

As part of a controversial $4 trillion budget blue print for fiscal 2018 unveiled by Republican House Budget Committee Chair Diane Black of Tennessee on Tuesday, a new special commission would be given oversight power with a mandate to slash future improper payments by 50 percent within five years.

“For the first time, our budget takes a serious look at improper payments by federal agencies,” the GOP budget document states. “It is not the government’s money; it is the taxpayers’ money, and we have a responsibility to be good stewards of those dollars.”

The budget document estimates that the new commission could reduce improper payments and save taxpayers $700 billion over the coming decade. The House budget document also puts a premium on action by the new commission and other internal government watchdogs to streamline government to eliminate duplicative services and activities.

Related: How Private Insurers Rip Off Medicare Advantage for Billions of Dollars

According to a House Budget Committee analysis, there are 92 anti-poverty programs with overlapping or duplicative responsibilities that spent a total of $843 billion in fiscal 2015. For example, the analysis found 25 duplicative education and job training programs, 17 overlapping food assistance programs and 21 veterans programs.

A 2014 study found that it took 10 different offices at the Department of Health and Human Services to operate programs that addressed AIDS in minority communities, while autism research was spread over 11 different agencies.

Whether a new commission can prove any more effective than the GAO and a multitude of federal agency inspectors general in reining in billions of dollars of wasteful spending – or whether it would be little more than political window dressing – remains to be seen.

President Trump vowed throughout the 2016 presidential campaign to use his business skills and talent to overhaul the federal bureaucracy in order to rid the government of hundreds of billions of dollars of “waste, fraud and abuse.”

Many of Trump’s Democratic and Republican predecessors, including former presidents George W. Bush, Bill Clinton and Barack Obama, proposed major changes to improve the quality of government and reduce wasteful spending that had varying degrees of success.

Related: Doctors and Nurses Charged in Massive $900 Million Medicare Fraud

However, changing the way the federal government does business and cracking down on fraud and waste is a herculean task that requires changes in politically sensitive programs like Medicare and Medicaid and an enormous amount of bipartisan cooperation and good will that is sorely lacking in Washington today.

A lack of bipartisanship was clearly on display on Wednesday, when Republican and Democratic Budget Committee members began debating the fiscal 2018 budget resolution, which calls for a major tax cut that would largely benefit the wealthy, a huge boost in defense spending and a sharp reduction in domestic programs important to the Democrats.

The most contentious provision seeks at least $203 billion of cuts over the coming decade in mandatory programs such as Medicare and Social Security.

Some Democrats have dismissed proposals for eliminating waste and fraud as Republican cover for attacking important entitlement programs.

Related: $124 Billion of Overpayments and Fraud in Medicare, Medicaid

“Here we are today, with a budget that again displays total indifference to the challenges Americans face,” said Rep. John Yarmuth of Kentucky, the ranking Democrat on the committee. “The House budget embraces the worst extremes of the Trump proposal: tax cuts for millionaires and billionaires at the expense of American families, our economic progress, and our national security.”

“The enormity of these cuts and the severity of the consequences for American families cannot be overstated,” he added.